1. Italian BTPs

BTPs gained on the back of comments made by Finance Minister Giovanni Tria. He pledged fiscal prudence with respect to the Italian budget. Lower BTP yields, especially in the front end of the yield curve, take the stress of the banking community and European financial markets in general.

2. Crypto Meltdown

The year-to-date change in most cryptocurrencies is very dramatic. As a group, the top 20 coins have lost more than $330 billion in value this year. Some coins have become virtually worthless.

3. Bear Market Territory for EM Stocks

It’s official. EM stocks are in a bear market if you use the old “20% drawdown from the peak” methodology. The 20% correction is even more surprising when compared to the US market which is setting new highs.

4. The US vs the World

It’s not just EM that is underperforming the US when it comes to equity markets. The entire world has been selling off in the last 6 months. Some of the return difference is explained by the divergence in economic growth; the US is accelerating and the rest of the world is decelerating. Most of it due to US profit growth.

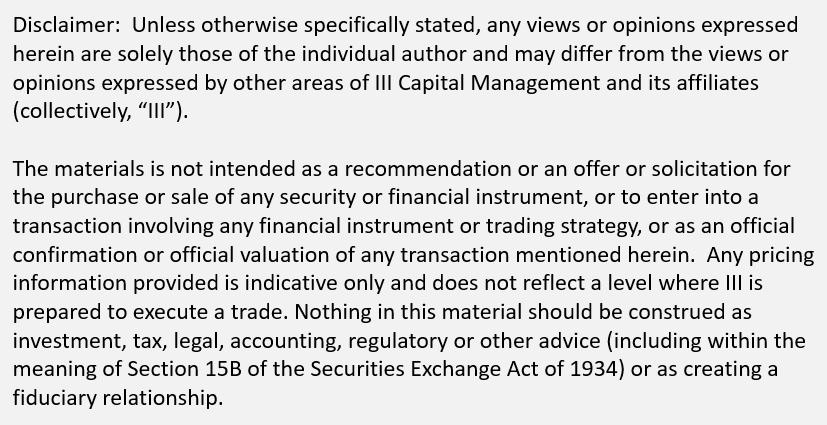

5. Really Long History of Real Yields

Short-term real yields (T-Bills vs inflation) are finally moving into positive territory. The last decade of easy monetary policy and negative real returns on cash is only matched by the periods surrounding the Civil war and the two World Wars.

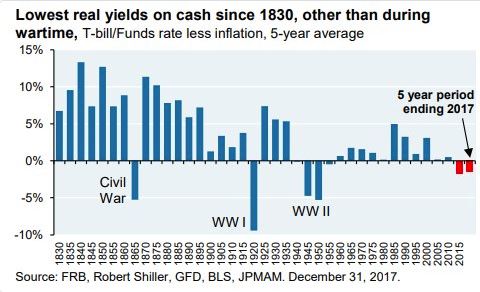

6. Divergence in the Global Gas Market

Some commodities are truly global. Others are dominated by local supply and demand characteristics. Natural gas is one such example. Prices are stable in the US but are soaring in the UK and the rest of Europe. UK Gas futures are up 38% in the last 3 months; US futures are down 5%.

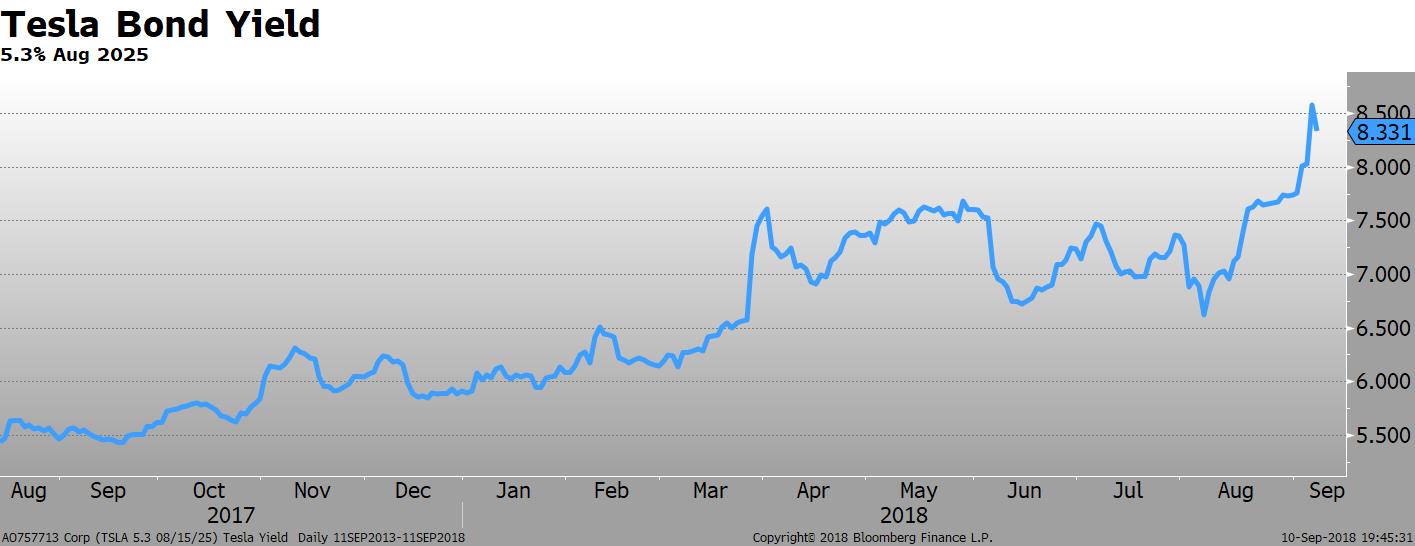

7. Trouble at Tesla

Tesla bond yields are hitting new highs, and so is Elon Musk. The latest hit to Tesla stock and bond prices came after he smoked pot in an interview with Rogan. It is going to hard for a capital-intensive business to continue to compete with such a high cost of capital.

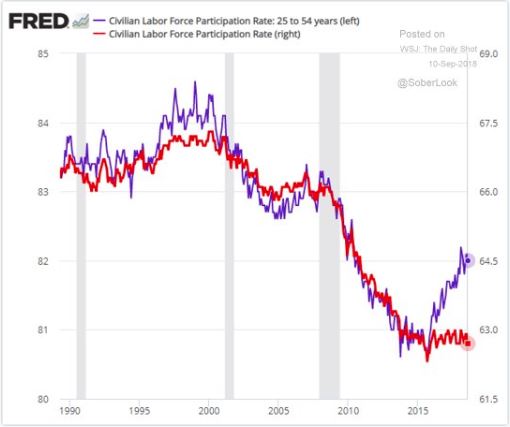

8. Labor Participation

One factor that may be keeping wages in check, despite the very low levels of unemployment, is the rise in the labor participation rate of the 25-54-year-old cohort. The participation rate has fallen over the last 20 years but appears to have bottomed. The economy will need more people to re-enter the workforce to satisfy the growing demand for workers.

9. Low Equity Market Breadth

Pundits point to the lack of breadth in the US market as a sign of concern– most of the gains have come from a small group of stocks. The same situation holds at the country level. The MSCI All-Country World Index (ACWI) is flat YTD in terms of performance, yet only 30% of the country constituents are above their 200 day moving average.

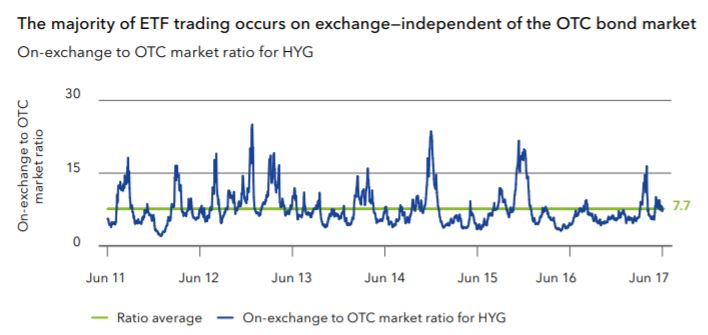

10. ETF Secondary Liquidity

ETF naysayers take note: most trading of high yield bond ETFs does not involve an OTC transaction. There is almost 8 times the volume traded in the secondary market compared to the create/redeem process. Most trades do not involve the cash market. Historically, the ratio tends to climb when share volume increases in down markets. That’s good news.