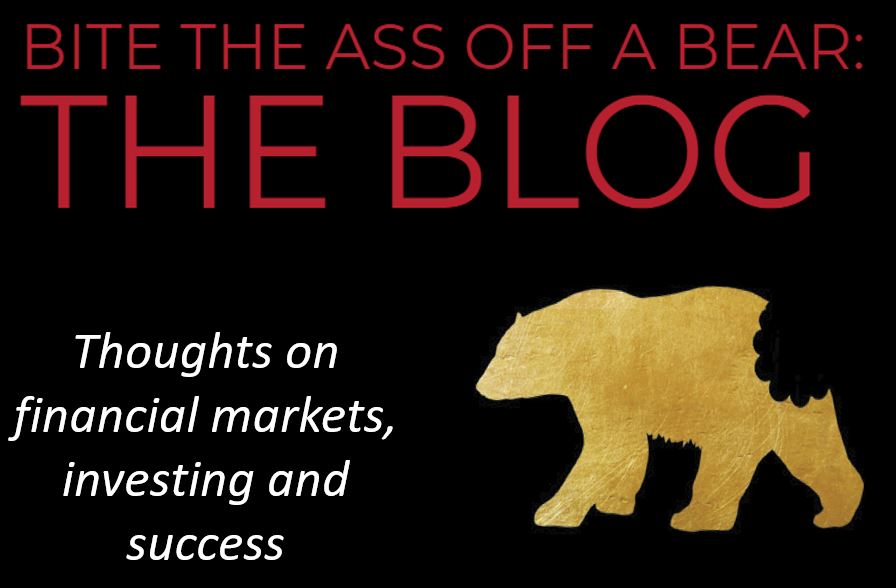

1. Brazilian Real

The market has put Brazil on notice. Bond yields are moving higher as the currency weakens. Brazil has an allocation of almost 10% in the JPM EM Global Core Index, making it the largest country risk. Rising rates in Brazil will hurt most allocators to local currency EM debt.

Why it Matters

The Brazilian Real weakened further yesterday, holding above the psychologically important barrier of 4.05 vs the USD. The currency has lost almost 20% of its value to the dollar in the last year. Part of the weakness is Turkey contagion, but local elections are also a factor.

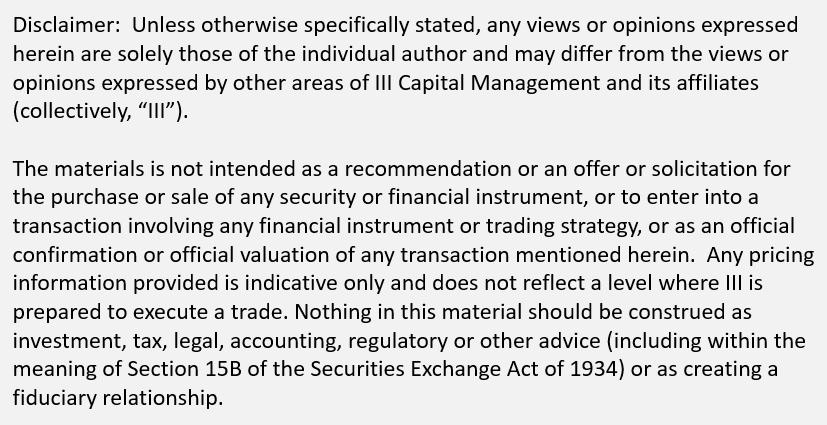

2. High Yield ETF Flows

High Yield ETFs (HYG and JNK) are once again receiving inflows. The two largest junk bond ETFs have attracted $4 billion of inflows in the last six weeks, but are still below the $32 billion AUM peak at the start of 2018.

Why it Matters

The high yield market is sometimes the first to react when it comes time to forecasting a downturn in the economy. Recent flows indicate US investors plan to continue to ride the positive fundamentals a little bit longer.

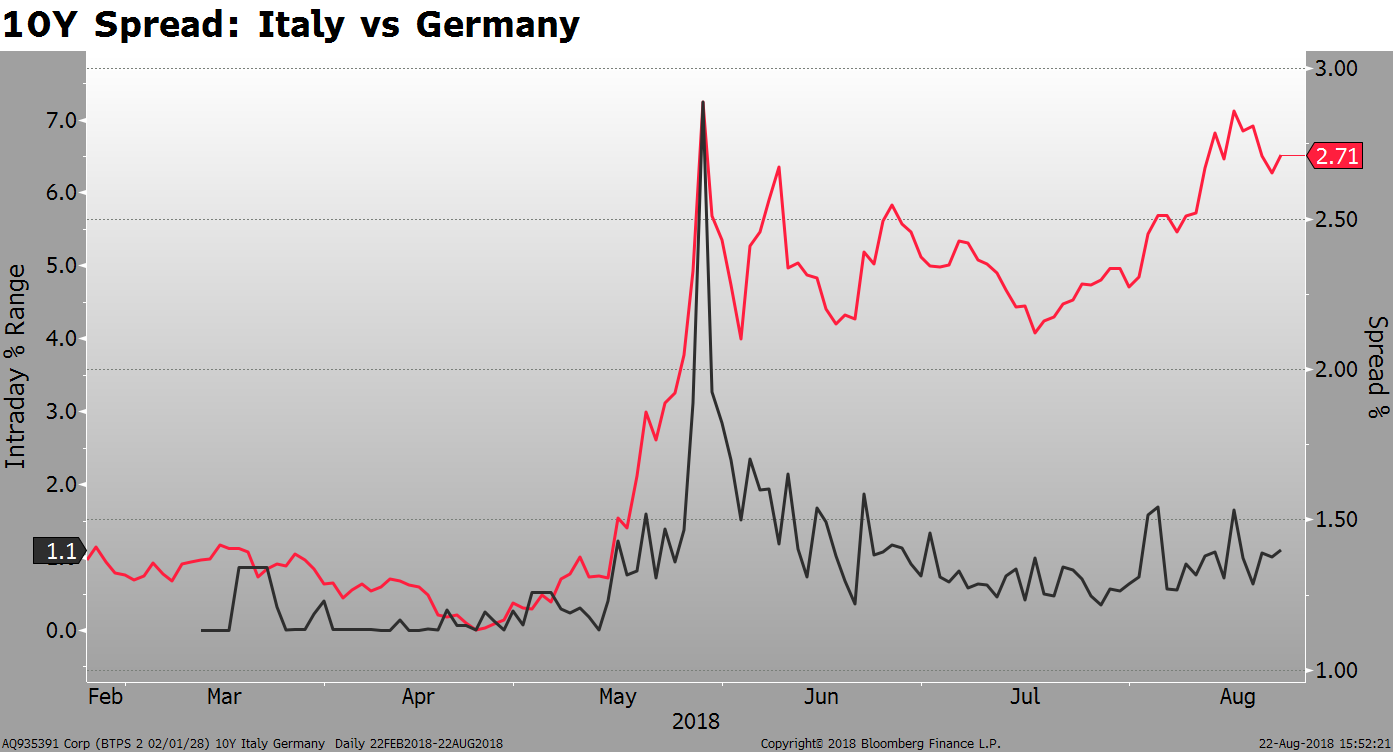

3. Italian Debt

Italian bonds weakened again yesterday, with the 10-year spread to Bund widening to 2.71%. The spread is hovering around the widest levels seen during the political crisis in May. Interestingly, intraday BTP volatility has not picked up in the recent cheapening.

Why it Matters

While the headline spread is widening, the market is nowhere near as panicked as it was in May. It looks like positions are more balanced. It doesn’t appear that more spread widening is going to be a catalyst for more short-term rate volatility in Europe.

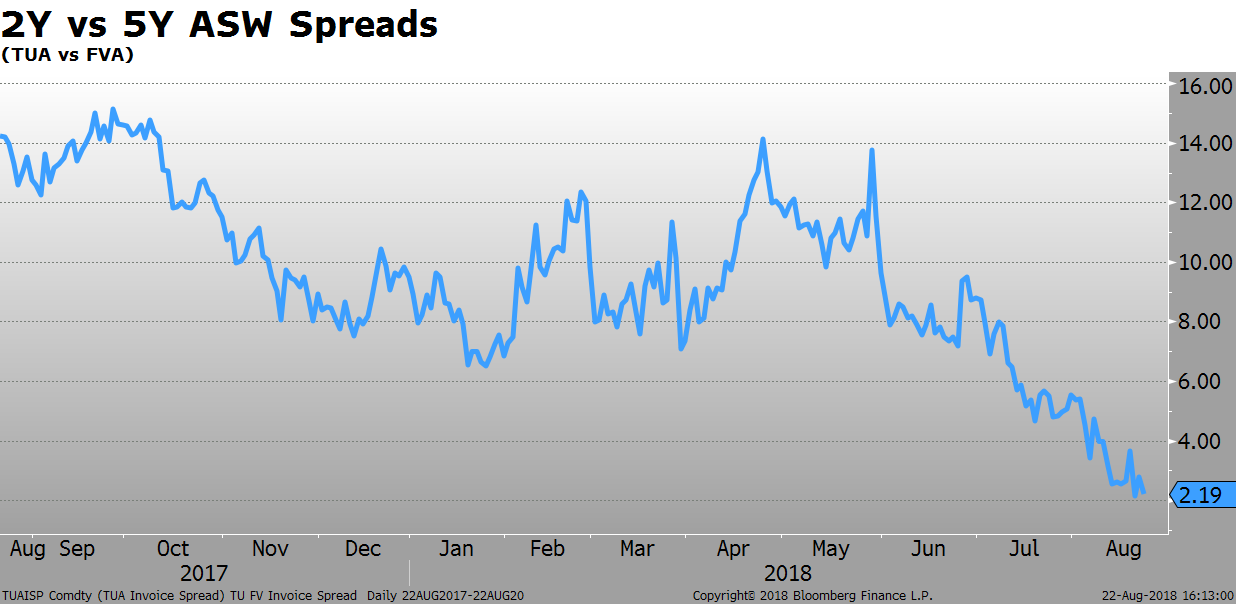

4. Swap Spreads

2-year and 5-year swap spreads are converging. Using futures, the difference between the two is just over 2 bp. The spread touched 14 bp during the market disruption in May.

Why it Matters

A long position in 2-year swap spreads has demonstrated flight-to-quality characteristics. Pairing a 2-year long with a 5-year short (or something further out the curve) is a liquid way to position for a “risk-off” environment.