The significance of the events that have taken place over the last two weeks is hard to fathom. For those in Ukraine, the degree of human suffering is truly tragic. For those in the Western world, the economic fallout is just beginning. Since Russia’s full-scale invasion of Ukraine, markets have gone through a tremendous adjustment, attempting to discount the possibility of WW3, hyperinflation, a global growth slowdown and rapidly changing terms of trade.

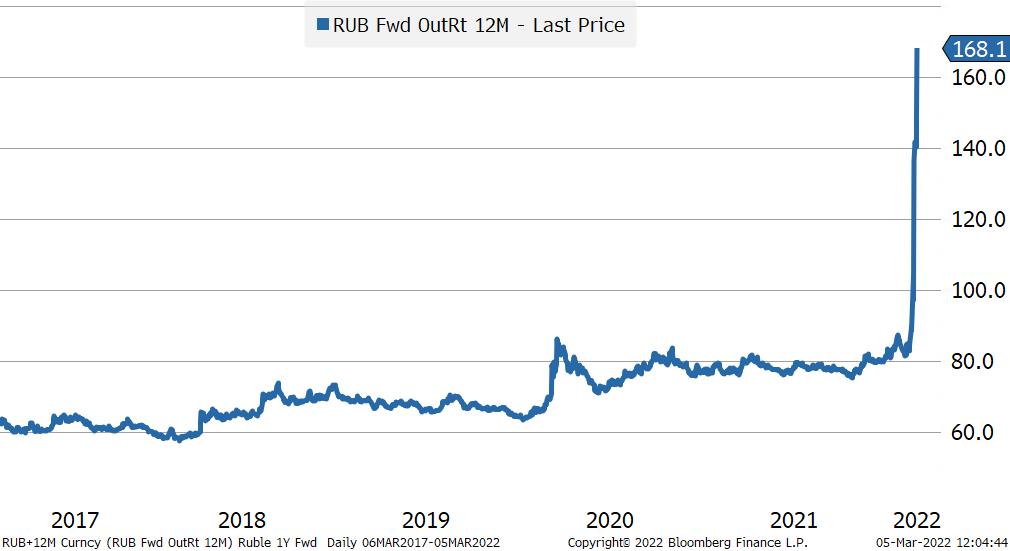

In response, Western countries have introduced a series of measures to force the Russian economy into meltdown. Many Western governments have imposed strict sanctions on Russian banks, Russian Central bank assets, oligarchs and exports, and major international companies have suspended their Russian operations. Since they were introduced, the value of the ruble has plummeted. It spiked from 81 rubles to the dollar on Feb. 23, the day before the operation was announced, to 123 rubles to the dollar on March 6.

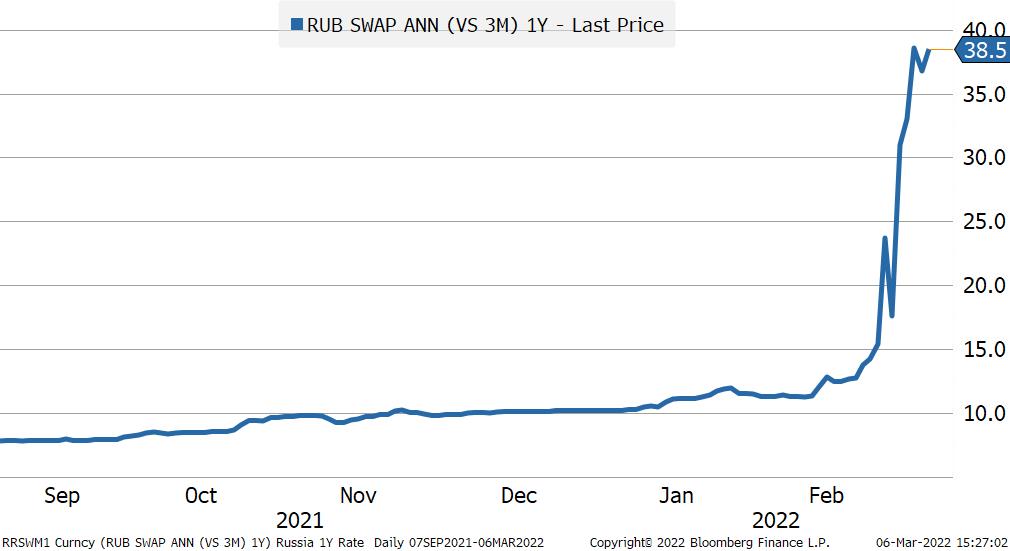

Because of the jump in short-term local currency rates in Russia, which popped from around 10% at the start of the year to more than 38% at the end of last week, the forward ruble FX rate to the USD is even weaker. On a one-year forward basis, the dollar buys 168 rubles. If the Western world is worried about the inflationary fallout of the war, Russians must be outright panicked.

On top of the decline in the currency, Russian assets have been crushed and are practically worthless. Moscow has imposed restrictions on foreign exchange and the share value of major Russian companies has crashed. Foreign businesses operating in Russia are also expected to take huge writedowns. Some of the firms that announced at least partial suspensions of their Russian operations include Boeing, Airbus, Apple, Nike, Exxon and automakers Daimler, Ford, BMW and Mercedes. If the supply chain was hard to manage before, it sure isn’t going to get any easier now.

No doubt, Putin expected sanctions and on Saturday claimed “everything is going to plan.” In addition to the war on the ground, he is also fighting a propaganda war at home. Moscow has blocked social media websites and foreign and independent media outlets, highlighting the Russian government’s extreme concerns about the war’s unpopularity and the impending effects of the sanctions on Russia’s economy and standard of living.

With everything snowballing so fast, it’s impossible to predict the end-game. Some are concerned that a cornered Putin can only get more dangerous and unpredictable. So what does the off-ramp look like for Putin? He is not the kind of guy that is going to concede or back down. So far, the invasion does not appear to be going the way he expected, despite what Putin says. If the intelligence reports are accurate, Russia has underestimated both the level of resistance from the population in Ukraine and the severity and speed of the global response to the invasion. There is no way to predict how this situation ends, but there is a growing sense from geopolitical experts that the conflict will last for a very long time. Possibly years.

Former CIA director and retired US Army General David Petraeus is doing the talk show circuit, highlighting the difficulty Russia will face after the first phase of the war ends. He thinks Russia will eventually be able to overthrow the government, but will likely be overwhelmed by heavy sustained guerilla-style urban resistance. There are many ways this can play out, but one thing is clear: the geopolitical landscape has been massively altered and there is little hope for a return to the world we knew just a few weeks ago.

To be sure, there is room for things to get worse in the coming weeks, both economically and geopolitically. Over the weekend, Secretary of State Antony Blinken said there were still more arrows in the quiver when it comes to sanctions, including an embargo on Russian oil & gas imports (which are currently exempt). A complete ban on trade with Russia will send commodity markets into even more of a frenzy. A ban on Russian oil & gas would no doubt have a bigger impact on Europe than on the U.S. given the differences in energy dependence between the two regions.

Will a U.S. ban on Russian energy be effective if it is not done in conjunction with Europe? Probably not. In an attempt to really stick it to the Russians, will the U.S. and its allies sanction other countries that won’t participate in a complete energy embargo, such as China or India, that depend on Russian energy imports to preserve their economic growth? Probably not, but can you imagine if they did? You can see how much further things could deteriorate.

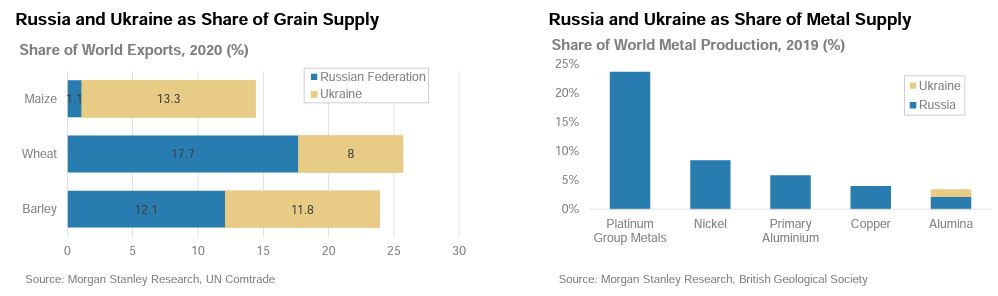

The shock to commodities markets is probably the worst. The U.S., EU and U.K. purchase (or used to, at least) more than $700mm of oil, gas, aluminum, nickel, and titanium from Russia every day. In addition, Ukraine and Russia are the largest suppliers of grains in the world, producing up to 20-25% of global demand for wheat and barley.

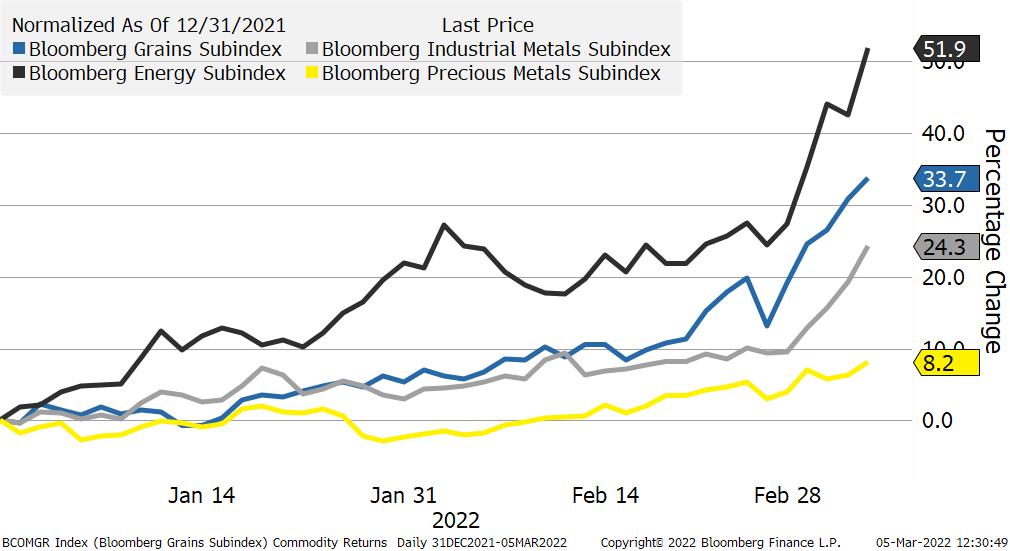

Prices for grains and metals have skyrocketed. The Bloomberg Grains subindex is up 33.7% YTD and the Bloomberg Industrial Metals subindex is 24.3% higher over the same period. And while precious metals are also rising in value, nothing competes with the jump in energy prices, which have risen an insane 52% since Jan 1.

Metals and mining companies are rallying on the back of the supply shortage. The SPDR S&P Metals & Mining ETF has outperformed the S&P 500 by 38% over the last year, with the vast majority of that gain taking place in the last month.

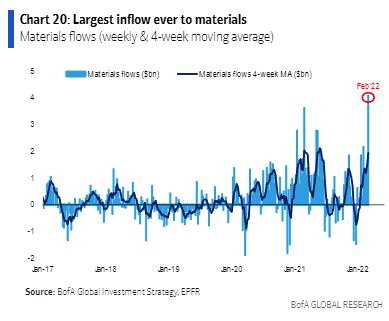

Investors are piling in. According to data from Bank of America, inflows into materials stocks hit a record toward the end of February.

Energy stocks are also on the move. XLE, the Energy Select Sector SPDR Fund, has ripped higher, beating the S&P 500 by almost 15% in the last month. It will take time, and a change in political will, to undo many of the policies that have been put in place to crimp U.S. domestic supply. The push to renewables, cancelation of pipelines, lack of investment in new production and a new operating discipline that favors cash flow over growth in supply all make U.S. energy independence less likely. They say in commodities, high prices solve high prices. Maybe so, but only in the medium term; not in the short run.

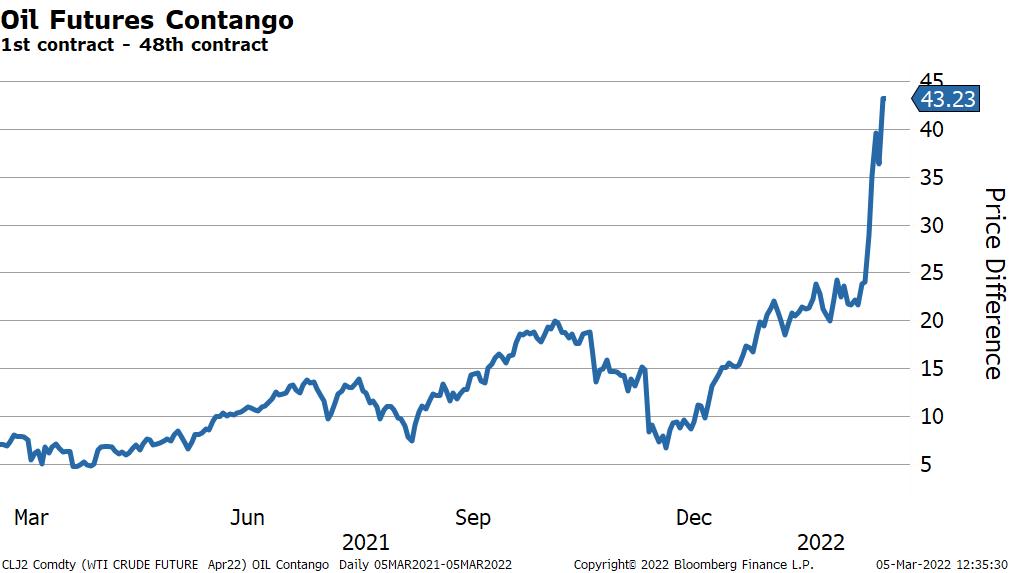

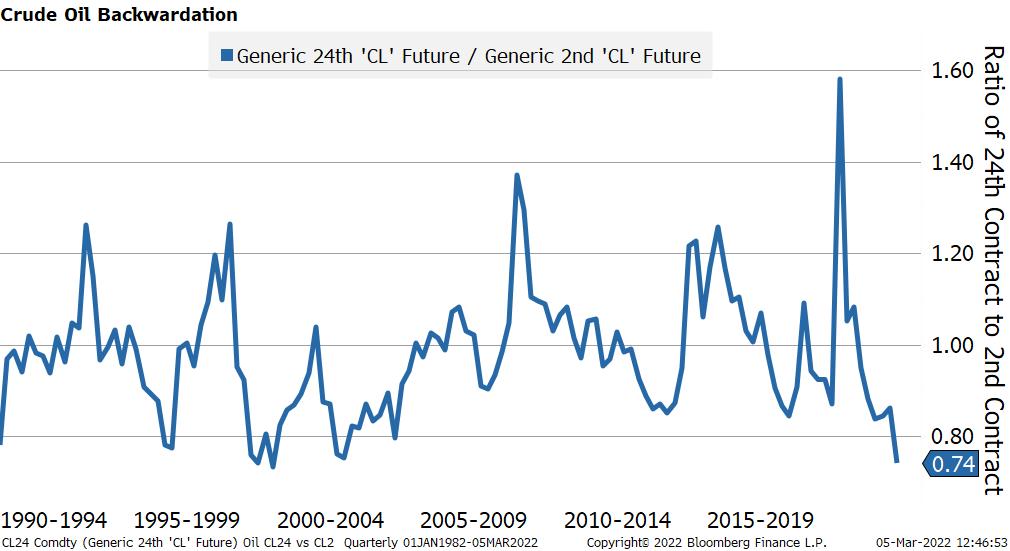

Extreme levels of backwardation in the crude oil market highlight investor concerns over a shortage of supply in the near term. Crude futures that expire in 2 months are trading more than $43/barrel higher than futures 24 months out.. That is a huge spread.

How extreme is this level of backwardation? Looking back over the last thirty years, 2-year forward crude prices are trading at the largest discount ever to near crude futures.

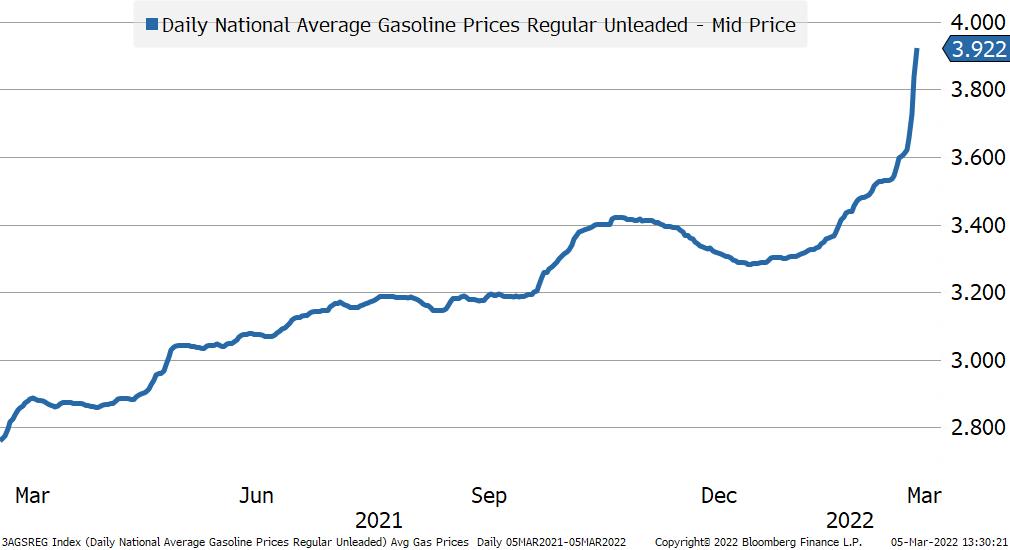

As oil prices press higher, they will not only impact inflation expectations but will also serve as a tax on consumers via higher gas prices. Higher oil prices are already having an effect on gas prices around the country, and all over the world for that matter. Average national gas prices are approaching $4/gallon.

In some parts of the country, prices are north of $6 per gallon. Economists will tell you that at some price, the substitution effect will kick in and change behavior. Extreme changes can’t be ruled out, such as the one suggested below:

Turning back to Europe, we need to closely watch Germany during this crisis. It’s been a military nonentity for some time, instead choosing to focus on economic growth. That will change in the coming years. Germany announced a $113 billion defense fund to modernize the German military and an increase in annual defense spending to more than 2 percent of gross domestic product. It remains a manufacturing juggernaut with an export-oriented economy that requires a ton of energy. Much of that energy comes from Russia. That is also likely to change over the next decade. Still, in the short term, Germany has a lot of economic exposure to Russia.

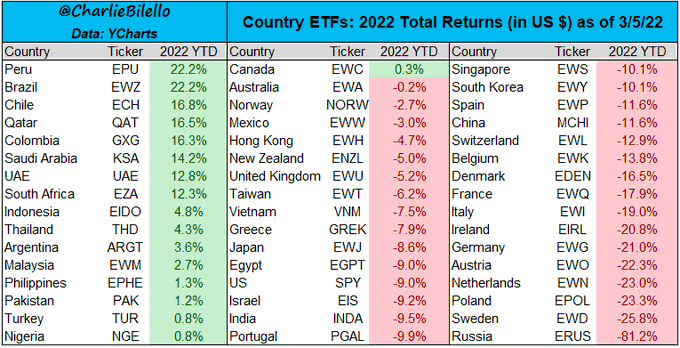

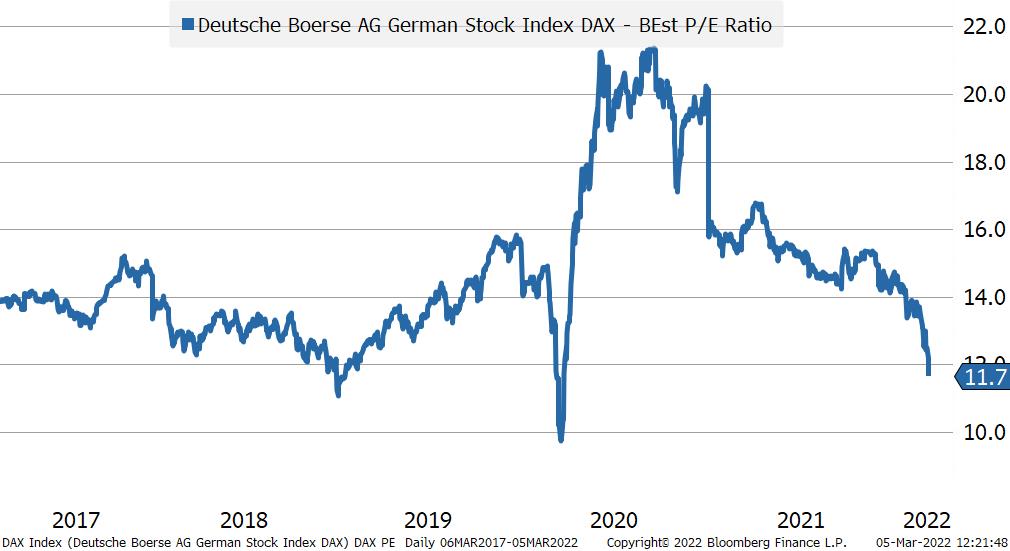

Indeed, German assets have been among the hardest hit in the last week. EWG, the iShares MSCI Germany ETF, has plunged 21% YTD, worse than the 17.3% drop in the SX5E. Valuations have plummeted to extremely low levels. The 1-year forward price/earnings multiple on the Ferman Dax index is now 11.7X, near the low end of the range over the last five years. Of course, earnings and earnings growth are much harder to assess today compared to two weeks ago, but P/E multiples approaching single digits look mighty tempting for long-term investors.

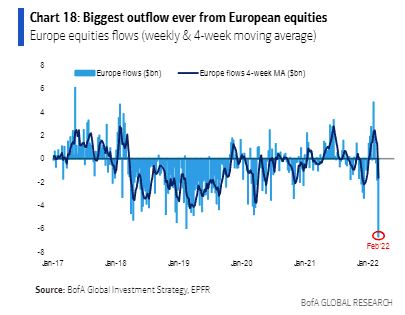

Warren Buffett is known for many pertinent sayings, but one of the most pertinent in today’s market is that investors should be “fearful when others are greedy, and greedy when others are fearful.” It’s hard to be “greedy” when we are on the brink of a world war and a potential nuclear catastrophe, but you can say the same thing about every market panic I suppose. That’s why it is easier to say than do. Right now, investors are ignoring the advice of the Oracle and hitting the sell button, pulling a record amount out of the European equity market last week.

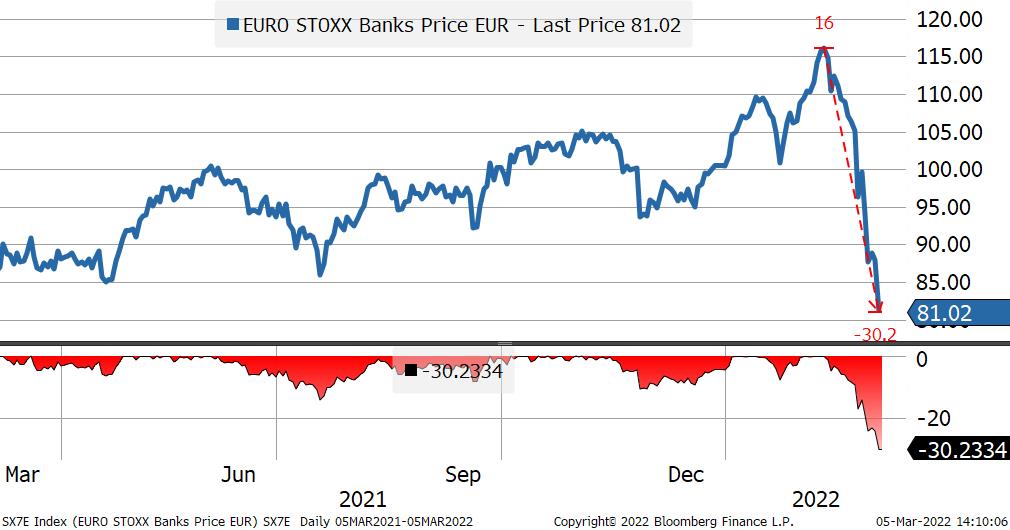

Within the European equity market, financials are amongst the hardest hit. The SX7E index, which had been on a tear with expectations for higher interest rates, has reversed, dropping 30% from its recent high. Banks in Italy, France and Austria are the world’s most exposed international lenders to Russia. Italian and French banks each had outstanding claims of some $25 billion on Russia.

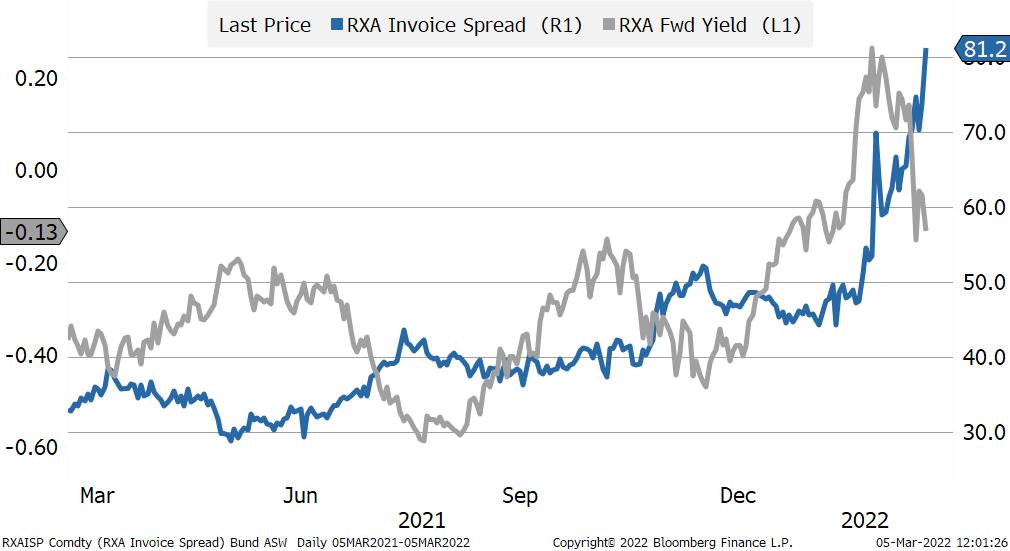

Where is the money going? Bunds. 10-year bund yields have fallen back into negative territory and Bund asset swap spreads have exploded higher. Bunds benefit from safe-haven flows as well as from repricing of how aggressive the ECB can be in light of the current situation.

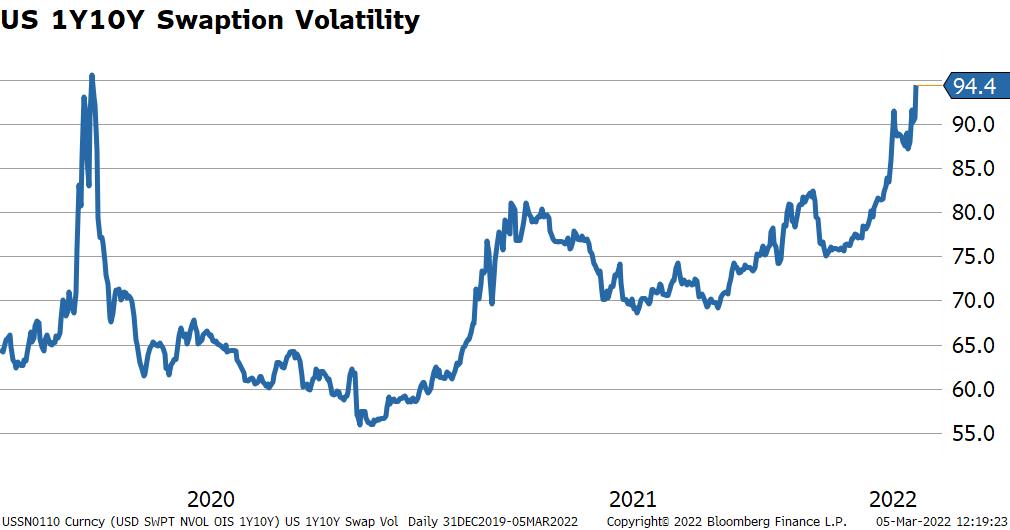

Treasuries also benefited from safe-haven flows. The massive daily swings reflect the heightened uncertainty. As a result, 1-year implied volatility on the 10-year rate is back up to levels seen during the onset of the COVID crisis. This reflects the expansion of the two distribution tails: inflation might spiral higher, forcing global central banks to be more aggressive with tightening of monetary policy, or the world may plunge into recession, slashing global demand, and policymakers will be forced to abandon hopes for higher rates. You can make a case for either. That’s why we are getting such large intraday moves and why volatility has gone ballistic.

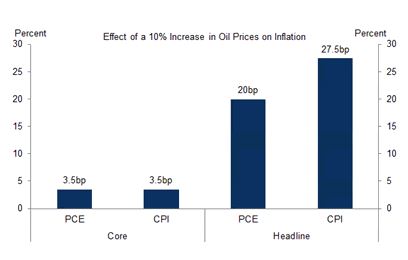

Unsurprisingly, what we see happening in the commodities market raises inflation concerns, evidenced in the spike of 2-year breakeven inflation priced via the TIPs market. 2-year breakevens have climbed from just above 3% at the end of last year to 4.15% today, largely due to the impact of higher energy prices. According to Goldman, every 10% rise in crude impacts headline CPI by 27.5 bps. Spot WTI has risen 50% since the start of the year, so the more than 100 bps increase in inflation expectations appears consistent with their analysis.

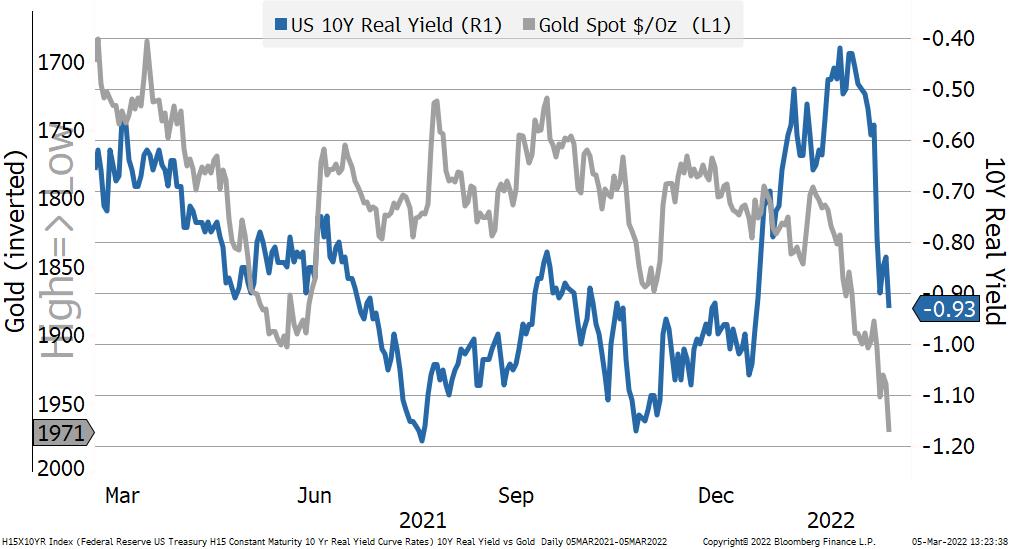

People who are afraid to buy Treasuries appear to be buying gold. Gold has broken out of its range and is narrowing in on $2,000 per ounce. Safe-haven flows are helping, but so is the correction of real rates back to absurdly low levels. 10-year real rates have rallied 50 bps in the last month. For now, the correlation between real rates and gold lives on.

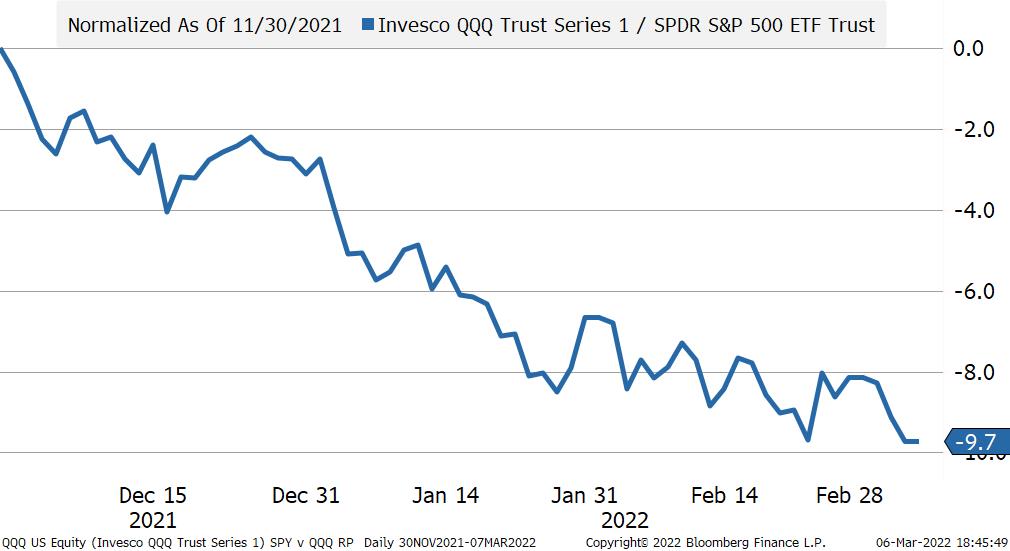

The correlation between growth stocks and real rates, however, is not holding up as well. The Nasdaq 100, QQQ, has lagged the broader S&P 500 by nearly 10% since the end of November. The underperformance, though, was well established before the situation in Ukraine deteriorated. If we end up in the scenario where global growth is marked down significantly and central banks remain accommodative, it is not too far-fetched to expect investors to return to industry-disrupting stocks involved that can deliver growth in any environment. Many of these stocks have already fallen 50% or more from their bubble-like highs and now have valuations that are a little more justifiable.

While it is tempting to nibble at the equity market, it is still probably too early to go hog-wild bullish. If Russia’s ambitions stop at occupying Ukraine, a meaningful bounce in risk assets could be in the cards. But if NATO Article 5 gets triggered somehow, and the U.S. and its allies get drawn into the physical fight, there will be a lot more downside volatility to come.

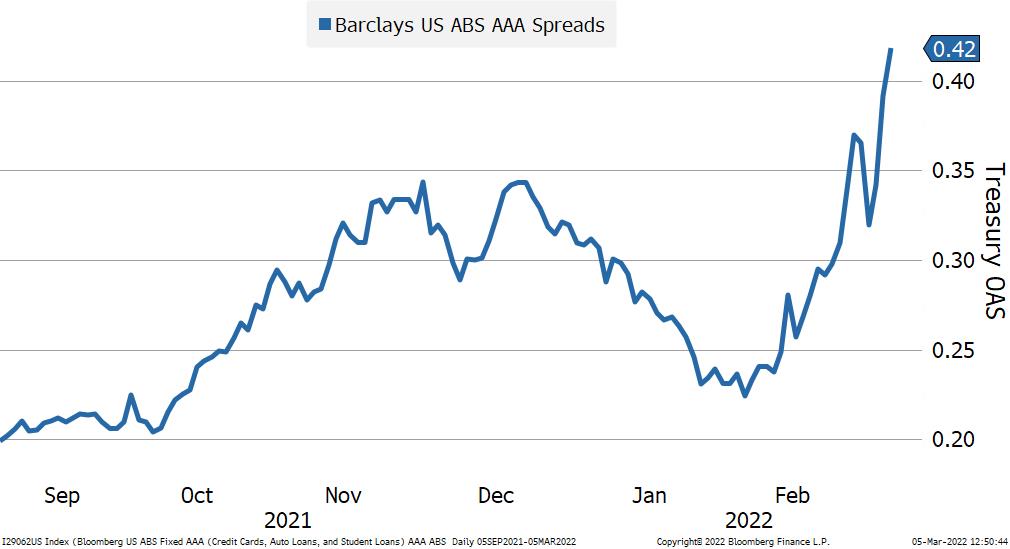

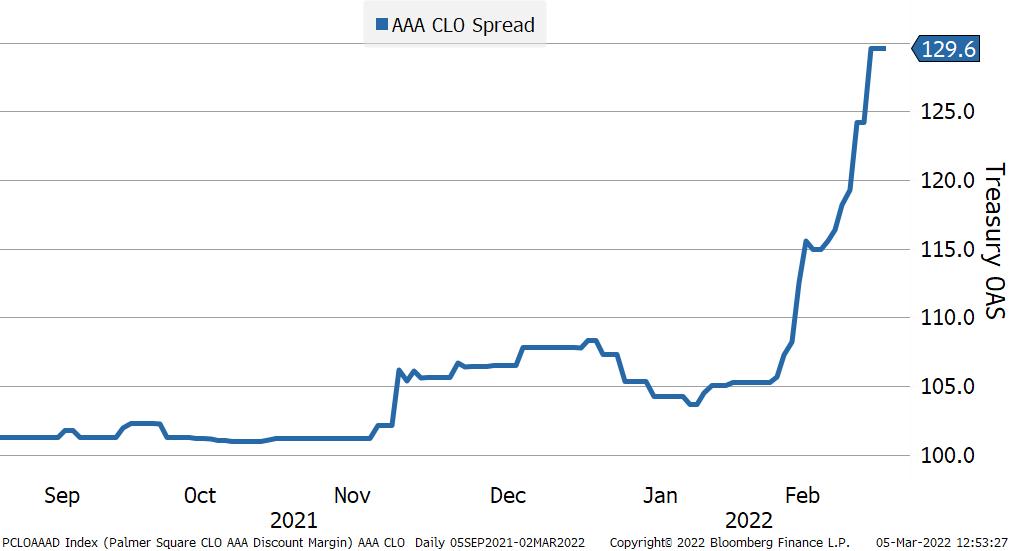

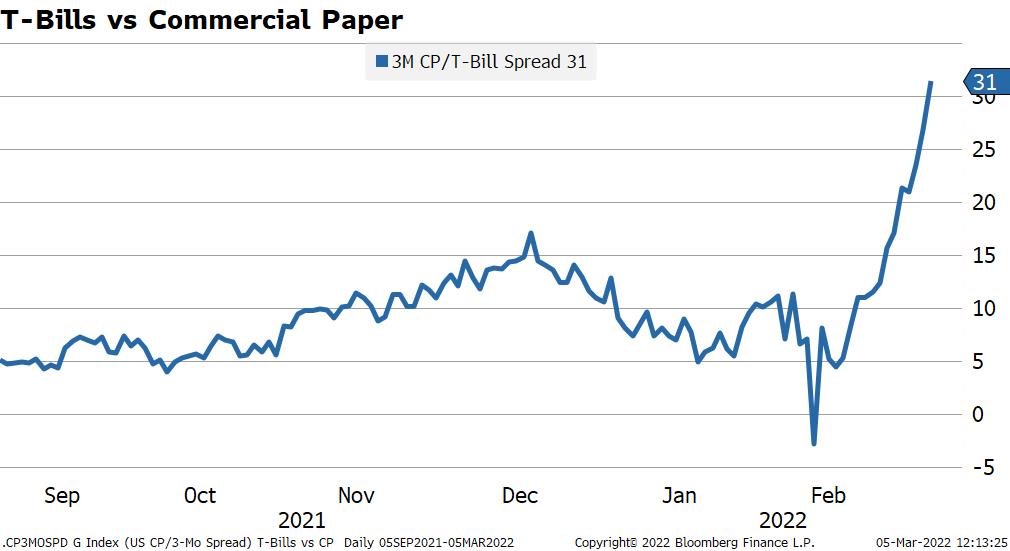

Credit markets are already starting to shake. AAA ABS spreads are 20 bps wider since the start of the year, rising to 42 bps from 23 bps in early February. So are AAA CLO spreads. AAA CLOs have bumped up to 130 bps from 105 bps. Even 3-month commercial paper yields have widened compared to Treasury Bills, from 5 bps a few weeks ago to the current level of 31 bps.

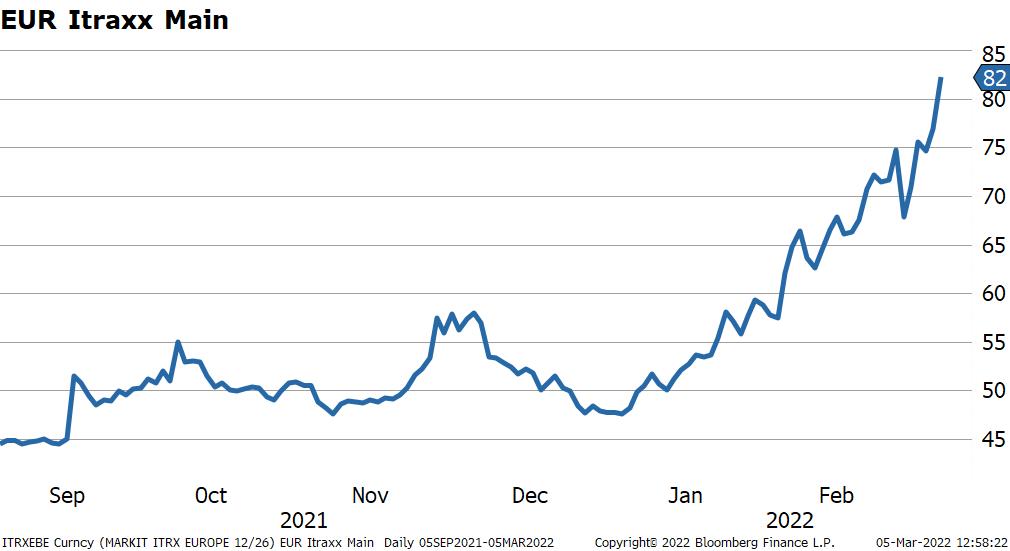

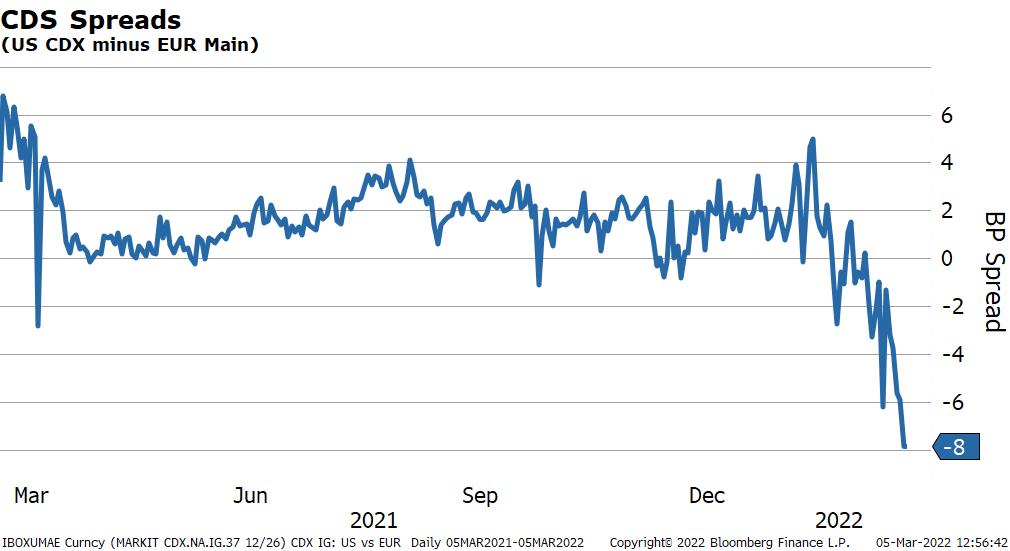

Credit default swaps on investment-grade corporate credit are pricing in the elevated tail risk in markets. European ITRAXX 5-year CDS has climbed to 82 bps from 47 bps at the start of the year. The move wider in corporate credit has been more pronounced in Europe, for obvious reasons, than in the U.S. For most of the last year, U.S. investment-grade CDS (CDX) was trading a couple of bps above its European counterpart. Now it is trading 8 bps below. This shift further highlights that Europe has been hit the hardest by the developments in Ukraine.

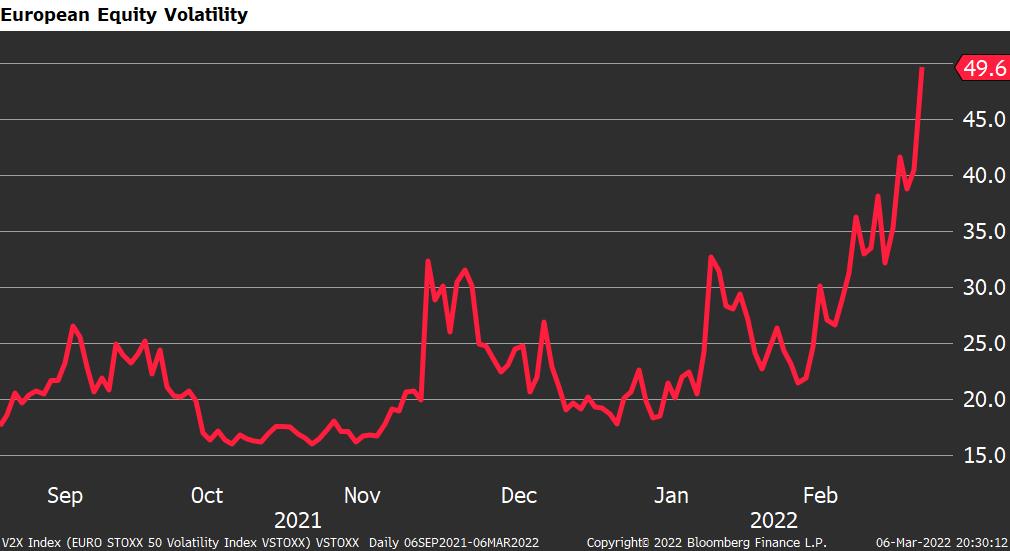

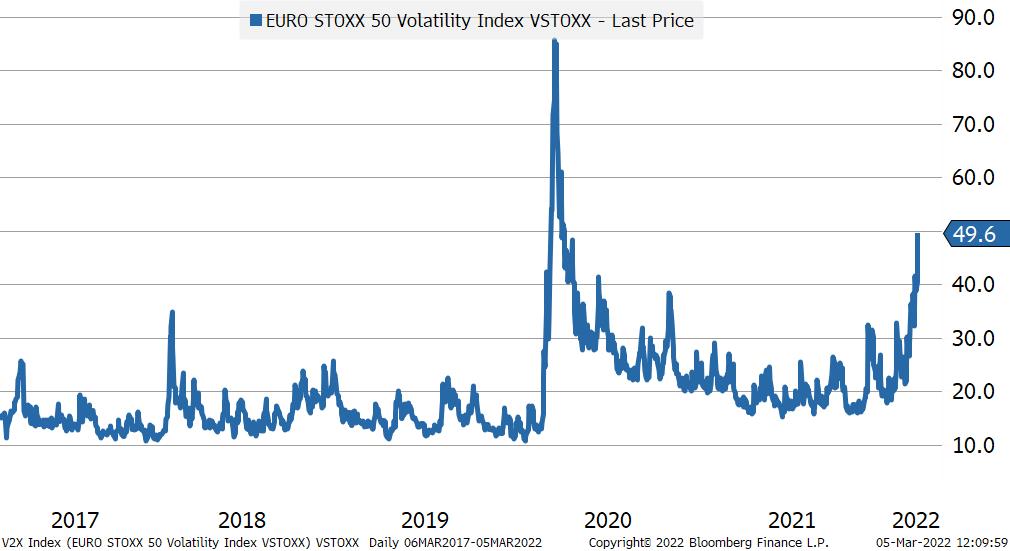

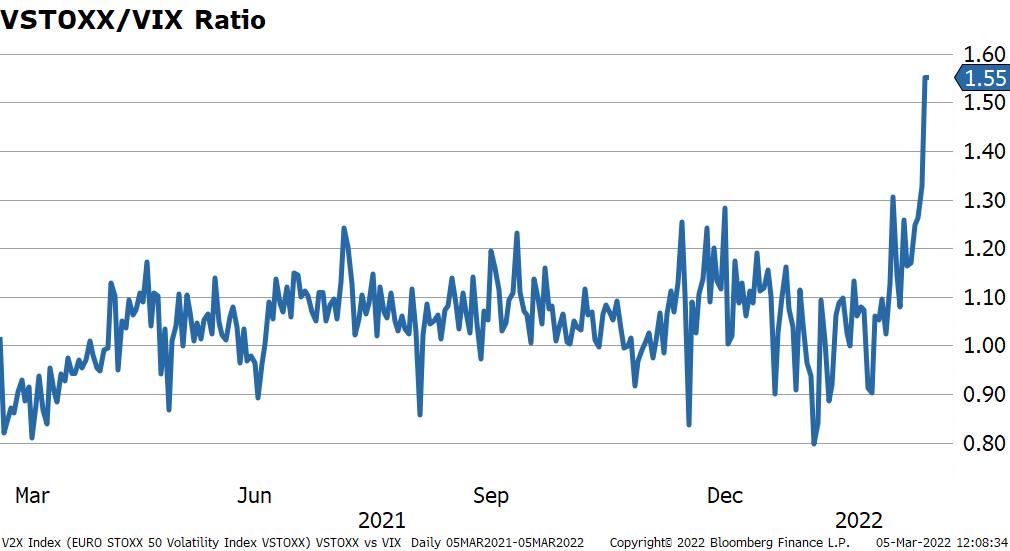

The epicenter for equity volatility appears to be in Europe. The VSTOXX index of implied equity vol, the European equivalent of the VIX, is at 50. The ratio of VSTOXX to VIX demonstrates just how much more volatile Europe has been compared to the U.S. Typically, the ratio of EURO STOXX 50 volatility to S&P 500 volatility is around 1:1. In the last couple of days, it has exploded to 1.55:1. Both the opportunities and the risks are greatest across the pond.

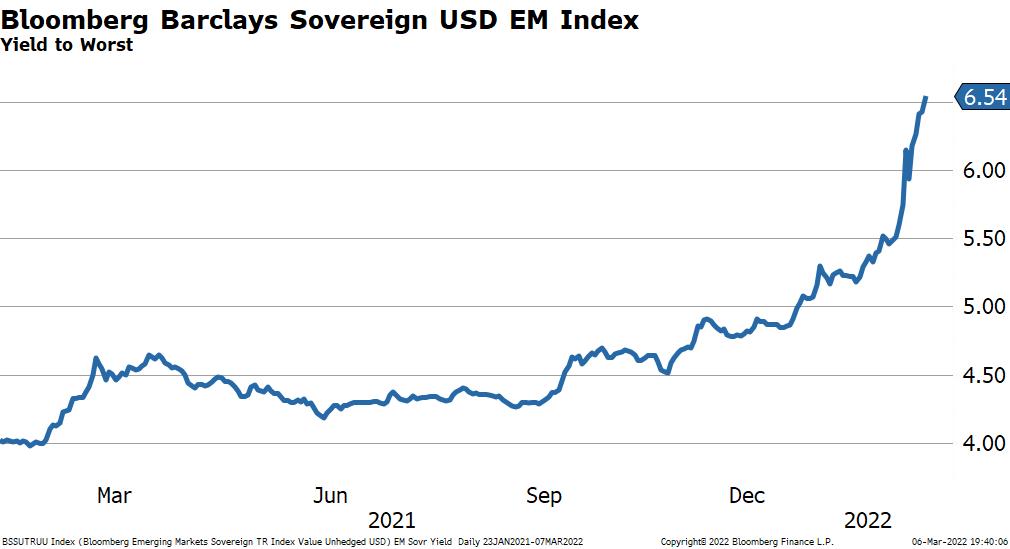

Emerging market credit, especially sovereign debt in the areas in the Baltic, has also suffered significantly. S&P moved Russian sovereign debt from BB+ to CCC- for both its local currency and dollar debt, which is only two notches above a default level. Spreads for many other issuers have spiked, for both USD and local currency debt.

Conclusion

Sorry to make you weed through so many charts before getting to the part about what we can do to protect assets and adjust allocations to reflect the new world we find ourselves in. This is not investment advice, so PLEASE don’t go and blindly follow these recommendations because first, I have a 50% chance of being wrong, and second, my risk tolerance may be totally different from yours. That said, here is a list of some of the trades I have done in the PA over the last month to try to take advantage of some of the dislocations:

- I have been allocating back into some fixed income after being underweight for the last two years. I have not gone back into Treasuries because I still don’t want negative real-yielding assets in a long-term portfolio. I like the Muni market better. Yes, yields are still low by historiocal standards, but when you can pick up 3.5% tax-exempt yields in Muni IG bonds via unlevered closed end funds like NUV that are trading at a 5% discount to NAV, I just can’t help myself. I also like Vanguard’s High-Yield Tax-Exempt Fund, VWAHX.

- I continue to allocate to private markets. I like the drawdown nature of the private equity structure in that is reduces market-timing risk. When you make an allocation today, it typically takes 12-24 months to get the capital deployed. If some really good opportunities come up due to the volatility, I will let the private market pros determine the how and when to get involved. Within the last week I subscribed to a small cap China manager and an industrial real estate development fund.

- With implied equity volaility so high, I have added to some covered call strategies using ETFs like QYLD. The Global X Nasdaq 100 Covered Call ETF follows a “buy-write strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and sells corresponding call options on the same index. At this level of vol, the yield is around 15%. Not bad if we get a stable or rising market. I’m still exposed to further downside in QQQ, but given its underperformance recently, I like adding it here.

- In nontaxable accounts where I can take capital gains, I have lightened up on energy (XLE) and metals (XME) exposure, and in a taxable account, I made my first small allocation to EWG, the iShares MSCI Germany ETF. I’ll probably add some more on further weakness.

- I have been building a position in some fixed-floating financial preferreds. These are issued by major financial firms like JP Morgan, Goldman, Citigroup, BOA etc and pay a fixed coupon until a specified date and then switch to a floating rate plus a spread (typically 350-400 bps) if they are not called. Many have call dated in the next couple of years. I like the low duration aspect of the securities and am comfortable with the credit. The yield-to-worst, depending on a variety of different factors, is currently in the 4.25%.