- Recession Fears

Yet another call for a recession, using the yield curve as a predictor. This time from Marc Seidner from PIMCO. He says there is a 70% chance the world economy enters a recession in the next 5 years.

Why it matters.

It doesn’t. First, making a recession call with a 5-year window at the end of the business cycle does not help anybody make investment decisions. Second, the yield curve is distorted by QE. Some suggest the curve would be as much as 50 bp steeper if the Fed had not inflated its balance sheet..

- Market Positioning

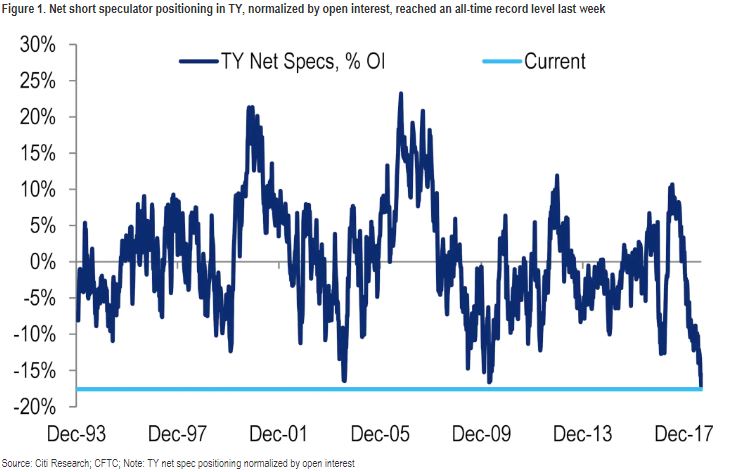

According to Citigroup, the spec positioning in US 10Y futures is the largest ever. Citi looked at the positioning to relative to open interest.

Why it matters.

All eyes are on Powell’s Jackson Hole speech on Friday. Plus, but we have the release of the FOMC Minutes this week. If the market is already set up short, a surprise dovish turn in rhetoric could cause a sharp rally in rates.

- Bank Exposure to Turkey

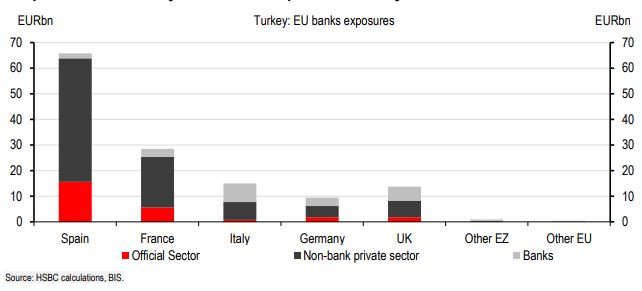

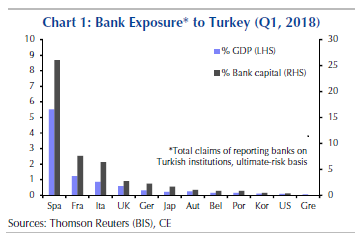

Spanish banks are the most vulnerable to defaults in the Turkish public and private sector. Of the Spanish banks, BBVA seems to be the most exposed via large ownership stakes in Turkish banks.

Why it matters.

It’s all about what happens in the worst case scenario, which would include defaults on USD and local currency debt. If the worst-case scenario affects bank capital ratios in Spain to the point where it curtails lending, the Spanish economy could underperform the rest of Europe. This could ultimately lead to more debt issuance and credit downgrades. Bottom line: if Spanish banks are vulnerable, so are Spanish yields.

- Emerging Market FX Vol

The volatility of emerging markets currencies is at an extreme. 3-month implied vol on a basket of EM currencies put together by BOA is trading at a 10-year high relative to DM FX volatility. The current ratio of volatility is similar to what was experienced in the global financial crisis and after 9/11. It’s not just Turkey causing the spike; it’s global. Brazil, South Africa and Russia are all affected.

Why it matters.

The market is already pricing in large potential swings for EM. It’s hard to see this level of volatility persisting for much longer. From a contrarian perspective, I would rather be a seller of this vol than a buyer. But you don’t have to position directly in EM vol to benefit from its decline. There are fixed-income trades that should work when EM FX vol falls:

- Long European peripherals vs Bunds

- Short 10Y UST as flight-to-quality unwinds