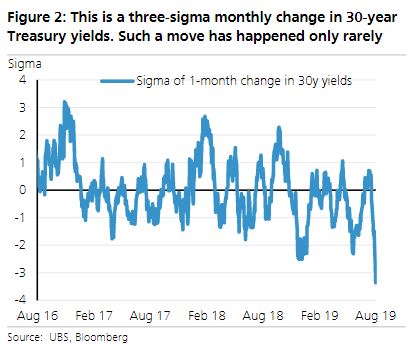

Well, you can’t say the markets were quiet last week. While the stock market plunge of 3% on Monday may have dominated the news, the big story for bond and credit folks like us was the dramatic drop in rates, especially the 30-year sector. There was too much going on to fit everything into the usual ten charts, so here are some other things worth mentioning that caught my eye.

Global PMIs

Germany is making waves with its promise to add fiscal stimulus ion the event of a major recession. They are just one quarter away. Germany, a manufacturing and export-driven economy, is not the only one facing a manufacturing slowdown. Only India has shown growth in manufacturing PMI over the last year. Many countries have PMI readings less than 50, suggesting economic contraction. The next major policy move in Europe could be coordinated fiscal stimulus which could put an end to the momentum in the bond market.

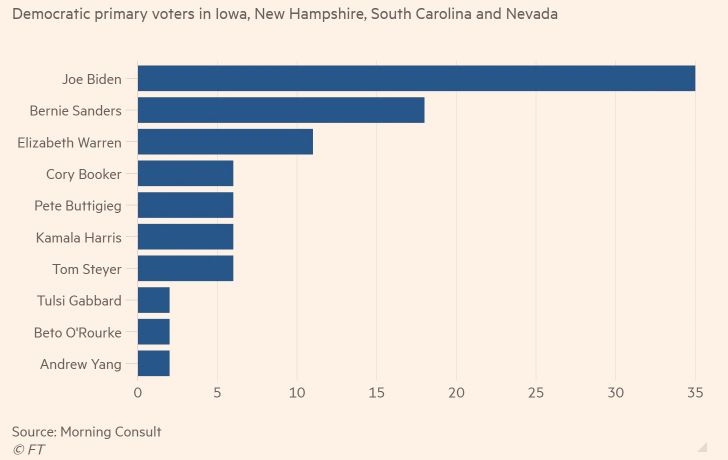

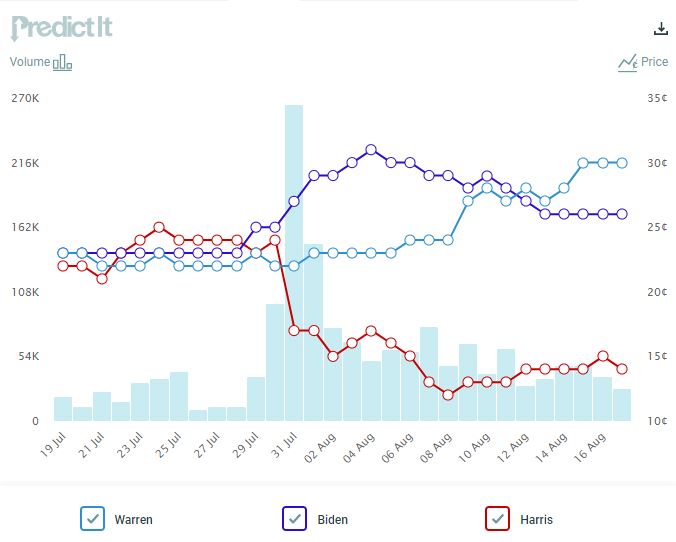

2020 Democratic Primary

I hate polls. You can mine for the answer you want just by changing the phrasing of the question. I don’t know what is going on in the polls, but there appears to be a bid difference between polling data and market-based betting sites like PredictIt. According to most polls, Biden is predicted to win the 2020 Democratic Primary; however, the betting sites have Elizabeth Warren ahead of Biden. I don’t know which is right, but I do think a Warren win will be MUCH worse for the market than a Biden victory. The worst candidate, as far as Wall Street is concerned, is Bernie Sanders. He wants to impose a financial transactions tax to raise money to eliminate student loan debt for all Americans (and maybe others, too). His latest proposal would tax stock trades at 0.5%, bond trades at 0.1%, and derivatives transactions at 0.005% (5 bps). When Sweden implemented a similar tax, 60 percent of transactions on Sweden’s stock market moved to other countries. It just won’t work.

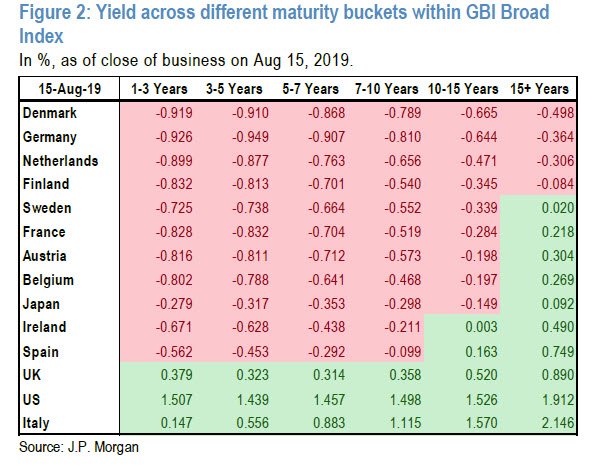

Global Bond Yields

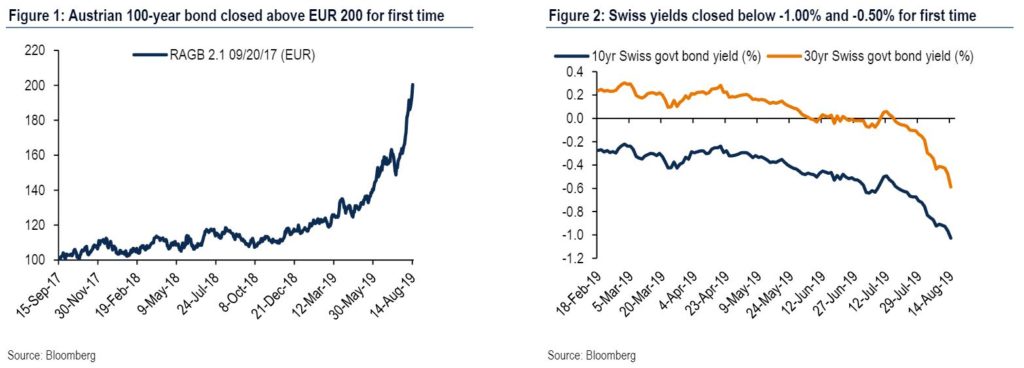

If you have not checked recently, interest rates are insanely low. I have referenced grids like the one below before, but they change so fast that I have to keep updating them. The entire bond curve for many European countries is now negative. In Denmark, homeowners can even borrow at negative rates. The real rate matrix, which takes into account inflation, is even more negative (I’m working on putting a real rate grid together).

For somebody used to looking for bonds at a discount to par, it is quite a shock to see a 100-year bond trading over $200 in price, like the one in Austria.

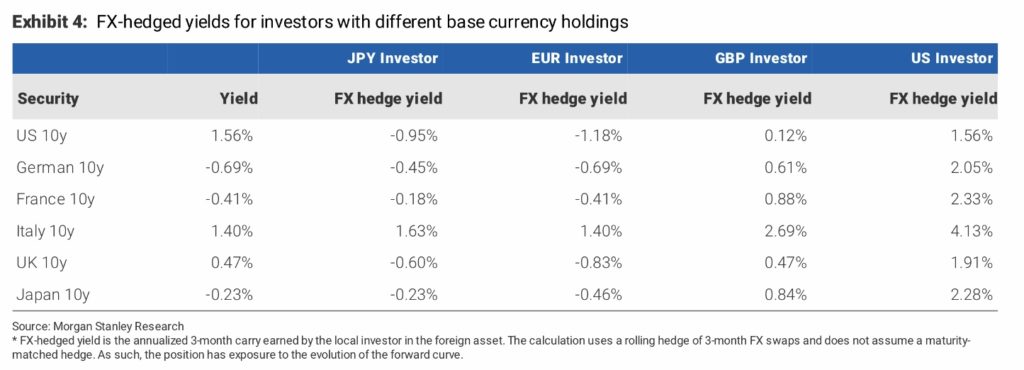

FX-Adjusted Yields

As you can see from the above grid, the US is one of the few markets with a positive yield curve. I heard Joe Kernan on CNBC this morning say something like: “I wonder why the entire world doesn’t dump their negative-yielding bonds and plow it all into the United States bond market?” Good question, Joe. The answer is that most bond investors are not going to take currency risk to earn a measly 2.5-2% coupon. The return from the FX change will dwarf the return from the bond yield. Therefore, they need to hedge., The problem is that when they do an FX swap, they give up all that juicy yield. The flatness of the US curve, combined with high short-term rates, makes the US market UNATTRACTIVE to foreign bond flows.

For example, a German institution that is looking for an alternative to the -0.69% yield offered by 10-year bunds, would end up with a yield of -1.18% in a US Treasury after doing a 3-month FX hedge. Sorry, Joe. Nice idea, though.

Below is the latest Week in Pictures, with charts and commentary on the following:

- 30-Year Sector Leads Bond Prices Higher

- 30Y Bond Yield declines to match S&P Dividend Yield

- Long-Dated Corporate Bonds on Track for Record Returns

- Global Non-US Rates Reach New Lows

- US Data Not Supportive of Rate Cuts

- Can Inflation Hand-Cuff the Fed?

- Agriculture Sector Leads Commodities Lower

- No Love for Small Cap Equities

- Chinese Economic Data Disappoints

- Argentina Bond Market Collapses

Have a great week. Good luck navigating these markets!