Memorial Day marks the first official day of summer. While the thought of summer usually brings joy to many, it’s worth pausing for a moment to recognize the service of the men and women in the military that keep us safe. More than a million people have died defending this country since 1861, and we owe them a great deal of gratitude and respect. We can debate the merits of U.S. foreign policy, but there is never a question that the soldiers who fight for the country deserve heartfelt recognition.

As the summer kicks off, it’s a good time to reflect on markets and think about what may be next for stocks, bonds, commodities, and currencies. I’ll share some interesting themes developing in the market, provide the usual blast of charts that caught my eye over the last week, and give an update on BCAT, the closed-end fund I highlighted in my last post.

I’ve spent more time reviewing earnings reports this quarter than usual. There are a few themes worth discussing, specifically in the retail sector.

Several retailers missed their earnings and/or sales forecasts in the first quarter of 2024. Here are some notable examples, along with relevant quotes from their management explaining the reasons behind their performance:

Target

- Earnings Miss: Target reported earnings of $2.03 per share, missing the Zacks Consensus Estimate of $2.05 per share. Revenue also declined by 3.2% to $24.5 billion, slightly below the anticipated $24.6 billion.

- Management Quote: CEO Brian Cornell stated, “We continue to see soft trends in discretionary categories, which impacted our overall sales performance.”

Home Depot

- Sales Miss: Home Depot reported sales of $36.42 billion, missing the Zacks Consensus Estimate of $36.65 billion. However, earnings per share were $3.63, surpassing the expected $3.61.

- Management Quote: CEO Ted Decker expressed optimism despite the challenges, stating, “We navigate a delayed start to the spring season and ongoing consumer hesitancy towards larger discretionary projects.”

Yum Brands

- Earnings and Sales Miss: Yum Brands reported earnings of $1.15 per share, missing the expected $1.20 per share. Revenue was $1.6 billion, below the anticipated $1.71 billion.

- Management Quote: The company noted that “”As far as the international consumer goes, it’s probably more of an emphasis on value than there has been in past quarters. We’re seeing the same thing in the U.S.”

Starbucks

- Earnings and Sales Miss: Starbucks reported non-GAAP EPS of 90 cents, missing expectations by 4 cents, and revenue of $9.4 billion, which was $230 million below analyst expectations.

- Management Quote: CEO Laxman Narasimhan stated, “We continue to feel the impact of a more cautious consumer, particularly with our more occasional customer, and a deteriorating economic outlook has weighed on customer traffic and impact felt broadly across the industry.”

These retailers have cited various challenges, including inflation, consumer spending shifts, and economic uncertainties, as reasons for their underperformance in the first quarter.

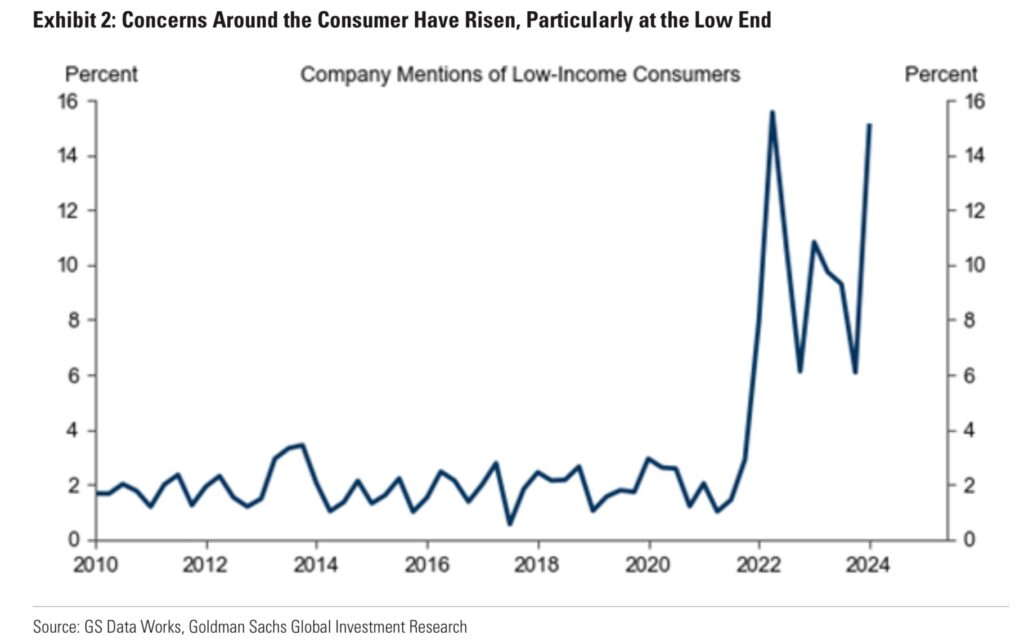

The number of companies mentioning “affordability” during Q1 earnings calls is the highest since 2012.

Similarly, the number of “low-income consumers” mentions has also spiked.

But not all retailers are suffering. In fact, some benefit from consumer stress by “trading down” to get more bang for the buck. Here are a few examples:

Walmart

- Earnings Beat: Walmart reported adjusted earnings per share (EPS) of $0.60, surpassing management’s guidance of $0.49 to $0.52. Consolidated revenue totaled $161.5 billion, exceeding expectations.

- Management Quote: CEO Doug McMillon stated, “Our team delivered a great quarter. Around the world, our goal is simple – we’re focused on saving our customers both money and time.”

Urban Outfitters

- Earnings Beat: Urban Outfitters, the parent company of Free People and Anthropologie, reported strong comps of 17.1% and 10.4%, respectively, beating the 2.6% SSS estimate with a 4.6% Q1 comp result.

- Management Quote: The rise in consumer spending on the latest fashion trends was a key driver. “The U.S. consumer remains resilient despite sticky inflation, and our focus on the latest fashion trends has paid off.”

TJX Companies

- Earnings Beat: TJX Companies saw healthy sales growth across divisions, driven by customer transactions.

- Management Quote: “Our performance this quarter reflects the strong demand for designer clothing at off-price points, and we have raised our full-year outlook as a result.”

Macy’s

- Earnings Beat: Macy’s reported earnings of 27 cents per share, surpassing the estimated 15 cents.

- Management Quote: CEO Tony Spring stated, “Our updated outlook assumes customers will continue to be discerning in their discretionary purchases and provides flexibility to respond to the competitive landscape and promotional environment.”

At the opposite end of the spectrum, uber-luxury brands continue to thrive. Growth is not what it was coming out of the pandemic lockdown, but it is still positive. There are few signs that the high-end of the income distribution is not pulling back on spending.

Hermès

- Earnings Beat: Hermès reported a robust 17% increase in revenue for Q1 2024, significantly outperforming the industry average.

- Management Quote: Hermès management highlighted their confidence in continued growth, stating, “The willingness to spend and purchasing power among high-end consumers have been robust, resulting in double-digit growth across key product categories.”

Moncler

- Earnings Beat: Moncler reported a 20% increase in revenue for the first quarter, bucking the industry trend.

- Management Quote: Moncler’s management noted, “Honestly, there are no regions that are performing particularly well or particularly badly. A region that is of particular attention for everyone is China and the Chinese cluster: the performance is still positive, but not as strong as the results we reported for the first quarter”.

LVMH

- Earnings Beat: LVMH achieved a 3% organic revenue growth in Q1 2024, with its fashion and leather goods division growing by 2%.

- Management Quote: CFO Jean-Jacques Guiony commented, “Our scenario would be a continuous strength from the top-end customers and a gradual, a very gradual, improvement from the aspirational customer.”

The luxury brand segment of the market appears more concerned about the slowdown in consumer spending in China, not the potential slowdown in the U.S. That said, one retail analyst I spoke with this week summed it up perfectly when she commented, “In a recession, there are no winners in retail.”

The luxury segment is doing fine, but if unemployment starts to creep up and consumers retrench, the narrative will shift from “winners and losers” to “losers and survivors.”

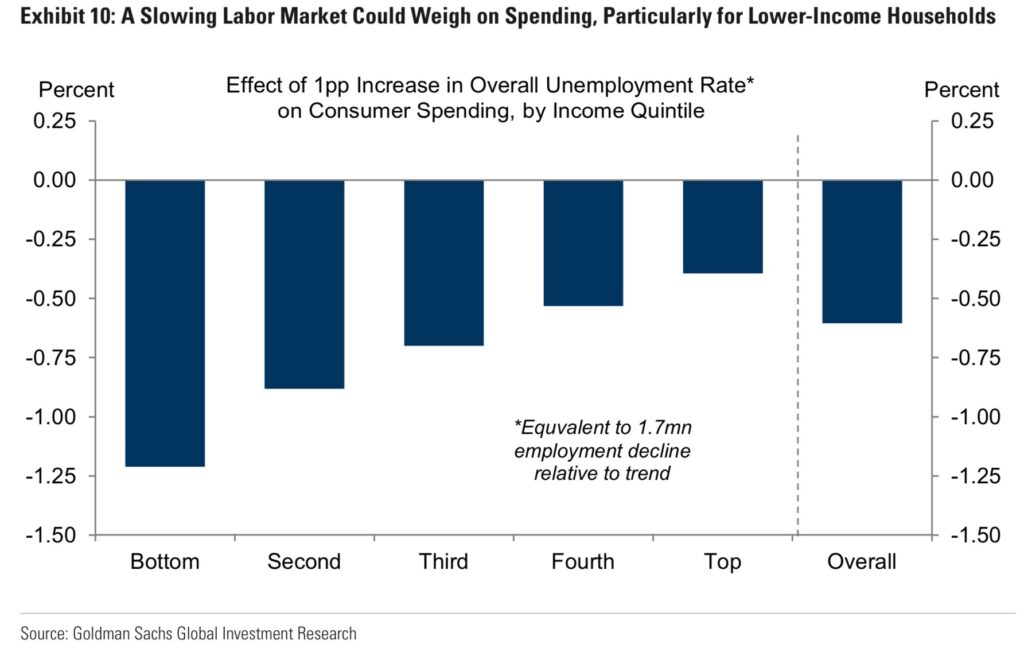

Goldman estimates that all consumer categories will slow spending if unemployment rises, with the bottom tier declining the most.

Blackrock Capital Allocation Trust (BCAT)

In my last post, I mentioned that the closed-end fund BCAT had good potential for risk-adjusted total returns over the medium term. While I like the asset allocation (roughly 50% equities and 50% senior loans), the main attraction was the significant discount to NAV.

The stock caught a bid last week, rallying 5% on heavy volume and is now up 10.5% over the last month. This rally has narrowed the discount from roughly 12% to 4%. Full disclosure: I sold 10% of my position on Friday. I like the allocation, but as the fund price approaches NAV, or fair value, the higher fees associated with closed-end funds like BCAT make them less attractive. One could replicate the exposure using lower-cost ETFs and avoid the hefty management fee.

The jump in price is linked to the ongoing battle between Saba Capital — a hedge fund that takes large positions in closed-end funds trading at significant discounts and then advocates for shareholder-friendly activities to close the gap — and Blackrock. Saba has done this before but has never taken on Blackrock. It has been interesting to watch the battle unfold.

Saba is trying to unlock $1.4 billion in value for investors, while Blackrock is trying to hold on to high fee-paying funds for as long as possible. It seems like Saba is winning. A shareholder proxy vote scheduled at the next annual meeting would allow Saba to gain control over the board and make changes to the management of the fund that would potentially bring the fund back in line with its net asset value. Details of Saba’s “takeover attempt” can be found on a website it created called HeyBlackrock.com.

Here is a CNBC interview with Boaz Weinstein, founder of Saba Capital Management:

In response, Blackrock has engaged in several activities to narrow the discount. It announced a buyback program, raised its dividend, and communicated with shareholders, including launching a campaign titled “Defend Your Fund,” which aims to rally shareholder support against Saba’s proposal.

The buyback announcement, or “Discount Management Program,” as Blackrock calls it, was the first nod that something needed to be done. As per the announcement:

“If a Fund’s common shares trade at an average daily discount to net asset value (“NAV”) of more than 7.50% during a 3-month measurement period (each, a “Measurement Period”), the Fund intends to offer to repurchase 2.5% of its outstanding common shares at a price equal to 98% of the Fund’s NAV, as determined on the trading day after the tender offer expires, as soon as practicable following the Measurement Period end date.”

However, the dividend increase announced last week really got the stock moving. Effective May 20, BCAT will pay monthly distributions to shareholders at an annual rate of 20% of the fund’s 12-month rolling average daily net asset value. In essence, Blackrock has agreed to return capital faster than initially required under the fund’s term trust by more than doubling the dividend.

The market clearly liked the news. That is why BCAT has jumped and the discount to NAV has narrowed. There is still some value left from a discount perspective, but much of the work has been done. We will see if Saba continues its aggressive pursuit of change at Blackrock or whether it monetizes its gains and moves on to the next target. Either way, thank you, Saba.

Charts of the Week

The Japanese yen has stabilized a little against the US dollar but continues to weaken against the Euro.

After a brief jump in April, equity volatility has resumed its downward trend. The VIX closed below 12 on Friday.

Trading volumes are down along with the fall in volatility. The 5-day moving average of SPY volume is at the lowest point in a year and roughly half of what it was a month ago.

With Q1 earnings coming to an end, investors can breathe a sigh of relief. Overall, S&P 500’s earnings growth was 6%, and 78% of the companies beat expectations. In continuation of the trend, the tech sector was responsible for most of the EPS gain.

In fact, just five companies (Amazon, Google, Meta, Microsoft, and Nvidia) were responsible for the gain in the S&P 500. These five firms saw earnings growth of 64.3% vs. a 6% decline from the other 495 companies.

But not all tech is participating. Unprofitable tech companies continue to lag the broad index, underperforming the S&P 500 by 27% YTD.

One of the reasons cited for the pinch in consumer spending is inflation. Check out the change in price of various items at McDonald’s over the last decade. On average, they have more than doubled.

That’s it for this week. Thanks for reading. Next week, I plan on going into detail about how the boom in AI is spilling over into other sectors. Don’t forget you can sign up on the website to get an email notification whenever a new post is published.