There is a lot to highlight this week, as there usually is when markets show signs of stress and investors hit the brakes. So far, most of the downward pressure is due to the disappointment with the inflation picture and the reduced likelihood that the Fed will deliver on an easing campaign later this year. “Higher for longer” is back in play, and the bond and equity markets are punishing sectors and companies that will struggle with 10-year rates approaching 5%.

Some of the biggest losers last week were biotech (XBI: -6%) and momentum stocks (MTUM: -5.6%). Surprisingly, due to their sensitivity to interest rates, utilities and financials had a great week (XLU: +1.9%, XLF: +0.8%). The broader market (VTI) shed 3.1%. The S&P 500 has had six consecutive down days and three down weeks. Ouch.

On the positive side, geopolitical tensions remain on a simmer rather than a boil. The back-and-forth retaliations between Israel and Iran have paused for the moment, and front WTI crude futures closed 2.8% lower. The next hurdle for equities will be earnings season (roughly 40% of the S&P 500 is set to report this week).

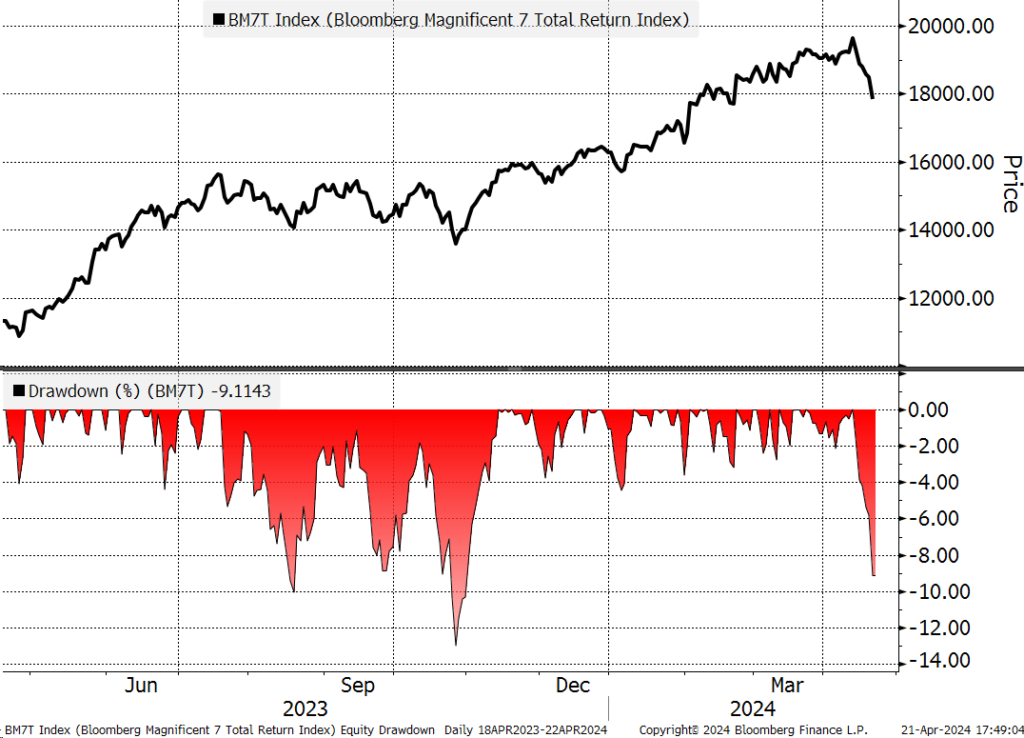

Some of the high-flyers have already started to reprice. Netflix (NFLX) has lost nearly 13% in the last two weeks and Nvidia (NVDA) has shed almost 20% from its March 22 high. Mag 7 momentum has stalled for the moment, with the index dropping 9.7% in the last ten days.

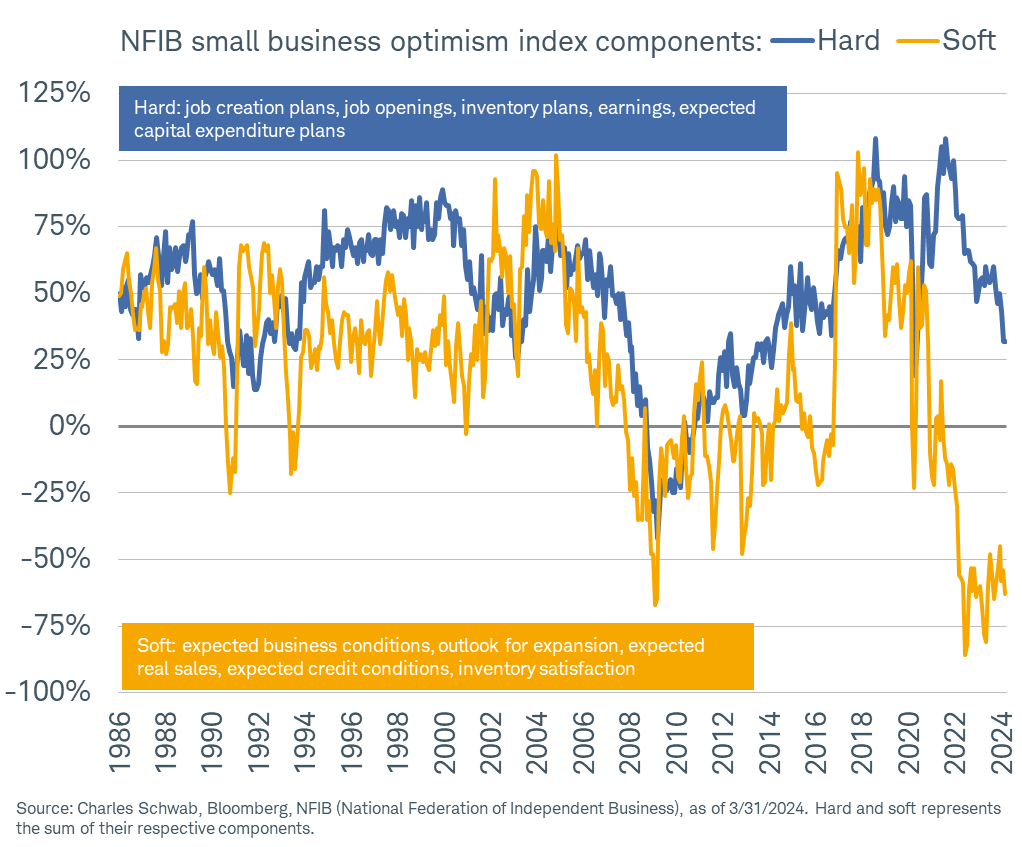

Optimism and sentiment in small caps are even worse. Recent National Federation of Independent Business (NFIB) survey components point to a deterioration in both hard and soft data, with soft data (expected business conditions, expected credit conditions, outlook for expansion, etc) hovering near 40-year lows.

And small business confidence, compared to large cap confidence, is getting worse.

Small caps are more leveraged than the typical company in the S&P 500 and are more vulnerable to the higher-for-longer theme that is ripping through markets again. The Russell 2000 is once again becoming more correlated with 10-year bond yields.

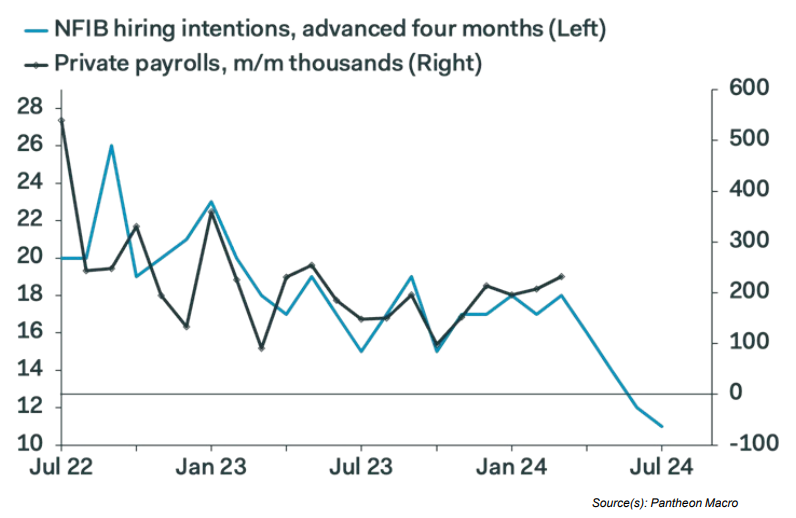

If there is one thing that will change the Fed’s view on easing from “nice” to “needed,” it will be a change in the employment picture. Labor markets are still holding strong and are yet to be a source of present concern for policy-makers. Roughly 46% of private sector workers are employed by small businesses, so if the poor outlook noted above is realized, layoffs could be around the corner. Pantheon Macro published a nice chart last week showing the link between NFIB hiring intentions (advanced four months) and private payrolls. It doesn’t look pretty.

For most of 2024, the S&P 500 has operated in the “good news is good news” regime, meaning strong economic data has led to stock market gains. So, despite the bond market weakness in Q1, equities managed to ignore the fact that Fed cuts were getting priced out of the market and instead basked in the glory of a potential “no landing” scenario.

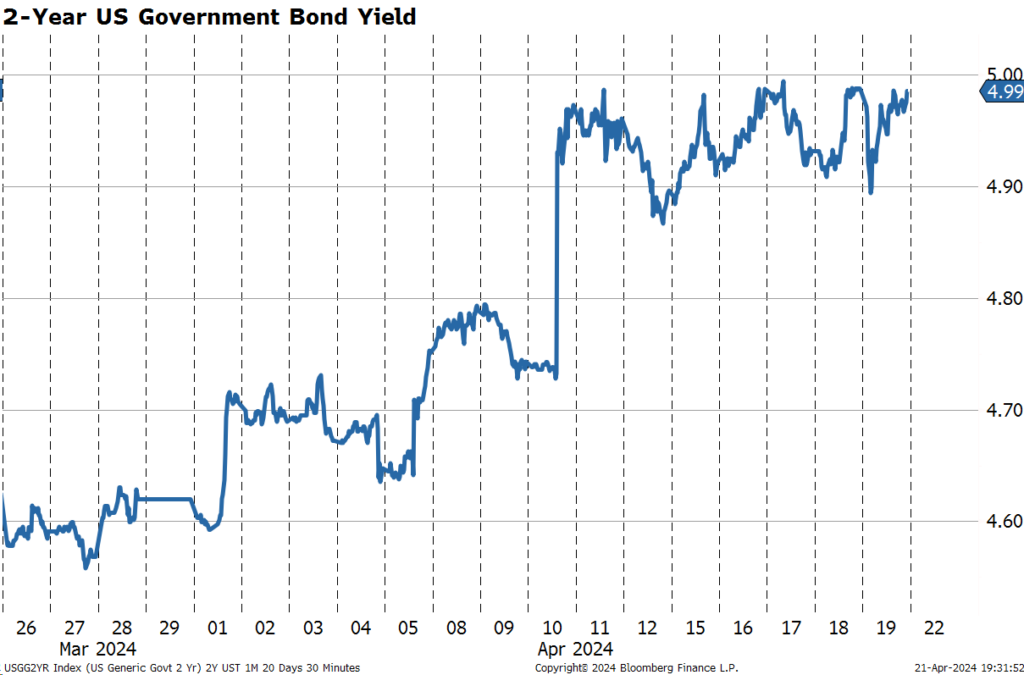

Bonds look like a good bet here. It might be a bit early, but 5% yields on 2-year Treasuries have a good risk-reward. The carry is still a little negative, but if the employment market starts to crack, geopolitical tensions escalate, or risk assets take a bigger dive, causing a material tightening in financial conditions, we could see a meaningful move lower in front-end rates. To take advantage of this, I have started to layer in some longs in 2-year futures and 3-month SOFR futures (Jun 2026 contracts). To somewhat hedge my bets that rates are going to stay high for a while, I also added some exposure to leveraged loans (BKLN) that are paying north of 9% coupons.

There are many more charts I could show, but the theme is the same: markets are still in risk-off mode, volatility across asset classes is picking up, momentum stocks are reversing, and the move higher in rates is causing a lot of uncertainty among allocators. In any case, as we know, it is very difficult to call the market on a week-by-week basis, so rather than trying to pick an exact turning point, let’s shift to a more structural, long-term investment theme on the radar of many investors: India.

India

India’s almost one billion voters started to cast ballots on Friday in the world’s largest election. Prime Minister Narendra Modi is expected to win a rare third term on the back of issues such as growth, welfare, and Hindu nationalism.

India has attracted a lot of attention in the last couple of years. Structural changes are improving the business climate, leading some to believe that “India is the next China” when it comes to rising economic superpowers. I have dabbled in Indian equities for the last decade or so with modest success (primarily using either index funds or Matthews Asia India Fund, MINDX), but I have failed to commit to the buy-and-hold strategy deployed in most of my portfolio.

A recent article in Foreign Policy highlights some of the major factors behind the transformation:

For the past quarter century, India’s development was hobbled by its infrastructure, inadequate to the nation’s own manufacturing needs and patently insufficient for foreign firms considering India as an export base. Over the last decade, however, its infrastructure has been transformed. The government of Prime Minister Narendra Modi has built roads, ports, airports, railways, power, and telecommunications, in such quantities that it has rendered the country almost unrecognizable from what it was just a few years ago. To give just one example, around 34,000 miles of national highways have been built since the current government came to power in 2014.

Much of the economic resurgence came after the surprise “demonetization” in November 2016, When Modi declared that the country’s two highest-denomination currency notes would be withdrawn immediately from the market. The withdrawn notes constituted 86% of India’s circulating currency. By rendering these notes valueless overnight, the government aimed to eliminate substantial amounts of unreported money held by tax evaders. Additionally, the government stated that this move would significantly reduce corruption and counterfeiting, and accelerate India’s shift towards a digital, cashless economy. It worked.

After the initial shock and adjustment, productivity accelerated. Digitalization supported the formalization of the economy, with around 8.8 million new taxpayers registering for the GST between July 2017 and March 2022. More taxpayers mean more tax collections, and this government revenue has been plowed back into infrastructure developments, which will lead to further productivity growth.

As for the investment theses, GDP growth is one of the main attractions. India has been among the fastest growing economies in the world, with three major agencies recently revising estimates for the next few years even higher. According to the IMF, India is projected to achieve a growth rate of 6.1% annually over the next five years, positioning it as the third-largest economy globally by 2027. By 2030, India’s annual GDP is expected to double from its current US$3.5 trillion to US$7 trillion.

One of the biggest hurdles for investors is valuation. Compared to other major emerging markets, India has the highest P/E ratio.

A lot of good news is priced into the equity market, but as we have seen in many countries and companies, investors love a good growth story. In a report released last week, JP Morgan forecasts earnings per share will grow at an annual rate of 16.8% over the next three years, compared to 6.8% for the MSCI EM index.

In the same report, JPM highlighted several factors driving the strong GDP and earnings growth:

- Favorable demographic dividend—India is home to over 900 million people aged 15 to 64. The Indian age pyramid has a “classic” shape, with a large base and a narrow top that implies a favorable dependency ratio. Increasing population and lower dependency ratios in a country argue for a demographic dividend as a factor for higher economic growth.

- Strong infrastructure push, pro-industry policies and government spending. Public investment has driven growth since the pandemic, and central capex is expected to have doubled in four years to 3.3% of GDP by FY24 from 1.7% of GDP in FY20.

- Positive optionality from supply chain relocation (China+1 Strategy) looking to expand away from geopolitical fault lines. As businesses look to diversify supply chain risk, India is expected to gain from manufacturing moving out of China. India’s labor cost advantages are explicit vs the rising labor costs in China. Exports have emerged as the largest contributor to India’s GDP post-COVID.

- Consumption tailwinds include urbanization and rising wealth. India’s GDP per capita crossed US$2,600 in 2023 and has grown at a 6.2% CAGR over the past 10 years. Many EM markets exhibited a significant increase in consumption spending after attaining a GDP per capita of $2,000.

- A robust structural reform agenda. These structural reforms have aimed to change how business is conducted in India. The resulting efficiency gains can be significant and can drive permanent productivity increases. Perhaps India should have started to see stronger benefits if not for the pandemic-led break.

The Indian stock market has historically been a good place to invest, especially on a risk-adjusted basis. Looking at the ratio of annualized returns over volatility, the Nifty is top-ranked with a value of 0.57 since its inception. To put this in perspective, the Nasdaq 100 trails slightly with a ratio of 0.54, while the S&P 500 stands at 0.46.

The country is also seeing increased domestic participation in the stock market. No doubt, some of it definitely feels speculative. India accounted for a staggering 78% of equity options contracts traded worldwide in 2023, according to an article in the WSJ last month.

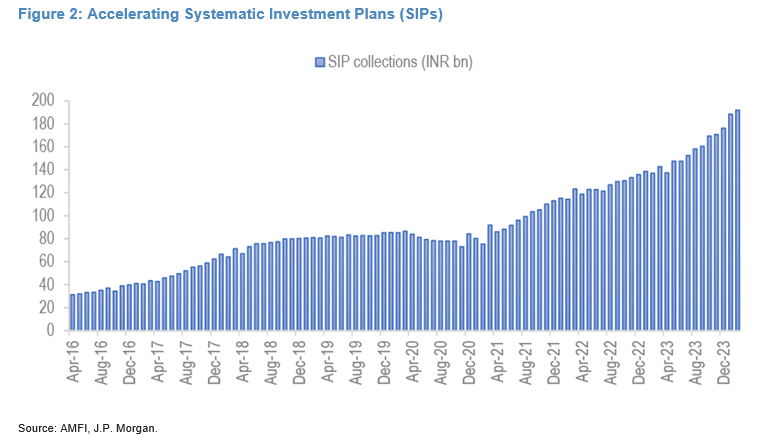

But a large part of the equity inflows A large part of this can be attributed to the growth in systematic investment plans (SIP). SIPs offer a way to automatically invest money in mutual funds regularly over a period of time. Annual SIP flows have more than doubled since 2020. Even with this, the share of equities (directly/mutual fund) in Indian household assets still remains low, which means the contribution to equities as part of the household saving pool will likely keep growing in the future, too.

In the long term, India’s growth drivers include a demographic dividend, increasing urbanization and wealth, a growing middle class, improved government investment in infrastructure, and a strengthening manufacturing sector from “friend-shoring.” India does not have the geopolitical tensions of China, the lack of economic diversification of Taiwan, or the export-focused dependencies of South Korea. It’s worth putting on the radar as one of those multi-year investable themes.

Other Random Musings:

It’s a great time of the year for sports. We have hockey playoffs, basketball playoffs, major golf tournaments and even the Olympics this year. Some thoughts below. Please keep in mind that I am a fan, not an expert, so take my comments with a grain of salt.

NHL Playoffs:

At last. The NHL playoffs have started. The games have gone pretty much as expected so far, and they all have had that playoff feel: fast, physical, intense. My wife, who recently got into hockey after attending a first-round playoff game in Las Vegas last year, instantly became a Vegas Golden Knights fan. As luck would have it, or more like destiny if you ask her, Vegas won the Stanley Cup in her first official year as a fan. Meanwhile, my team has NEVER won. Not when I lived in Vancouver. Not when I lived in Toronto. Not when I lived in South Florida.

There is a very clear pecking order when it comes to who I would like to see take home the Cup:

Looking at the betting markets, I think Carolina and Edmonton are a little rich, and Boston and and Tampa are a touch cheap. Since it is tough to make money in the equity market right now, I might throw a few bucks on Tampa at 25-1. Even though Florida won game one, Tampa showed moments brilliance and their goalie, Andrei Vasilevskiy, is playoff-tested and always strong this time of year.

Golf:

Congratulations to Scottie Scheffler. He won the Masters last weekend and, at the time of writing, had a five-stroke lead in the RBS Heritage with four holes to play. The guy inspires me. He thrives under pressure (which I fail to do every year in our Club Championship). He makes the shots he needs when they matter the most. My personal mantra is more like “you can count on me when it doesn’t count”. As a golfer, I look at the beautiful swings of guys like Rory McIlroy and know that there is no way I could ever emulate such perfection.

Then I look at the way Scheffler swings the club. It does not look like anybody else. Golfers typically generate power by transferring their weight forward, releasing pressure from the back foot and shifting it toward the front foot. But as Scheffler swings, especially on his drives, his back foot completely abandons its position, sliding behind his body and toward his front foot. It looks like he slips whenever he strikes the ball. But it works. He is the number-one ranked player in the world and is totally dominating the tour right now. I wish my less-than-perfect swing was equally effective.

That’s it for this week. Next week I plan to dive a little deeper in the loan and CLO markets where flows have turned positive as of yet.