These markets are just downright punishing. At one point early last week, anybody (including myself) who held a combination of risk and safe assets must have felt like there was no place to hide. The list of negatives was endless:

- S&P 500: technical “Death Cross” breakdown

- Nasdaq: bear market territory (20% drawdown)

- Chinese stocks: absolute capitulation in large-cap tech

- Gold and U.S. Treasuries: down along with equities

- “Risk-off” currencies like the yen and Swiss franc: weaker.

The Russia/Ukraine conflict appeared to worsen, Russia was on the verge of default, the Fed was set to embark on its tightening cycle, and China was entering a serious Covid lockdown.

Then, the news flow and market sentiment miraculously started to improve. Chinese officials pledged to stabilize financial markets, promising to ease a regulatory crackdown, stimulate the economy and support the property sector and technology companies. At the same time, peace talk negotiations between Russia and Ukraine gained momentum, and China did not move geopolitically closer to Russia, which would have added economic and political stress to the situation.

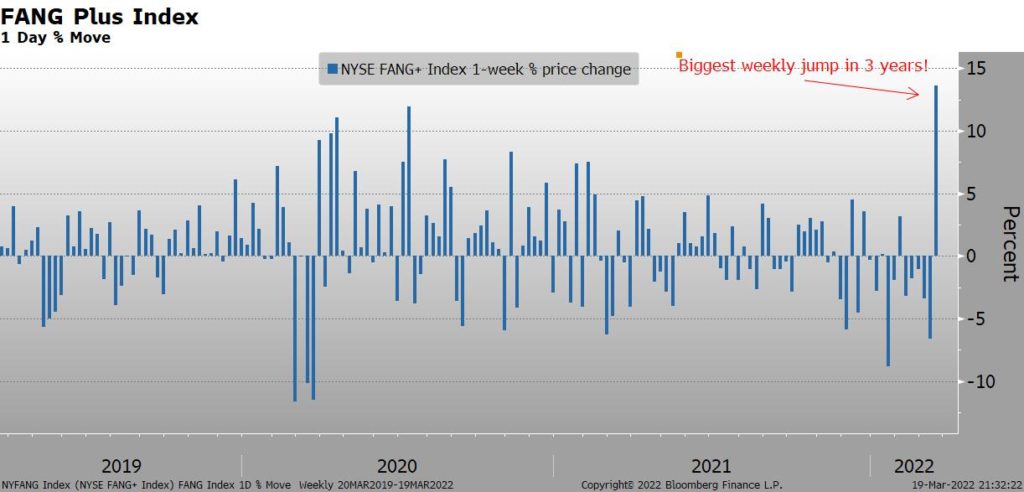

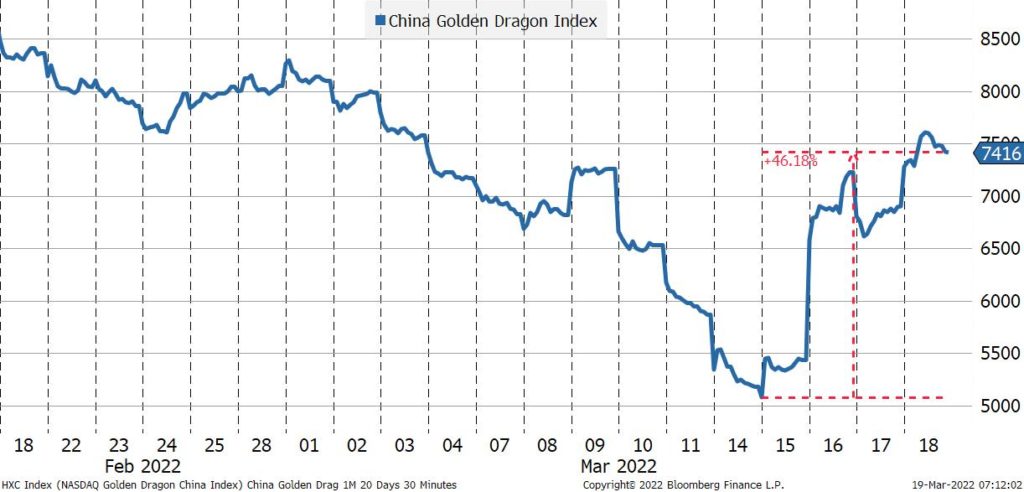

No doubt, these developments were positive. The MSCI All-World index closed the week up nearly 7%, the NY FANG Plus tech index jumped 14%, and the MSCI Golden Dragon index logged a huge 46% rebound from its lows earlier in the week. So the question remains: was the reversal of price action just a violent bear market rally or was the shift in policy out of China and a hawkish Fed determined to beat inflation enough to warrant a bottoming in fundamentals?

I’ll try to provide some data points and observations to answer that question. If you don’t want to hear yet another opinion on the market and want to skip directly to read about what trades/investments I’m focusing on, I won’t be offended. Just scroll to the bottom.

First, some charts.

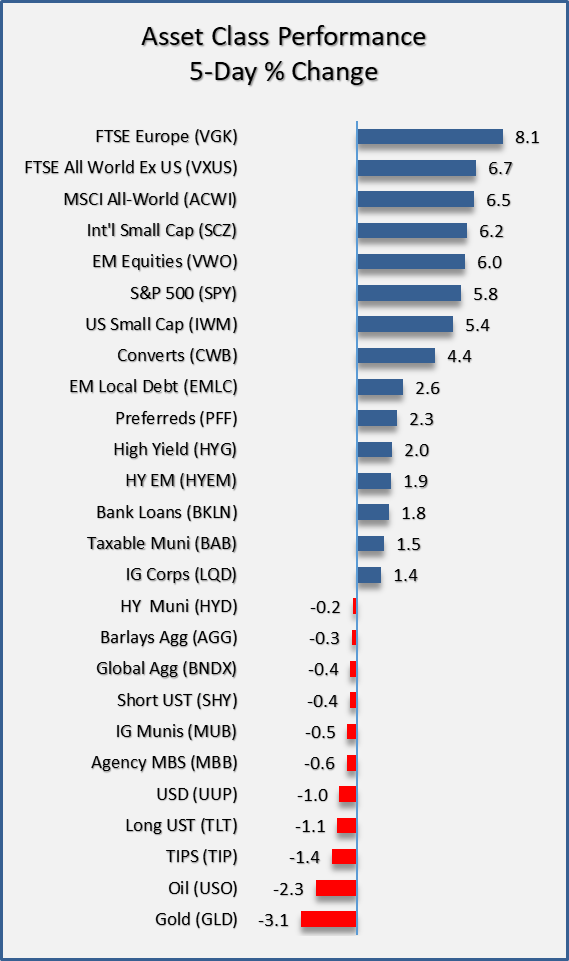

Overall, it was a good week for most asset classes, despite the poor start. European equities gained 8.1%, EM equities recovered 6%, the S&P 500 rose 5.8%, and high yield bonds appreciated 2%. Gold was down 3.1%.

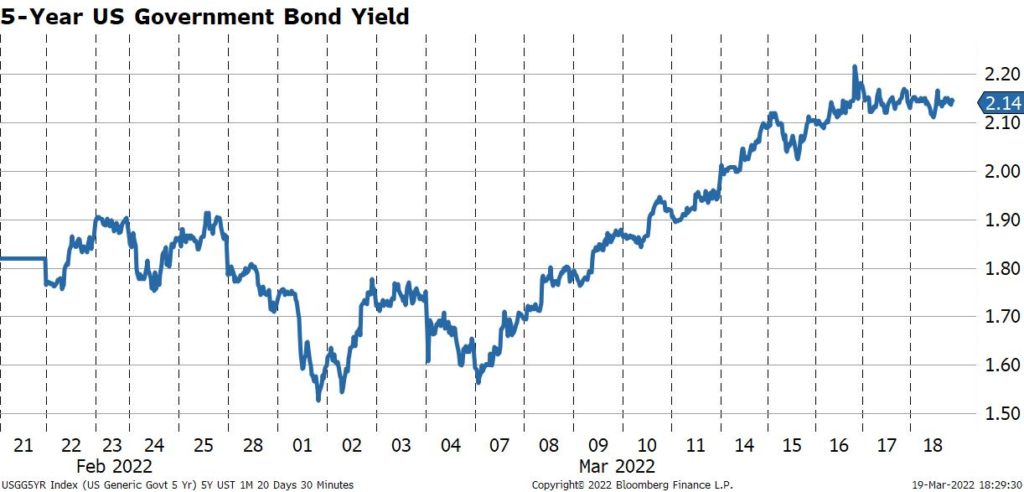

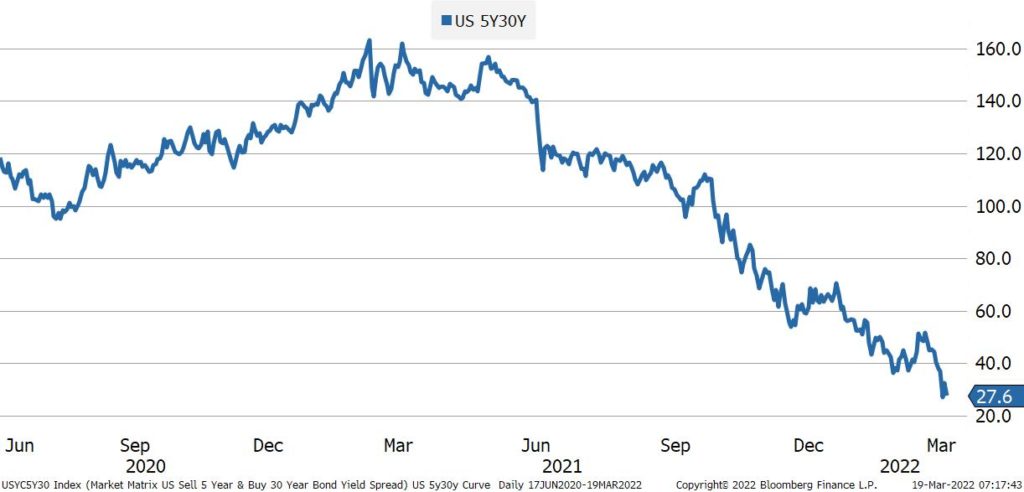

The FOMC hiked rates by 25 bps and delivered a hawkish message at its meeting last week. The median “dot” rose more than some expected to show a total of seven hikes in 2022 and a terminal rate of 2.75%. At the press conference, Chair Powell reinforced the hawkish tone by acknowledging the seriousness of the inflation situation. Bond yields rose, led by the front end of the yield curve.

“In hindsight, it would have been appropriate to move earlier.”

Jerome Powell

The move higher in short-term rates helped keep the flattening yield curve trend intact.

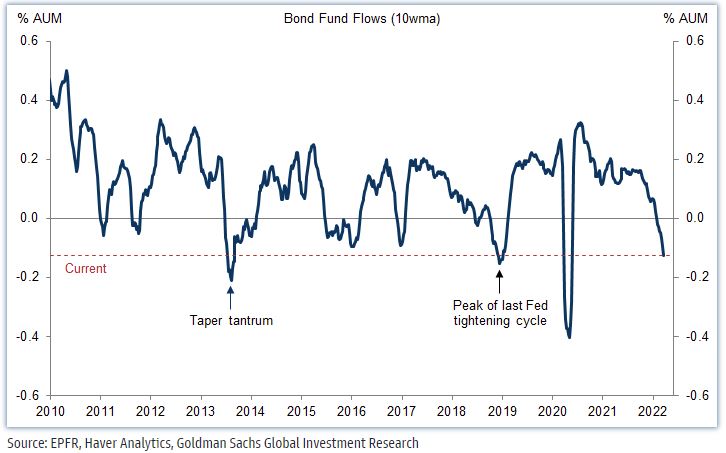

It’s hard to love bonds when the Fed is behind the curve and officials are arguing about whether to be more aggressive in removing policy accommodation. With staggeringly high negative real rates, investors keep yanking money out of bond funds.

But equity markets staged a massive rebound. Technology stocks, both in the U.S. and internationally, led the rally last week. The NY FANG Plus Index (Baidu, Tesla, Alphabet, Apple, NVIDIA, Amazon, Microsoft, Alibaba, Netflix and Meta) rose 13.6% on the week, the largest increase in more than three years.

Chinese equities posted huge gains on the week, but remain decidedly lower on a medium-term basis.

In fact, over the long-term, the cumulative USD return for the MSCI China index is barely positive over a 30-year horizon. Unbelievable, almost.

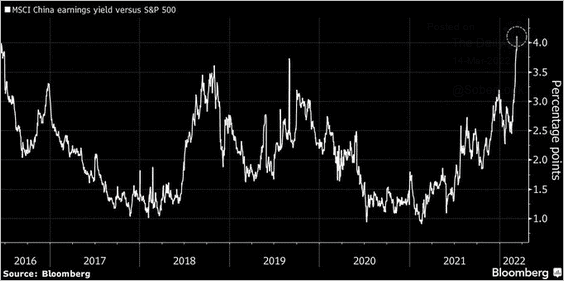

As painful as it has been to hold Chinese stocks during this latest drawdown, one can’t argue that the valuation story keeps getting better. In terms of one-year forward price/earnings multiples, the MSCI China index trades at more than a 40% discount to the MSCI All-World index. On a relative basis, compared to the S&P 500, Chinese stocks offer a 4% higher earnings yield. Not bad if you think China will not go the way of Russia and isolate itself from the rest of the world.

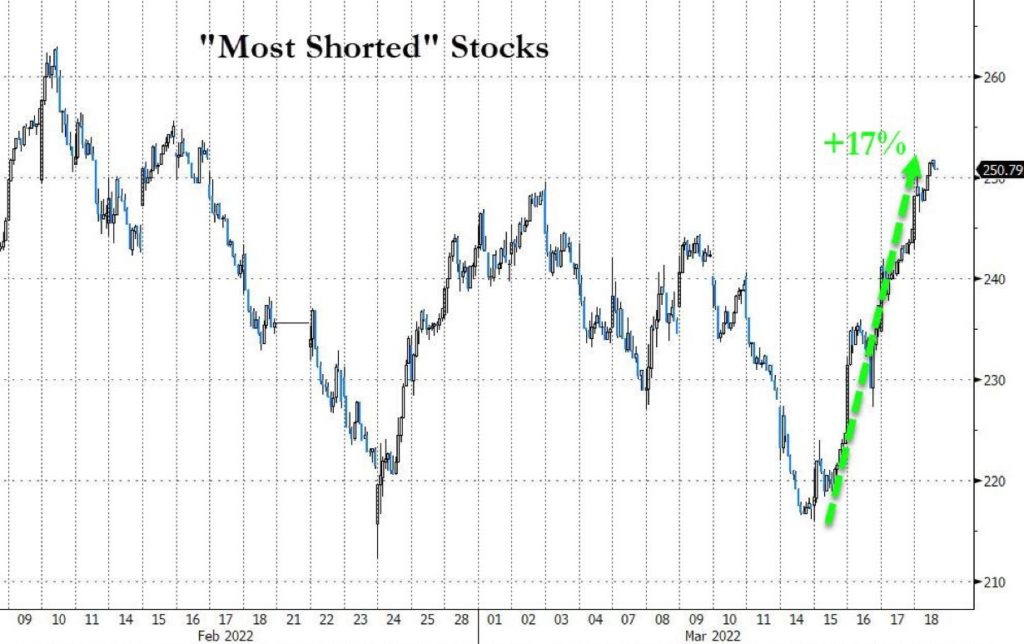

Shorts definitely got squeezed last week. A basket of heavily shorted stocks soared 17% from the lows.

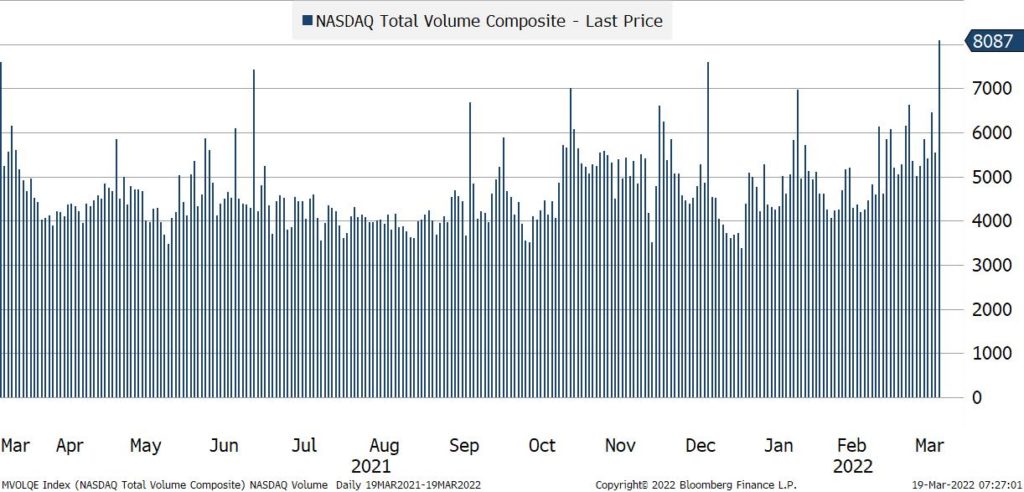

Even though most of the move higher took place mid-week, Friday was a particularly heavy volume day due to the expiration of $3.5 trillion in options. It was the highest volume day for the Nasdaq in the last year.

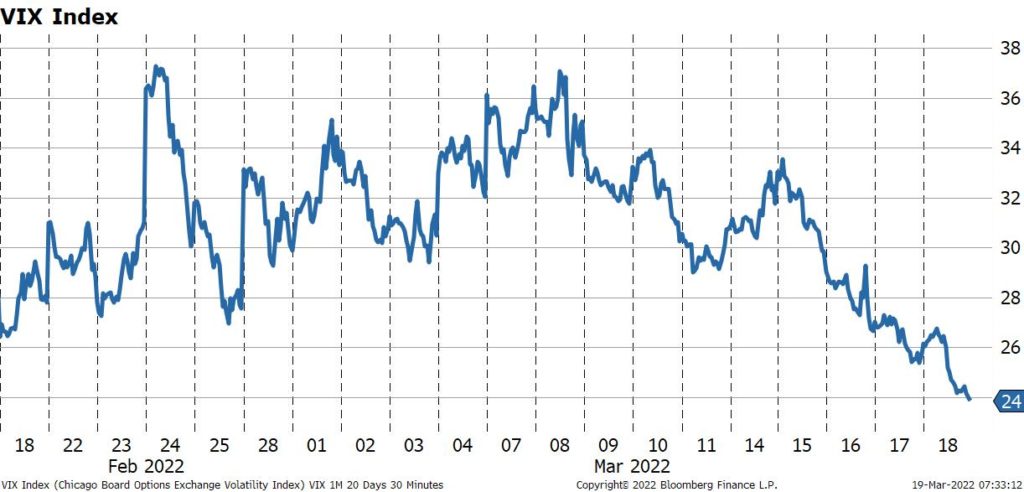

It also looks like traders are getting a little more comfortable with short-term tail risk in the equity market. The VIX dropped to its lowest level since the Russian/Ukraine conflict began.

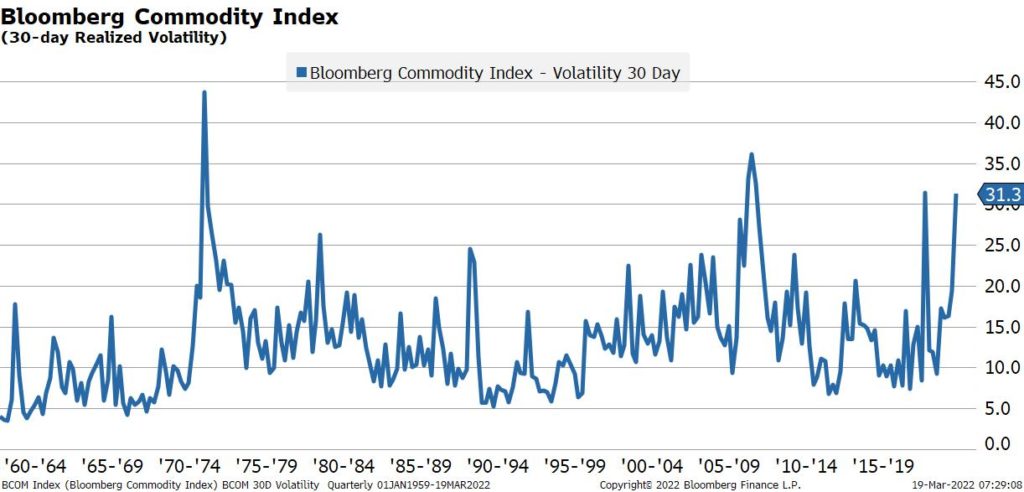

Commodity markets continued to exhibit crazy levels of volatility. How crazy? The 30-day historical volatility of the Bloomberg Commodity index is 31.3%. There have only been a few episodes of comparable price swings going back more than fifty years: the early stage of the pandemic when crude oil futures went negative, the 2008/2009 financial crisis, and the energy crisis in the 1970s.

Sanctions on Russia: it’s hard to get global support

The official sanctions imposed on Russia, and the unofficial sanctions stemming from the withdrawal of private companies that operate in Russia, will have a lasting impact on the Russian people and its economy. In that way, they can be an effective non-military tool to garner influence and inflict punishment. Sanctions, though, also cause economic pain to those that impose them.

The pain is broadly distributed:

- gas and electricity prices have spiked, denting consumer spending and confidence

- food shortages may create devastating humanitarian suffering

- supply chains have been disrupted as companies scramble to replace critical manufacturing inputs, adding to global inflationary pressures.

To inflict pain through sanctions on a worldwide supplier of essential products means that countries that initiate the sanctions must be willing to endure pain themselves. Every country has a different level of economic and geopolitical self-mortification that it is prepared to tolerate.

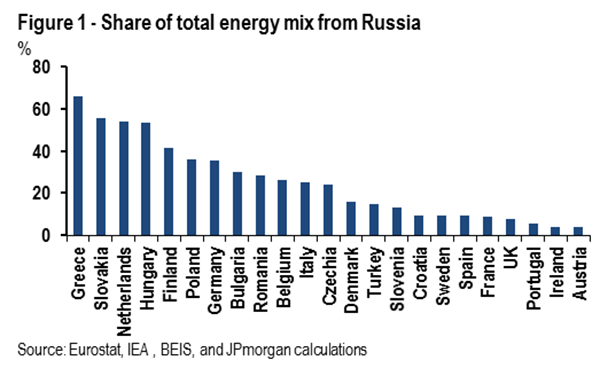

Just look at the EU. You would think that the region most negatively affected by the war would be the region most willing to support sanctions in an attempt to get it to stop. Politically, the Europeans are on the same page. Nobody wants a power-hungry aggressive neighbor knocking at their door. Yet, economically, Europe is divided concerning sanctions. A full energy embargo would hurt the Russians the most in the short term, but arguably, it would hurt many European countries even more.

For example, Greece, Slovakia, Holland and Hungry get more than 50% of their energy mix from Russia. A complete energy embargo on Russian oil and gas would devastate their economies and be politically disastrous. On the other hand, the UK, Portugal, Ireland and Austria import a small amount of energy from Russia. These countries can afford the economic hit and might gain politically from taking a tough, moral stance against the aggression. The divided economic interests associated with a full Russian energy embargo will prevent the EU from having a unified approach to sanctions.

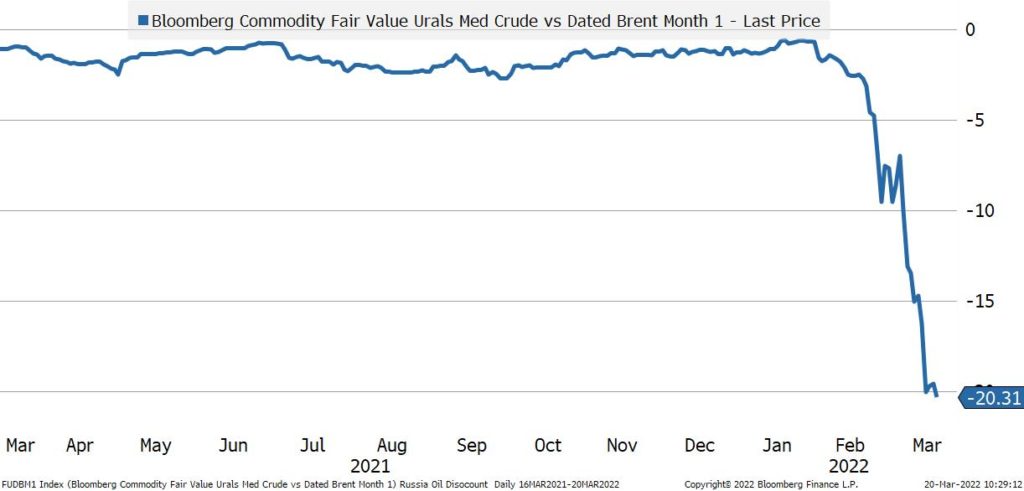

Other countries, such as India, are in the same boat. India is heavily dependent on imported crude oil for over 80% of its energy needs. Therefore, oil companies in India continue to trade with their Russian counterparts. Over the weekend, Indian Oil Corporation signed a deal with a Russian oil company to import 3 million barrels of crude. India will do what is best for India, which in this case, is to continue to meet its demand for crude by purchasing Russian oil. India also benefits from the steep discount for Russian crude, which is currently running at more than $20 per barrel, providing even more incentive to keep trade flowing.

But there is a deeper, more critical aspect to India’s trading relationship with Russia. It’s not only about energy. Geopolitics and its security are a major factors.

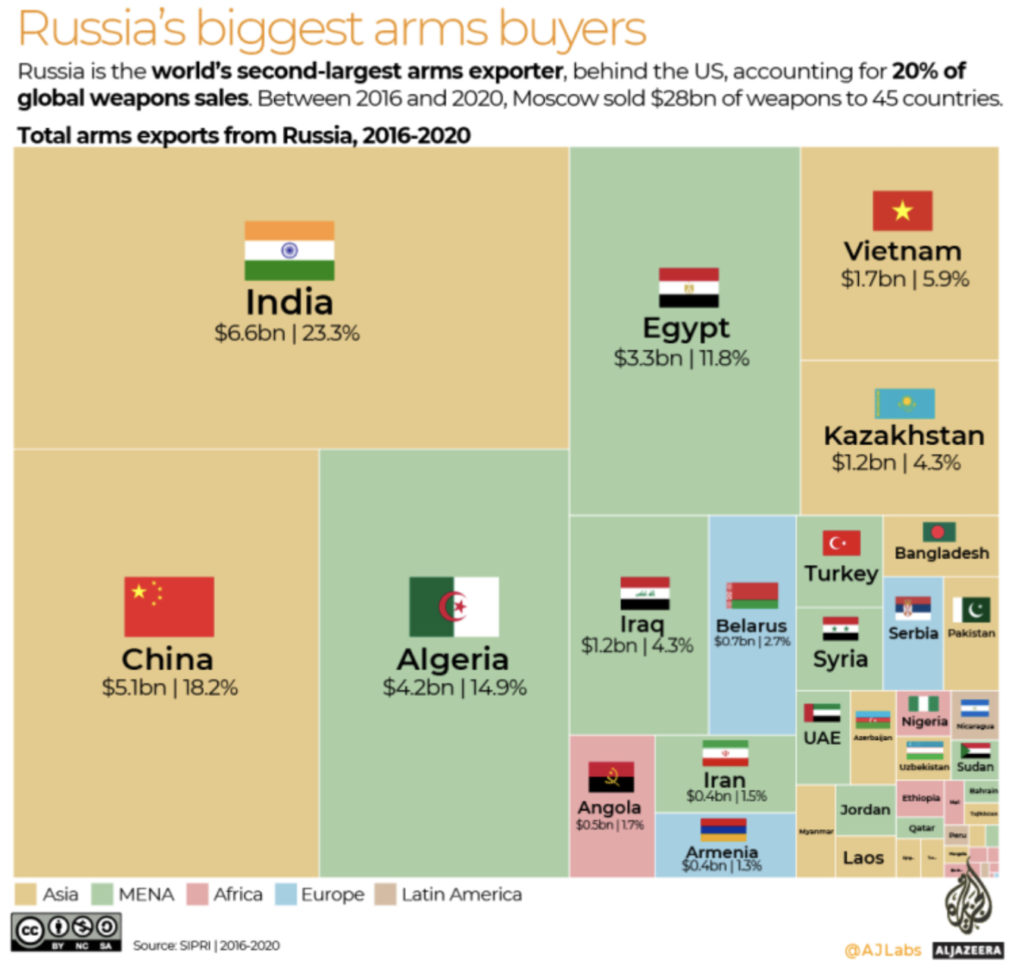

Russia is India’s largest supplier of arms, providing 46% of its total weapons imports, according to the Stockholm International Peace Research Institute (SIPRI). And for Russia, India is their export market, making up 23.3% of weapons exports. Such ties are operationally, diplomatically, and politically difficult to sever.

Between 2016 and 2020, Russia delivered about 400 fighter jets to 13 countries. India bought at least half of them. India is also one of only six countries that operate nuclear-powered submarines it has on lease from Russia.

As China continues to flex its muscles in Asia, and given the ongoing conflict with Pakistan, India will not stop trading with Russia because of the Ukraine invasion. It has its own security to worry about. That is why Western countries should not waste their time trying to get the whole world to cut off Russia. It just won’t happen. Still, the sanctions in place will shift global trade patterns where countries will seek both economic and geopolitical alignment in the development of their supply chains. The fact remains that many countries need energy and weapons imports, and as long as Russia is supplying them, most will continue to be a buyer.

So what does this mean for markets? If a global trade embargo is not likely to happen, some of the tail risks to inflation and supply chains are reduced. It also means that Russia may not be forced into a situation where it becomes desperate and does something to broaden the conflict to other countries.

China’s unexpected shift in policy

Developments in China require our attention. First, China is in the midst of dealing with a significant Covid outbreak across the country. In a series of measures to lower the risk of transmission, China said it would divert hundreds of international flights from Shanghai to other cities until at least May. It also closed schools and sealed off residential compounds to perform mass testing. The decision to lockdown Shenzhen, China’s most influential technology hub, caused the shutdown of dozens of factories, including Apple supplier Foxconn, adding to the strain on global supply chains. To make matters worse, the New York Times reported that cities near Shanghai closed highway exits to test every driver, creating miles-long lines of trucks trying to carry crucial components among factories.

Other Chinese concerns include the potential delisting in the US of some major technology companies, a rapid slowing in the real estate sector, a weakening economy, plummeting financial markets, and trying to remain neutral in the Russian/Ukraine conflict. The fortunes, or lack thereof, of Alibaba (BABA) provide some context to how bad things are for the technology sector that used to lead the equity market.

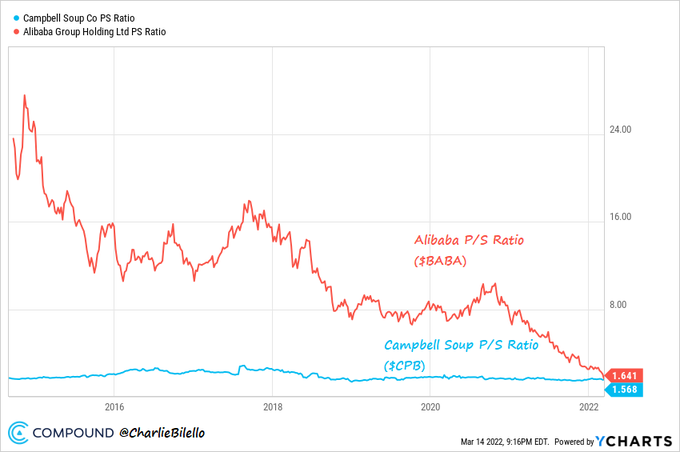

In 2014, Alibaba was growing rapidly and sported a price-to-sales valuation of more than 25x. Today, its price/sales ratio is just 1.6x. The regulatory crackdown over the last year has caused its share price to fall from $310 in late 2020 to a low of $74 early last week. By comparison, Campbell Soup trades at a similar price/sales ratio, a company that has barely grown its revenue over the previous ten years. Investors clearly don’t think that highly of BABA’s prospects. Last week, JP Morgan went as far as calling Chinese internet stocks “uninvestable.”

Then Chinese authorities capitulated. On Wednesday, in an abrupt change of tone, officials vowed to stabilize financial markets, ease up on the regulatory crackdown, come to the aid of the real estate sector, develop a more Covid-friendly economic policy, distance itself somewhat from Russia, and provide additional stimulus for the economy.

Obviously, financial markets liked the shift in policy. The extent of the relief rally is shown in some of the charts above. The trillion-dollar question remains how China will follow through with the promises. Some will be easier and faster to implement than others.

Distancing itself from Russia makes sense for China. China’s geopolitical objectives are aligned with Russia, but its economic interests are more integrated with the global economy. China’s share of international trade at the end of 2021 was about 17%. Anything that would materially damage that amount of trade is just not palatable for China. The economic consequences would be too great.

Stopping the beat-down of internet companies should help sentiment, and coming to the rescue of the property market is something that the government probably needed to do anyway. Regardless, the statement was powerful and delivered the message to investors that China did in fact care about its capital markets and economic growth was just as important as its other political goals such as “common prosperity.”

Dead cat bounce or have we seen the bottom?

Can it be both? Sure. I think the policy shift out of China is meaningful and sufficient to prevent a further test of the lows in their equity market, especially for the large-cap internet stocks. And if you call the bottom for China, you might as well call the bottom for the broad Emerging Markets indices given the weight China holds in most of the portfolios.

The S&P 500, however, is a different story. The inflation outlook keeps getting worse, which means that the Fed might have to deliver more hikes than currently priced into markets. Long-end rates will probably have to adjust higher, taking some of the relative value away from the equity market and decreasing the present value of earnings. I don’t see the Fed getting derailed from its hiking path unless the economy experiences a significant slowdown. In that case, the lofty earnings expectations still embedded in prices will likely not be met. Since this is not an environment that warrants multiple expansion, equity prices would have to adjust lower.

The S&P 500 is a mere 7% lower this year, which does not seem to reflect the incremental risks that have emerged. At the start of the year, supply chains were starting to improve, Covid was moving to the back pages of the newspapers, and the probability of a full-scale war in Ukraine was relatively low. Domestic labor shortages, rising input costs, degrading of global growth, and higher interest rates will at some point hit margins and earnings. Layer on the tail risk of further military conflict involving NATO, and it is not hard to make the case that if stock prices are to run away, they are more likely to run lower than higher.

Trades & new investments

I have to confess, I felt like an idiot early last week when markets were probing new lows and asked myself some serious questions: Why didn’t I take some chips off the table? What kind of optimistic fool continues to be overweight risk assets on the brink of a potential WWIII? Even with 30+ years of investment experience, these feelings of doubt are hard to shake. At these times, we need to convince ourselves that it is always darkest before dawn, and holding cash is a horrible long-term strategy – especially when real interest rates are so negative. Personally, I try to avoid major portfolio adjustments when there is so much uncertainty floating around, and doing “something” can make me feel even more idiotic than doing nothing. That said, I continue to nibble at a few things in the active part of my portfolio.

- In my last post, I mentioned I liked covered calls on the Nasdaq 100, accessing the strategy via an ETF QYLD. I still like the exposure with the broad index but have also been playing with narrow, more volatile indices that I think have started to bottom. The one I am targeting is XBI, the SPDR S&P Biotech ETF. I’m not going to tell you that I like the index for fundamental reasons, or that I have carefully analyzed the growth potential of the 190 names that the ETF holds. Because I haven’t. What I will say, though, is that I believe that innovation in biotechnology will continue, regardless of what goes on in China or Russia, or whether the Fed raises rates to 2% or 3%, and that the 40% drawdown from its November high to its recent low last week provides a better valuation than before to get involved. And with 10-day realized volatility hovering in the mid 50s, you take in a lot of premium by writing 1-week calls against the XBI long. When I get called out of the position, I wait for a nasty down day and sell puts to reestablish the long.

- Closed-end funds are looking more attractive. When investors, or their financial advisors, begin the capitulation process, the one-way momentum of selling usually leads to an opening up of closed-end fund discounts to net asset value. One fund I bought last week was BCAT, the BlackRock Capital Allocation Trust. BCAT uses moderate leverage (~ 18% as of Feb 28) and holds a mix of large-cap equities, private assets, and fixed income (mostly high yield credit). It is currently trading at a discount to NAV of 14.5% (vs. an average discount of 2% since inception), has a dividend yield of 7.5% and also engages in covered option writing strategies. I like the portfolio manager, Rick Rieder, I like the allocation to private assets, I like the option writing component, I like adding to credit at these levels, I can live with the 1.5% expense ratio, and I love the large discount to NAV. With respect to the fixed-income allocation, which is an obvious concern as the Fed embarks on its monetary tightening campaign, here is a quote from the Q4 update:

The bulk of exposure within the asset class remains mainly comprised of high yield credit and securitized assets where we find the most attractive carry within the asset class with minimal duration exposure, along with modest exposure to emerging market sovereign bonds which also offer similar characteristics. The Trust holds very little in the way of developed market sovereign bonds given their lack of income and higher duration exposure.

BCAT Q4 Update

That’s it for this post. Please remember to do all your own due diligence on any investments. My personal trades and investments should NOT be considered investment advice!