I’m sure I was not the only one trying to avoid looking at their brokerage account last week. I admit, I was turtling a little. Equities continued their push lower, credit spreads gapped wider, crypto currencies crashed, and Treasury yields finally rallied in response to the deteriorating liquidity conditions.

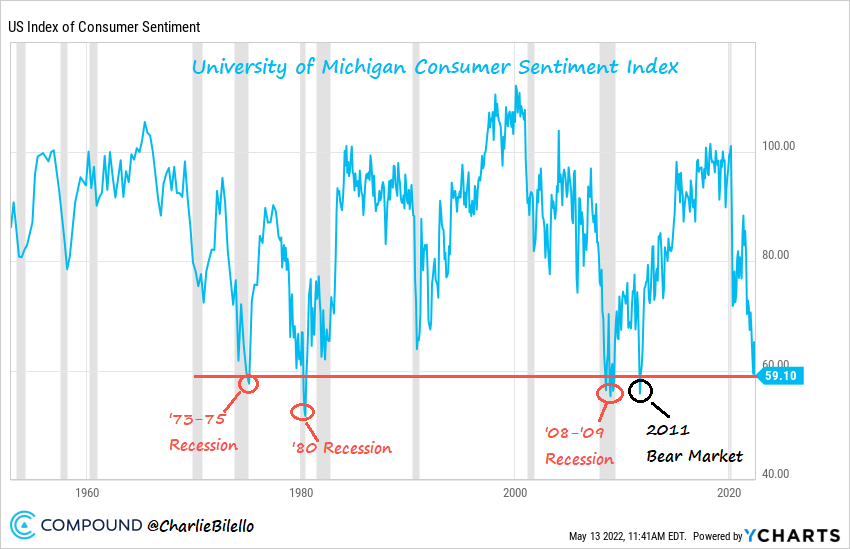

Looking at the moves in various asset classes and sectors, it appears the market abandoned hopes of a soft landing and started to price in the impact of a full-blown global recession.

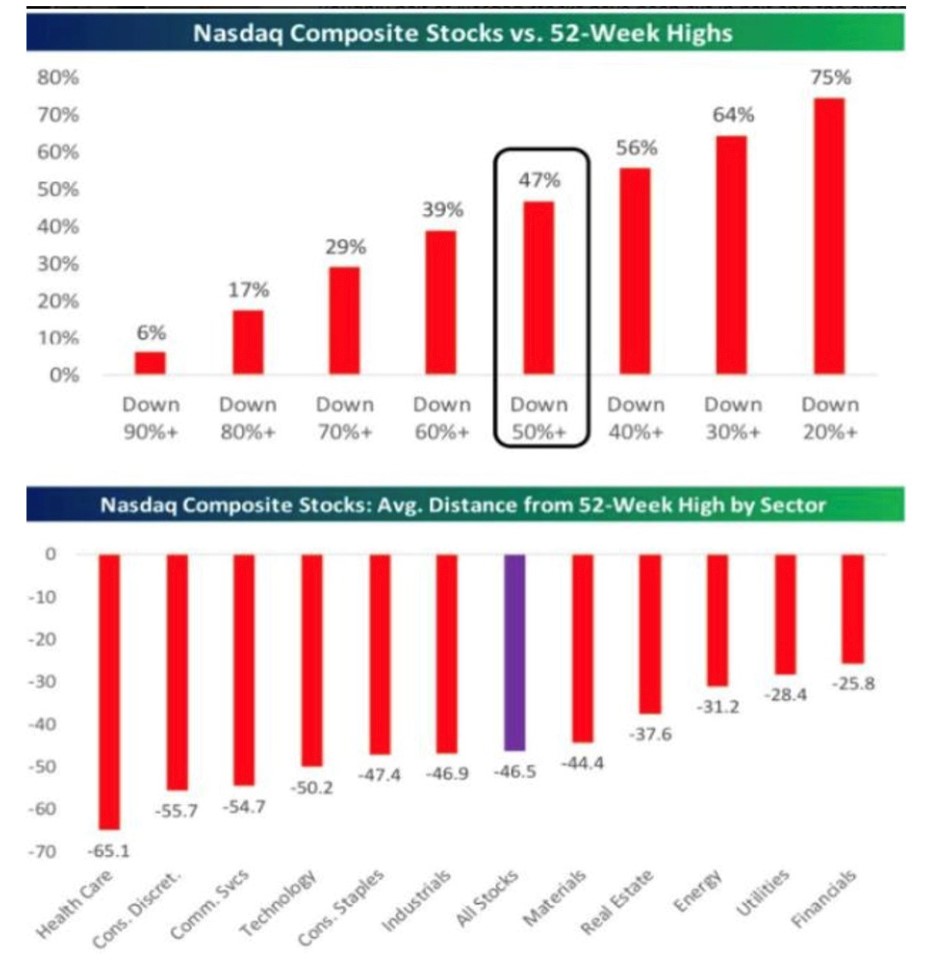

Growth stocks suffered again. Not because long-term interest rates were eroding the value of future cash flows, but because those cash flows were less likely to be realized. Stating the obvious, growth stocks don’t do so well in a growth scare, especially when nominal and real interest rates rise. Almost half of the Nasdaq have seen 50% plus declines; 30% of the index has declined 70%. Ouch.

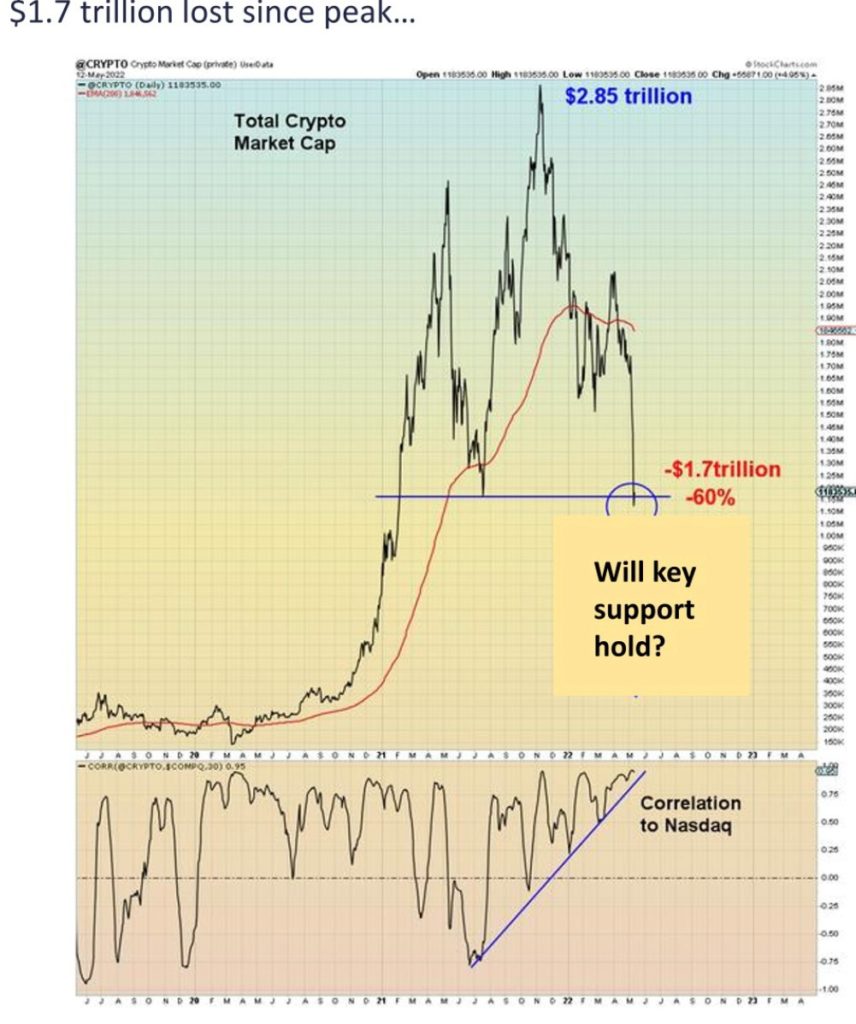

The big story last week was in the crypto currency market. The crypto market has lost $1.7 trillion in market cap over the previous six months, a decline of 60% from the peak.

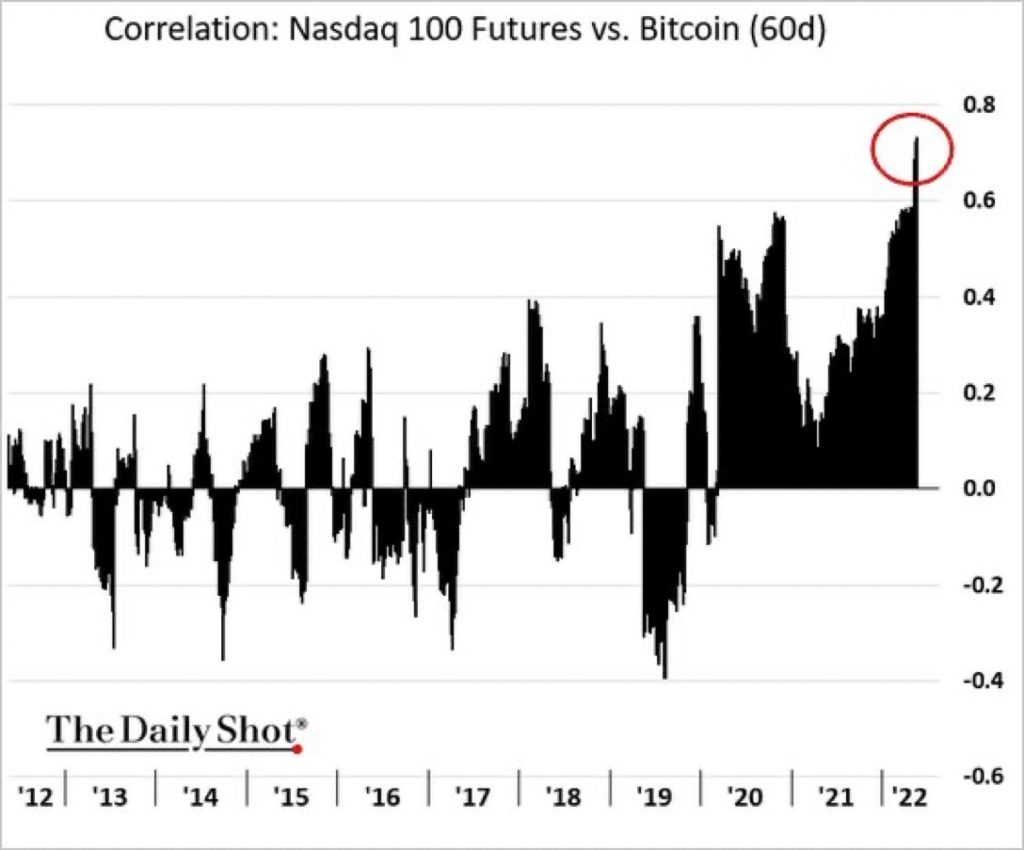

Losses accelerated last week when TerraUSD (UST), once the third-largest stable coin in the industry, lost its dollar peg. The sell-off prompted concerns of spillover risk to short-term debt markets should there be a run on other larger stable coins such as Tether. Tether holds roughly 84% of its reserves in money markets. Those that touted the diversification benefits of crypto are suffering from the increased correlation to other risk assets such as the Nasdaq.

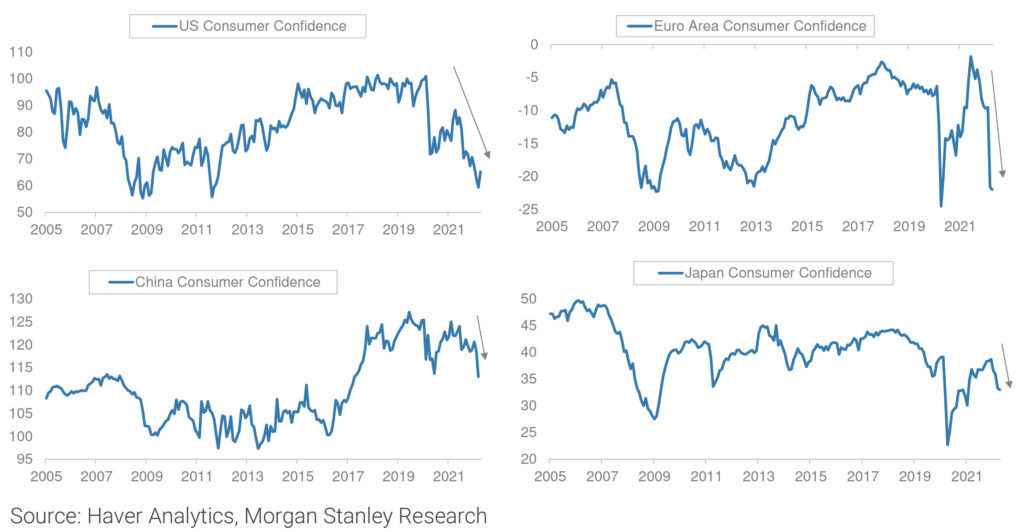

Market and consumer sentiment have taken a turn for the worse.

The outlook is no better overseas, where consumer confidence is also plummeting.

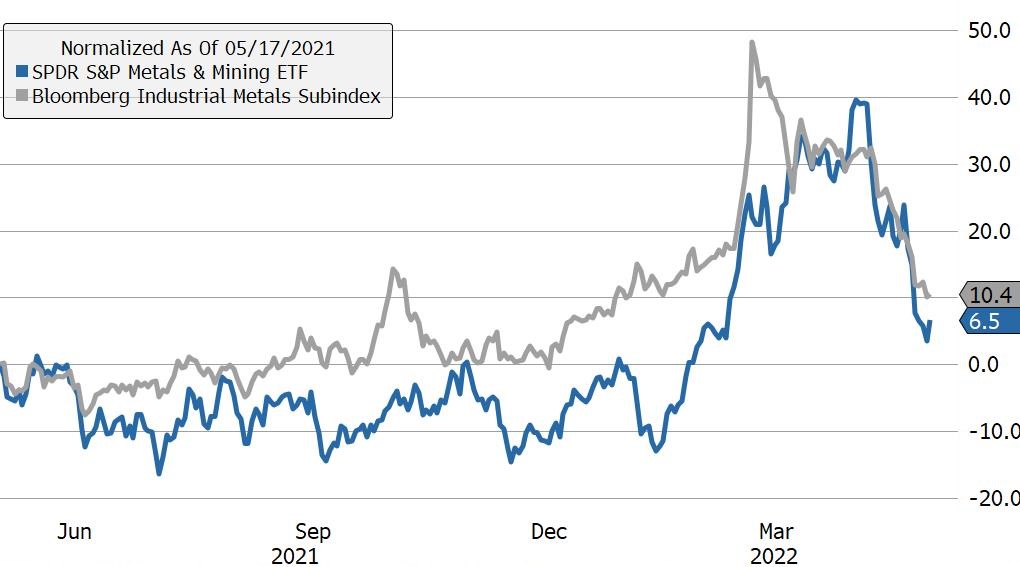

China, the primary driver of global industrial demand and supplier of many of the world’s consumer products, is not emerging from Covid lockdowns anytime soon. That means the supply chain issues won’t improve, which means the supply side of the inflation problem will not get resolved, which means central banks will have to orchestrate a bigger hit to demand, which means it is going to be hard to avoid a recession. While still positive on the year, demand-sensitive commodities like industrial metals got crushed last week along with the companies that produce them.

In Europe, geopolitical tensions are set to increase as Finland and Sweden announced their intention to join NATO, aggravating Russia, which is already concerned about Western influence along its border. Gas and energy prices are still way too high, and if supply is cut off before Europe has found an alternative, the economic consequences will go from bad to worse.

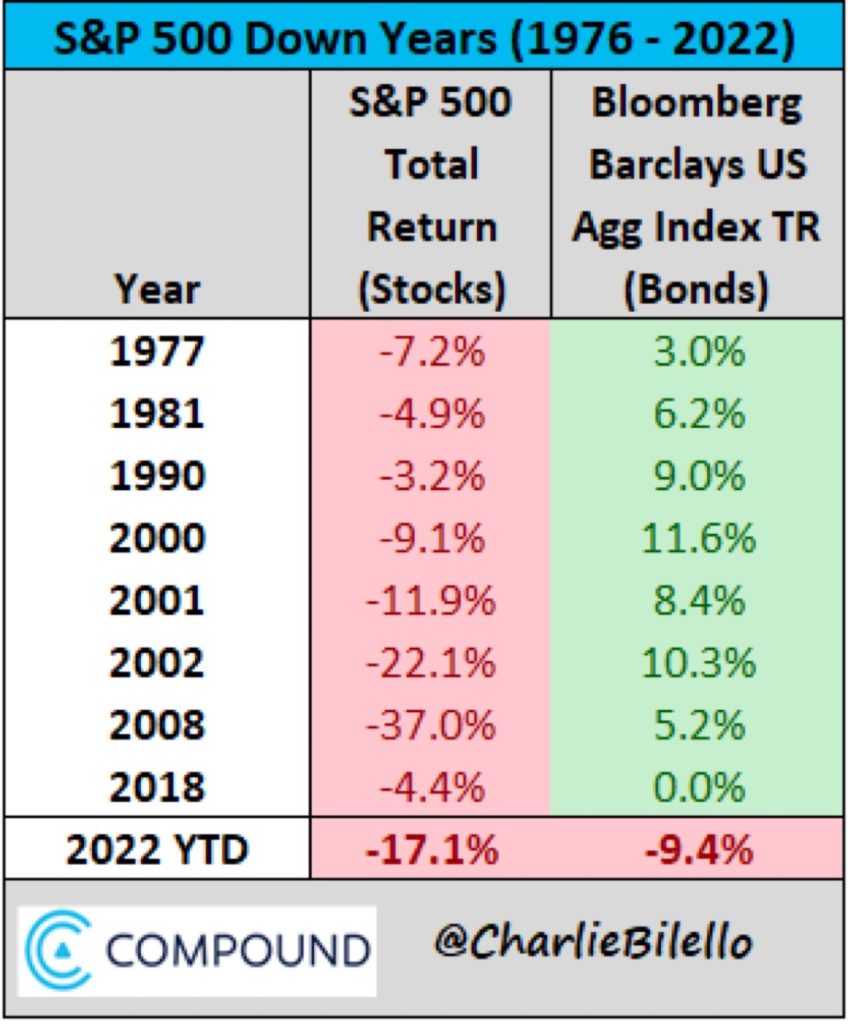

After the last several weeks, it’s important to remind ourselves that equity market drawdowns are normal and can’t be avoided. Long-term investors must be willing to take the pain to get the gain. We know when we invest and should not be surprised when we get the type of inevitable setbacks we are witnessing now. What is NOT normal by historical standards is the decoupling of the Treasury market from risk assets. The high-inflation environment, which has been absent for decades, has changed that dynamic.

Going back to the 1970s, if the year were to end now, this would be the only time BOTH stocks and bonds would finish lower. The equity drawdown has not been pleasant; the fact that “safe” allocations in portfolios are having an even worse run makes the situation so painful.

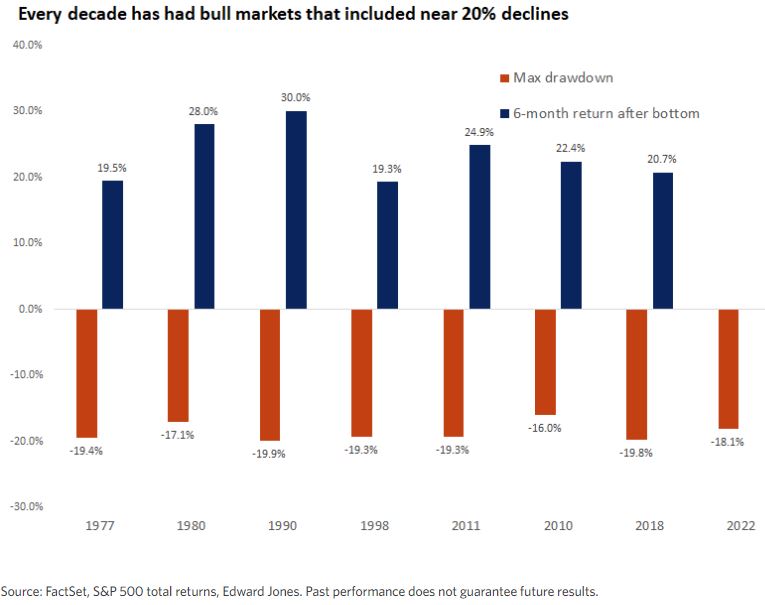

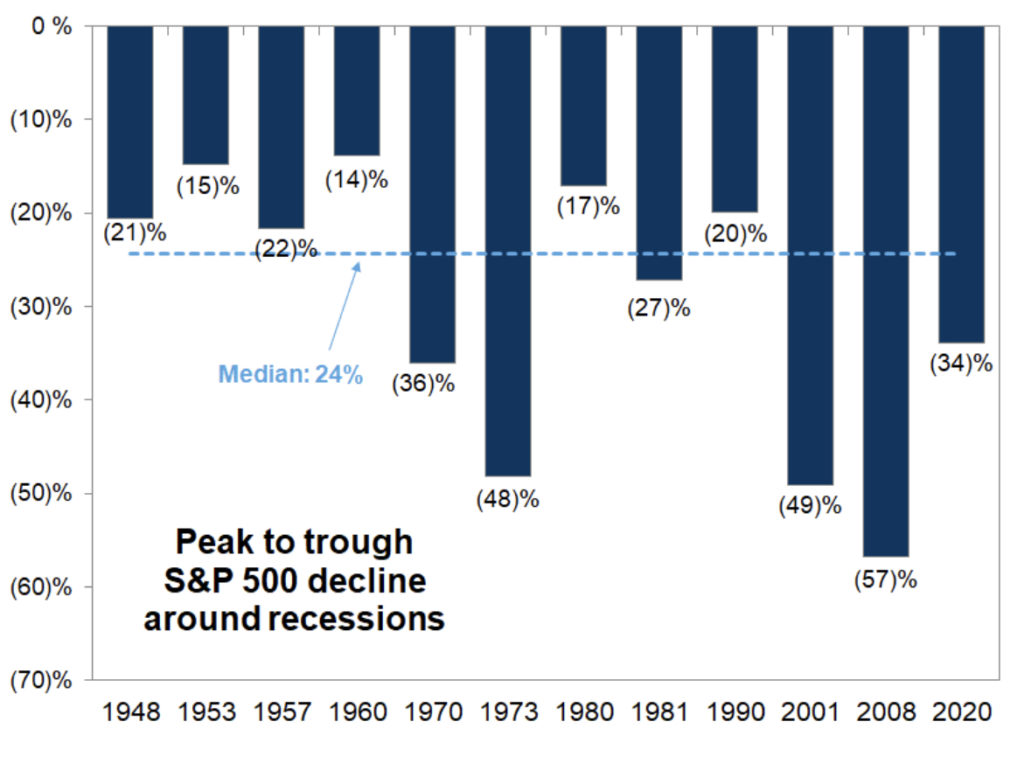

The chart below shows the average drawdown during bull markets: 20% pullbacks are typical.

And the median peak-to-trough decline around recessions is 24%. So we are in the middle of one of these periods.

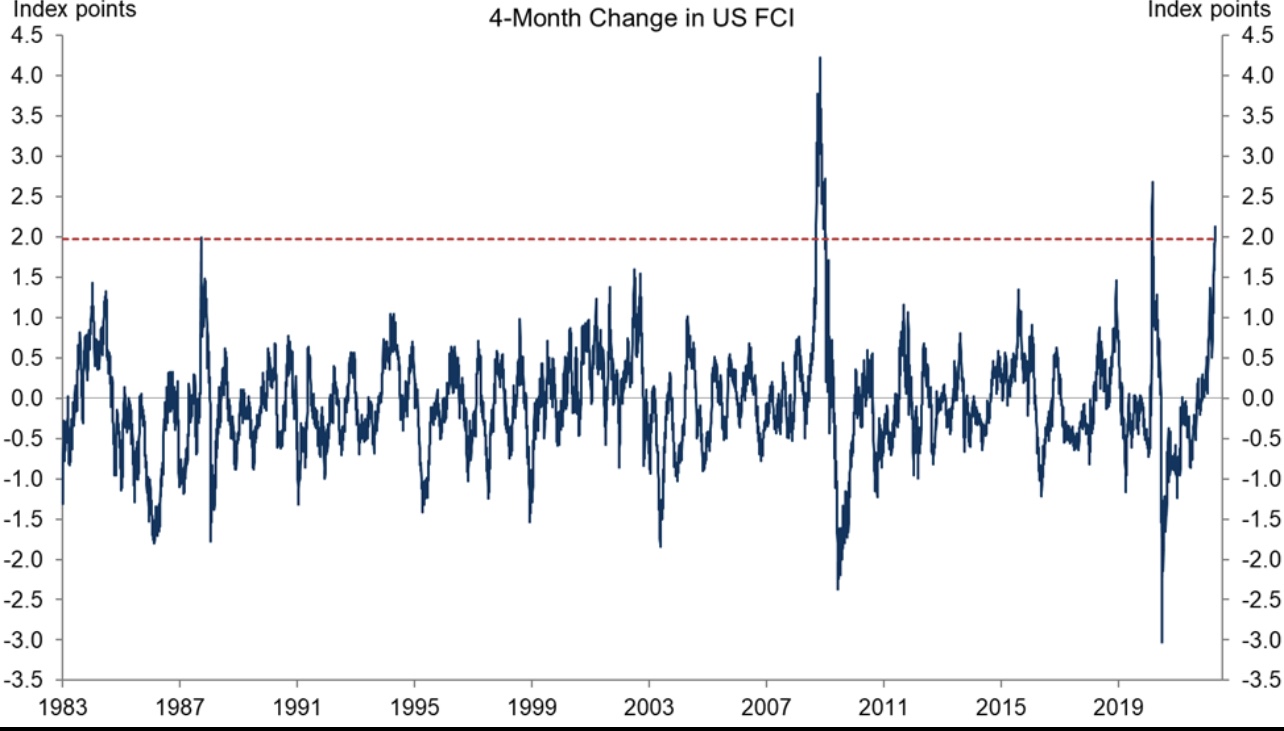

The pace at which the decline is happening is also disruptive. Some of that is pressure is from the removal of all the policy (both fiscal and monetary) accommodations. The Fed is targeting financial conditions, and interest rates are just one component. According to calculations from Goldman Sachs, there have only been two other occurrences since 1983 when FCI tightened more over a 4-month window: the 2008 financial crisis and the worst moments of COVID. Short-rates are a long way from peaking, but we may have seen the worst pace of overall tightening of financial conditions.

The fixed income markets are going through an adjustment process, seeking out liquidity and safety.

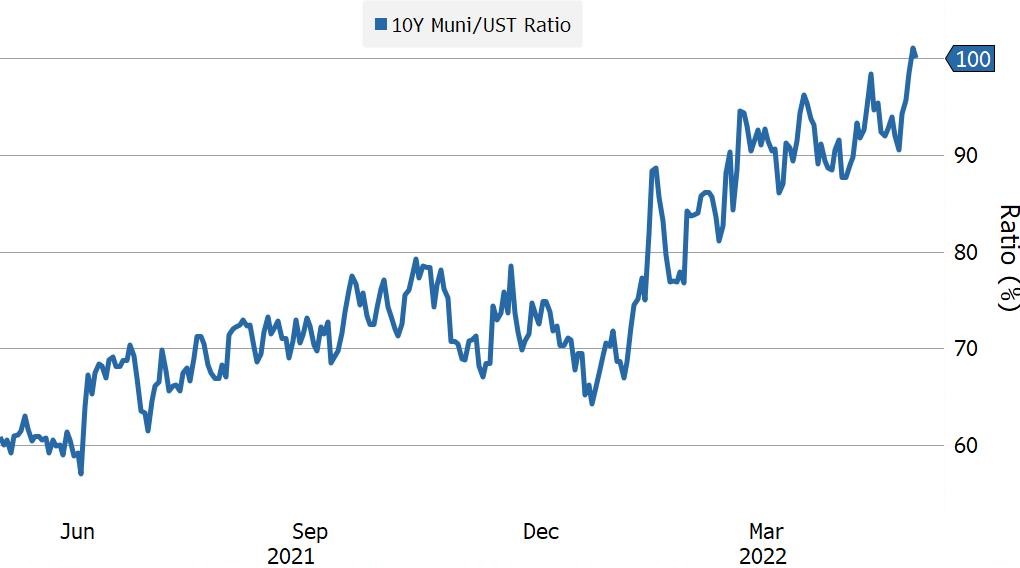

For example, municipal bonds failed to keep up with the recent rally in long-term interest rates in the U.S. 10-year Treasury rates fell 20 bps last week, yet similar maturity AAA-rated municipal bonds sold off another 8 bps, taking the ratio of yields between the two sectors to 100%. Investors can now get tax-exempt 10-year paper at the equivalent yield of Treasuries. With no major deterioration in municipal credit fundamentals, this is the type of opportunity that only shows up during flight-to-quality/risk avoidance periods in the market and is another sign of current investor demand for liquidity.

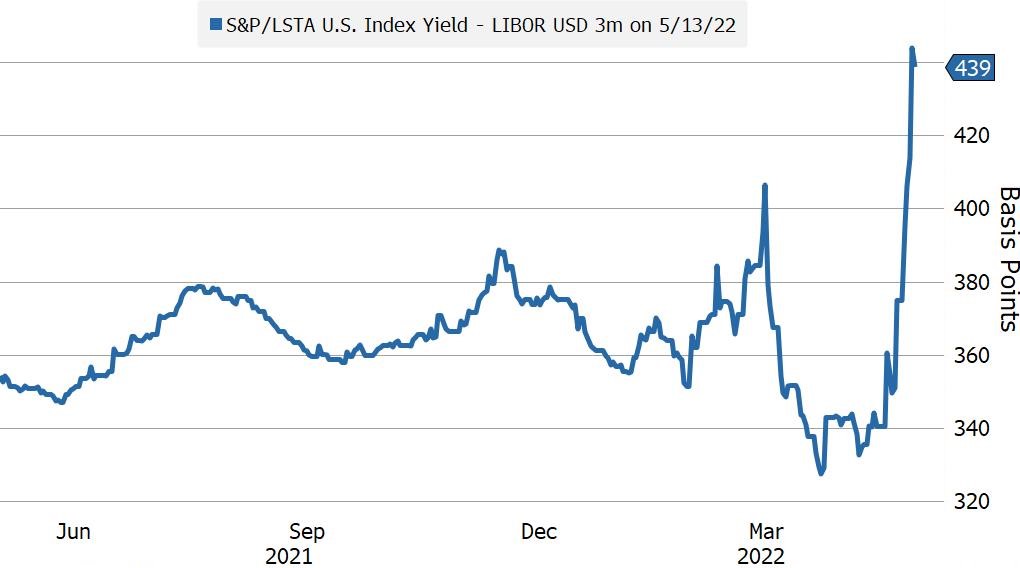

Leveraged loan spreads have begun to widen. Recession fears, outflows, flight to liquidity, and the overall risk-off environment are to blame. There has been decent support for the loan market because of the floating rate nature of the debt: as short rates rise, so does the coupon. Investors switched from fixed-rate high yield bonds to loans. That is a good strategy when the view is the economy will remain strong and the Fed is going to hike interest rates. But the market view is shifting. The Fed may be successful enough in tightening financial conditions through other channels (such as equities) that the hiking cycle may end with fed funds around 3%. The downside is that scenario most likely coincides with a hard landing. Hard landings are not good for corporate credit.

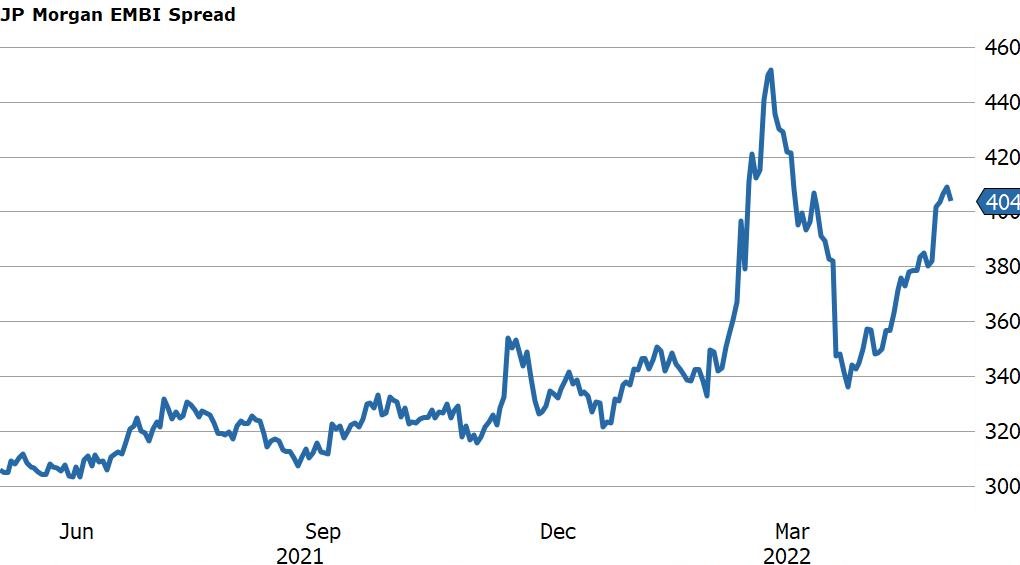

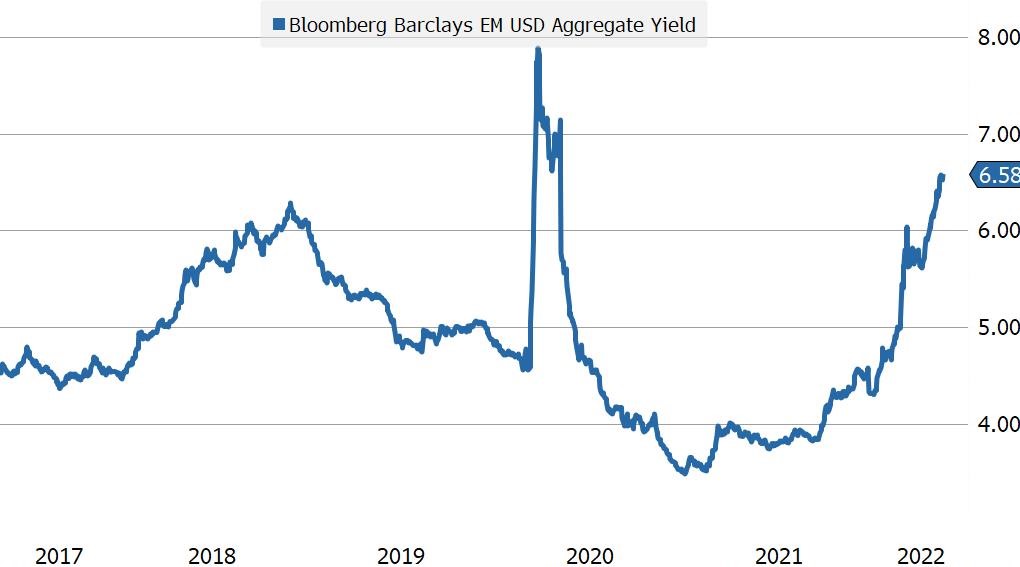

Another area experiencing heavy selling is emerging market debt, in both local and USD denominations. Yes, there are risks associated with EM bonds. US-dollar denominated emerging market bond yields have risen from the increase in Treasury rates and the widening of credit spreads. At least now, investors are getting some compensation for those risks.

If you own Treasuries, you probably own them for their “diversification” benefits – not for their yield. Most investors are painfully aware that government bonds have moved lower in price this year in lockstep with risk assets. Last week, as liquidity evaporated, 10-year Treasuries rallied 20 bps. It’s a great time to sell Treasuries, lock in any losses for tax purposes, and rotate into municipals or spread products like mortgages or investment grade corporates.

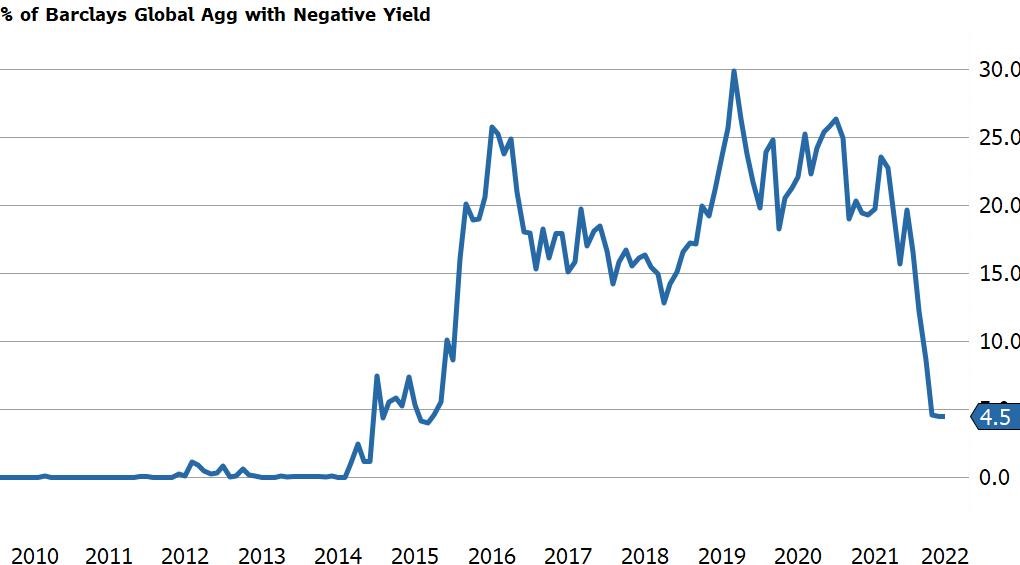

One positive development in global fixed income is the normalization of yields. For years, there was a debate whether central banks could ever end zero rate policies or whether investors would have to live with negative real rates forever. Well, those questions have been answered. There is very little negative-yielding debt left, real rates have moved back into positive territory, and allocations can buy bonds for yield again and not just diversification.

So how do we take advantage of the situation and stop feeling like a victim?

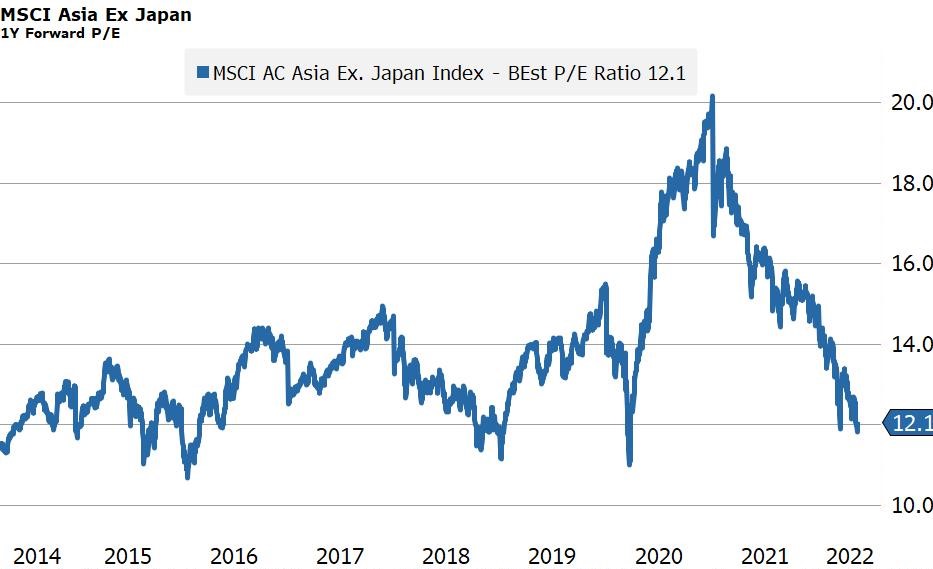

- If you are sitting on cash, it is NOT too early to begin to average into the equity market. I would stick with broad indices and add to ETFs like VTI, VXUS and VWO to get exposure to a basket of global, diversified stocks in both developed and emerging markets. Valuations are significantly cheaper in non-US markets and may provide a level of support sooner than in the US if prices keep dropping. In addition, additional total return may come from currency appreciation when the US dollar eventually runs out of steam and turns lower.

- This is the perfect environment for tax-loss harvesting. Selling one ETF or mutual fund and replacing it with similar exposure allows you to lock in some losses you can use in the future. I have been doing this with some China-focused funds that have underperformed pretty much everything in the last year.

- If you own US Treasuries in taxable accounts, it is a great time to sell them, lock in any losses for tax purposes, and allocate to your favorite municipal fund or ETF. I bought some PZA last week. If you are already in muni ETFs, you can do some tax-loss harvesting there as well.

- If you are looking to add some interest rate duration with a medium-term horizon, I prefer long-dated investment grade corporates to Treasuries. For example, the spread to government bonds for VCLT has widened to 174 bps, up from 100 bps a year ago.