When we have a momentum birthday (30,40,50,60..), there is usually a lot of drama. There are parties, claims of significance, reflections of the past, and forecasting of how our lives are going to change going forward. The “number” is meaningful, but the truth is you are just one day older than the day before. Looking at birthdays that way is no fun, obviously. Birthdays turn an ordinary event into a celebration, or depending on the number, into something we would rather not talk about at all.

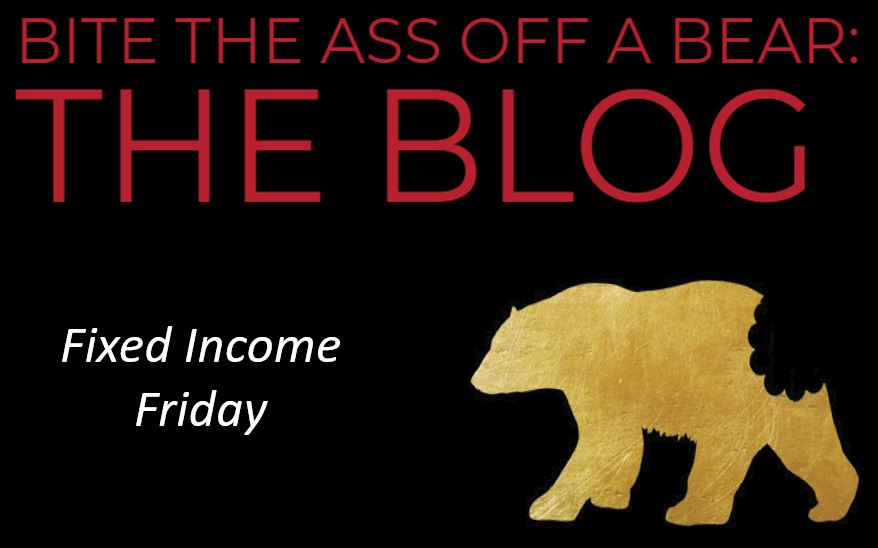

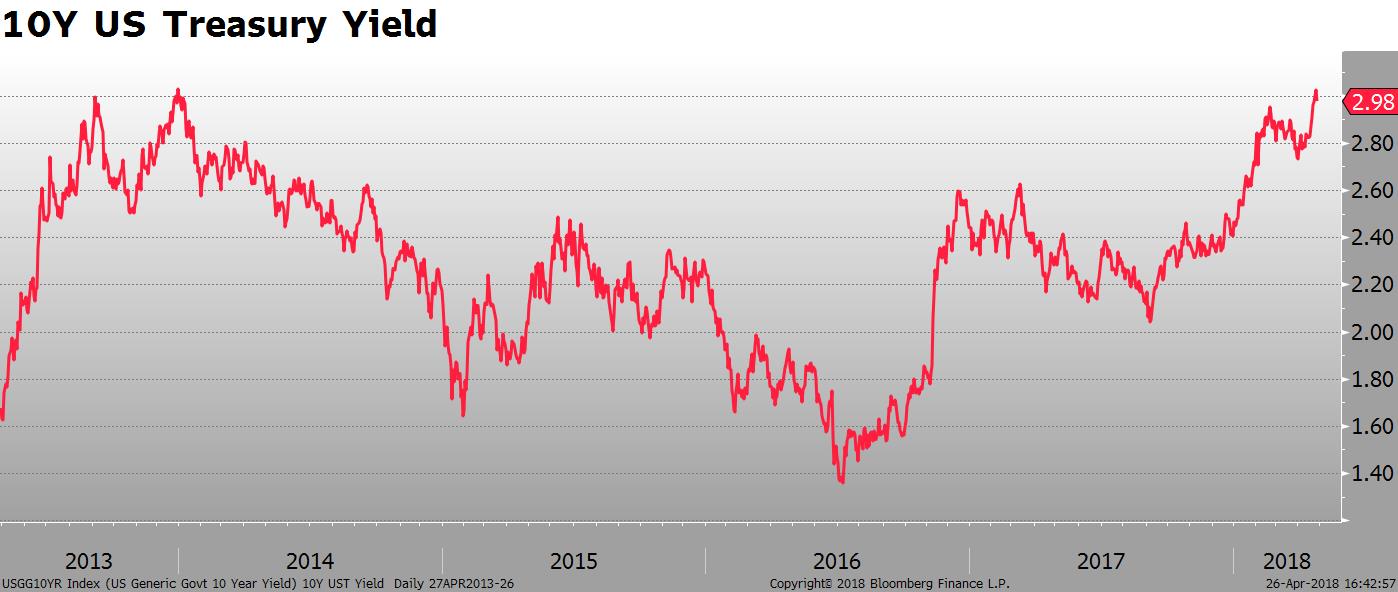

The bond market reacts to round numbers the same way we respond to birthdays. A 2.90% yield on the 10-year note was perfectly fine, but getting to 3.00% was an entirely different matter. Volatility spiked, equities got spooked and the USD surged. By the end of the week though, as the 10Y slipped back down to 2.95%, the market started to settle down.

The 3.00% is also a critical level for market technicians. It is the highest yield since the 2013 “Taper Tantrum” when bond prices plummeted and the curve steepness in response to the slowing of asset purchases by the Fed. The possibility of a breakout to new highs, combined with the psychological significance of the 3% round number, was the main event of the week.

Is the market telling us something important about the prospects for inflation? Possibly. The concern for investors is how the Fed will interpret the move. We should keep in mind that several Fed officials have gone on the record stating that an inflation rate higher than the stated 2% target is acceptable if it is seen as temporary. Here is a quote from Bostic, the President of the Atlanta Fed:

I am actually very comfortable going above the 2 percent by some amount—2.2, 2.3—I don’t think that is a crisis of overheating necessarily…I think it is also important that we take a stance so that everyone understands that the 2 percent level is an average, not a ceiling. I have some concerns we have been below for so long that if we go to 2 percent and do a hard stop and act aggressively to hold it at 2, that will send a signal that we really view 2 percent as a ceiling.

Even if the Fed is not that concerned, the market is worried. The swap curve steepened, putting a temporary end to the aggressive flattening of late. 10-year swap rates rose 8 bp and 2-year rates increased only 2 bp.

As you might expect at a potential breakout point, investors turned to the options markets to express their view. Normalized 1mx10Y swaption volatility jumped from 55 bp to 64bp before closing at 58 bp on Friday.

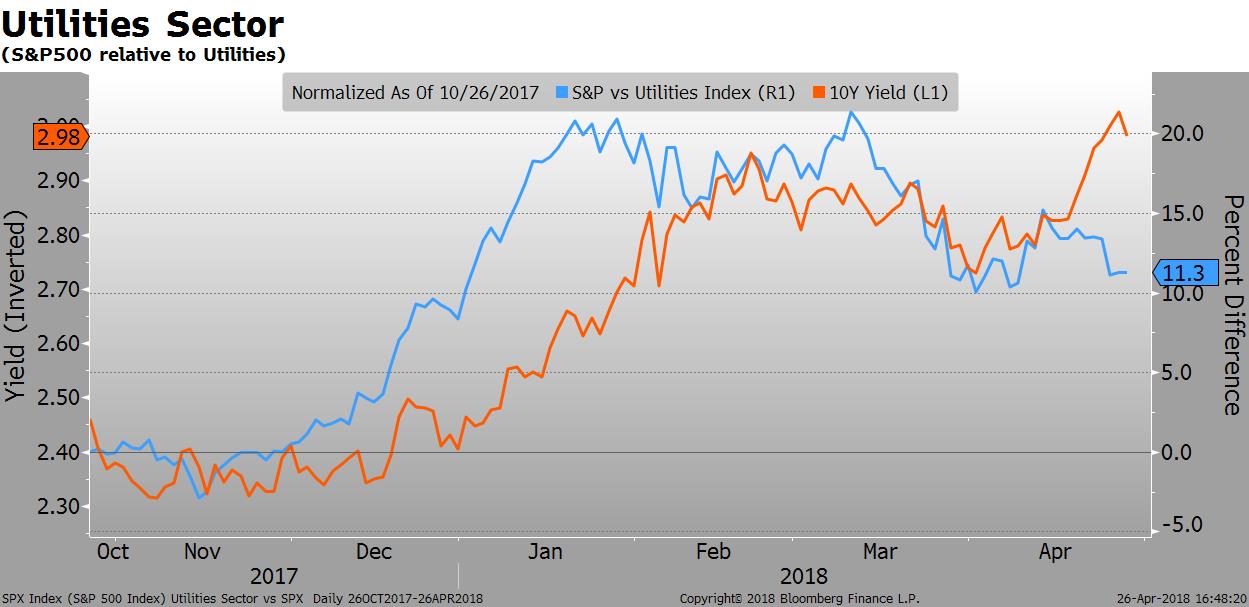

The equity market reaction was a bit odd to the developments in the bond market. For the last year, stock investors shrugged off the steady increases by the Fed and the corresponding march higher in the 2-year yield. The market as a whole rallied, but there was a lot of rotation in certain interest rate sensitive sectors. High dividend/low growth sectors like Utilities underperformed, for example. Interestingly, utility stocks outperformed the S&P 500 this week by 2.8%- not what you would typically expect from an industry that is sensitive to higher rates.

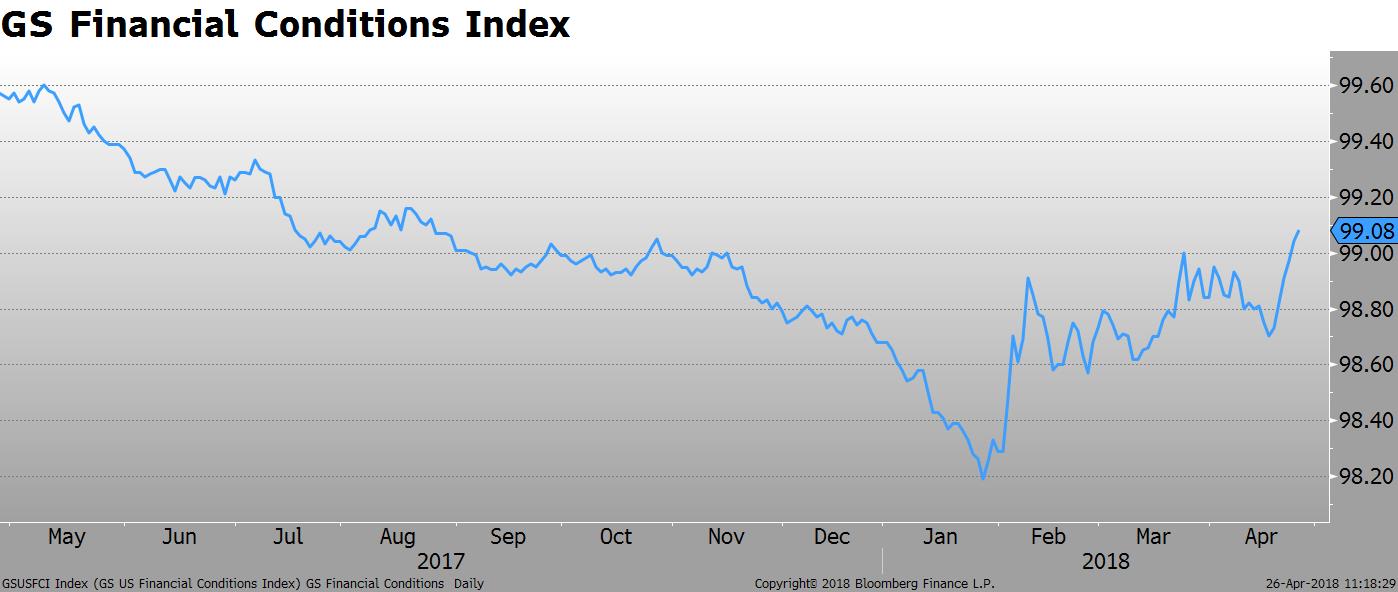

The Fed is trying to tighten financial conditions by raising rates. According to most models, they are accomplishing their goal. The Goldman Sachs Financial Conditions Index reached its highest level since August of last year. The Goldman FCI is a weighted sum of a short-term bond yield, a long-term corporate yield, the exchange rate, and a stock market variable. All elements contributed to the tightening this week.

The High Yield bond market decoupled this week from equities. Despite the flat stock market, High Yield cash spreads widened this week. The Bloomberg Barclays Index jumped 12 bp to 333 bp. The recent low was 314 bp on April 18th. Bonds of consumer discretionary companies performed the worst, widening 18 bp. Consumer staples were also wider by 13 bp.

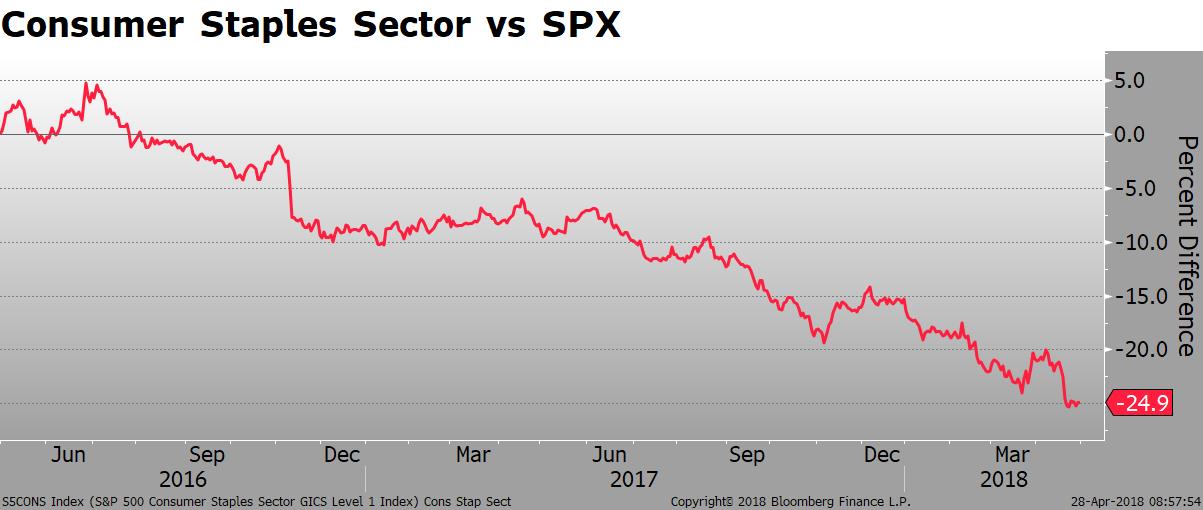

The damage to the consumer staples sector was not limited to bonds- the stocks got bashed again last week, continuing the multi-year trend.

Staples stocks include tobacco companies, consumer products manufacturers, big retailers like Walmart and Costco, amongst others. A lot of the underperformance comes down to the “Amazon Effect”. Anybody that competes with Amazon, or will be forced to eventually compete, is going to face declining margins and growth prospects.

The total return of the consumer staples sector has lagged the S&P 500 by 25% over the last two years. Over that same period, Amazon has outperformed the broad market by 84%. The P/E ratio of the sector has fallen from 23.5 in the middle of 2016 to under 19 today. The market has clearly repriced growth prospects for these companies.

Turning back to the bond market, both USD and local currency sovereign emerging market debt got hit pretty hard last week. The spread on the JP Morgan EMBI Global Index rose 12 bp on the week to 331 bp.

In developed markets, yields in the US an Australia were 8 bp higher on the week. Meanwhile, peripheral European yields (Italy and Greece) continue to fall in both absolute and spread terms.

ETF flows confirm the weakness in both the Em and HY bond markets. HYG and JNK led the fixed income outflows for the week, followed by EMB, the iShares J.P. Morgan USD Emerging Markets Bond ETF. Interestingly, despite the concern over US Treasury prices, TLT and AGG attracted large inflows. It could be a complete coincidence, but the flows out of “risk” ETFs almost matches the flows into safe-haven ETFs.

We are getting a lot of macro news next week that could impact global fixed income markets. 20% of the S&P reports Q1 earnings, global PMIs are released, there is an FOMC meeting, a US-China trade summit, and the monthly US employment data.

Stay tuned. Have a great weekend.