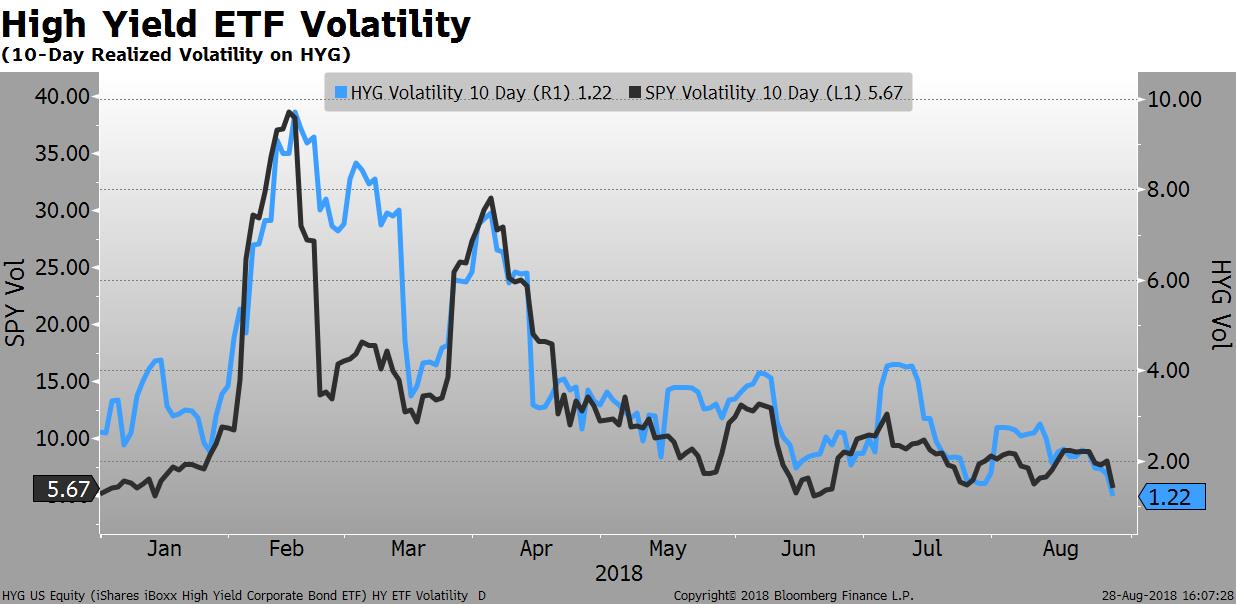

1. High Yield Volatility

Low volatility supports risk markets, but as we saw earlier in the year, it can create complacency which is often followed by sharp market corrections. It is odd that realized volatility in the S&P and the US HY markets is so low given the movements in emerging markets assets. Such divergences don’t last long.

Why it Matters

Realized volatility in the high yield markets just set a new low for the year. 10-day realized volatility on HYG is a mere 1.2% (blue line below). Equity volatility is also hovering at the lowest level of the year.

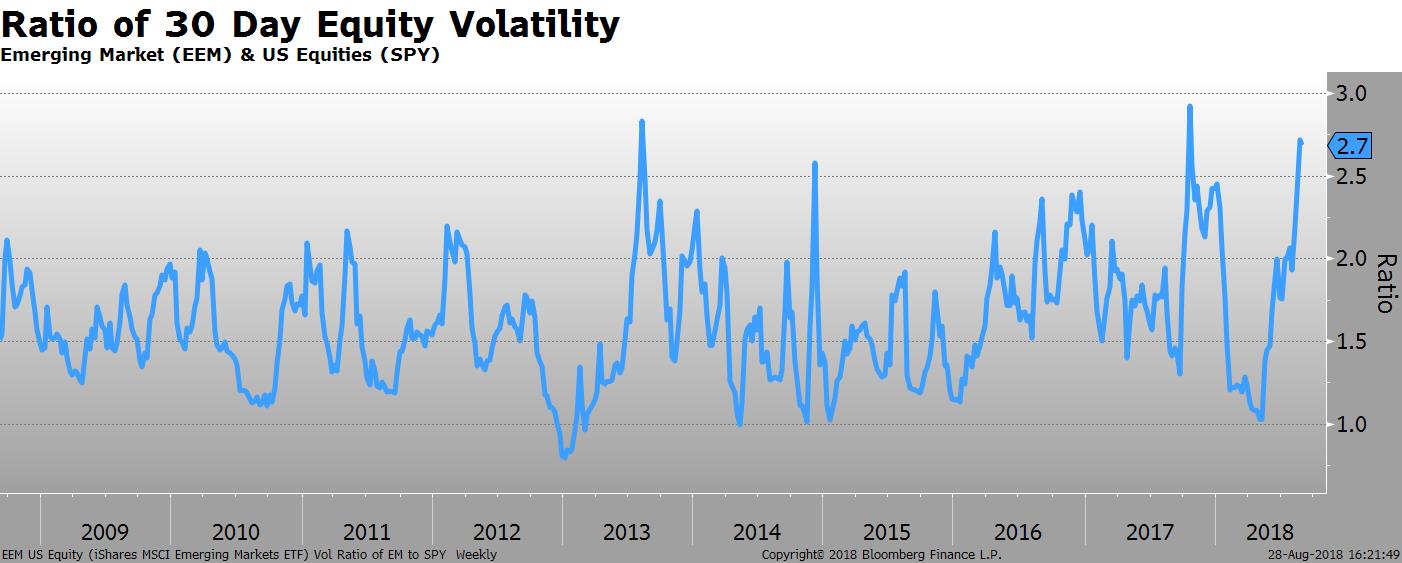

2. EEM vs SPY

Emerging and international markets matter to US companies, especially the technology sector where more than 50% of the revenue comes from overseas. A slowdown overseas and/or a strong USD will eventually curtail profit growth. As you can see from the chart, these market divergences in volatility tend to not last very long.

Why it Matters

The ratio of realized 30-day volatility in emerging market equities (EEM) to US equities (SPY) is approaching the highest level in the last 10 years. Realized volatility on EEM is 2.7 times that of SPY. There is a similar situation in FX that was highlighted last week.

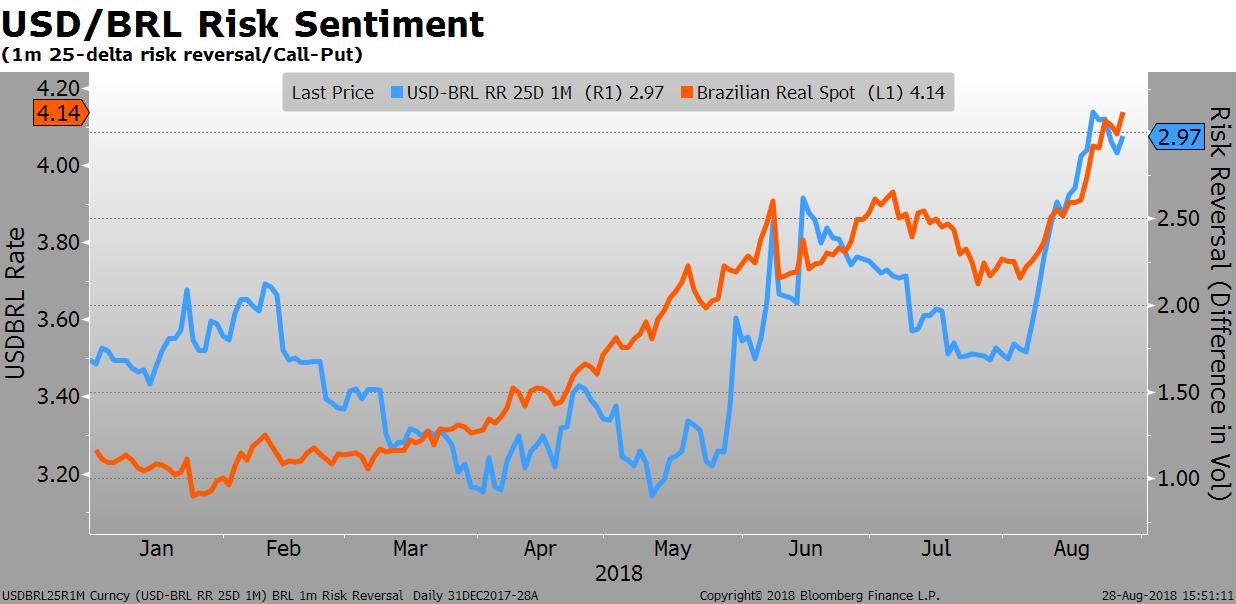

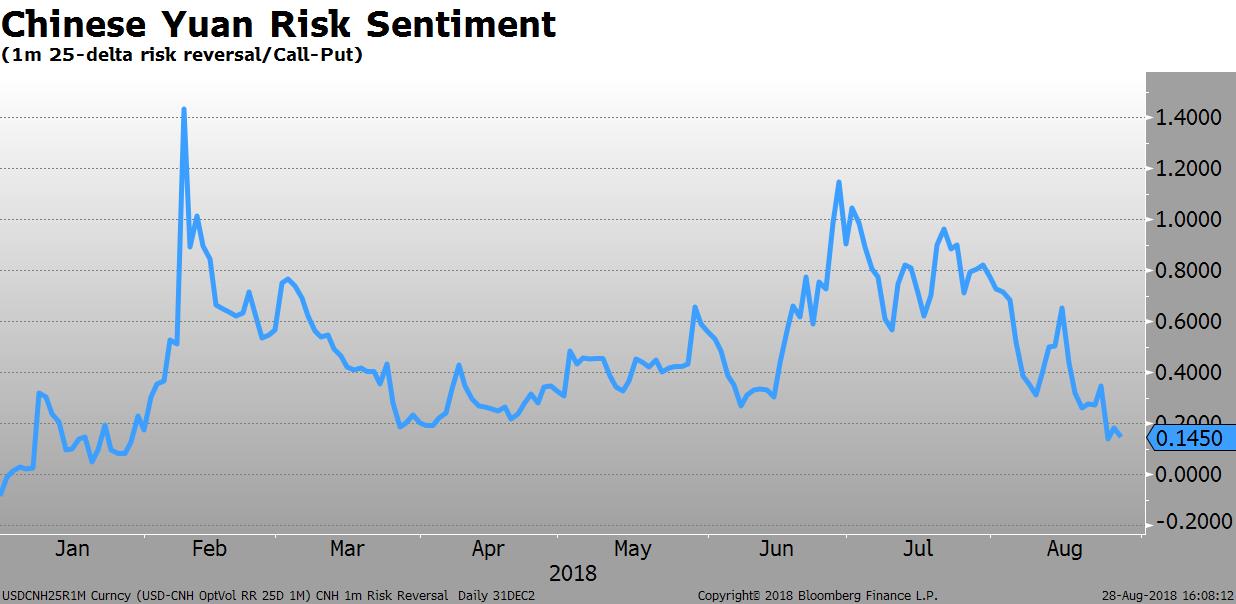

3. FX Risk Reversals

The elevated price for USD calls/BRL puts highlights the concern for Brazil. The options market is pricing in a high probability for further weakness, which in a perverse way, may mean the worst is over. The reverse is true for the Yuan where CNH put buying has slowed.

Why it Matters

Why it Matters

One way to follow the sentiment in markets is to look at “risk reversals” in the options markets. This is simply the difference in implied volatility between calls and puts with similar deltas. The 1-month risk reversal for USD/BRL is at an extreme whereas the risk reversal for USD/CNH is fading.

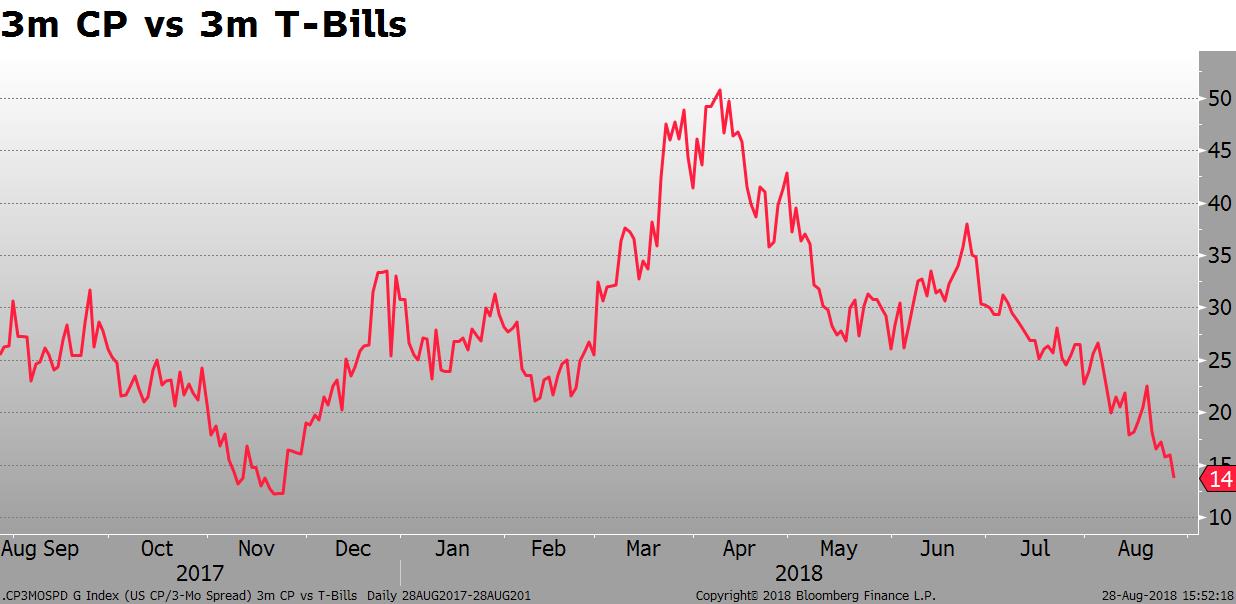

4. Commercial Paper Spreads

Commercial paper spreads continue to contract to Treasury Bills. The spread between 3m CP and 3m T-Bills is down to 14 bp. It was as high as 50 bp in April. All the stress in US money markets appears to be gone.

Why it Matters

Low stress in money markets means attractive entry points for positions that will benefit if the stress resurfaces. The entry point for a long swap spread position in short-dated Treasuries is very good at the moment. Unlike the purchase of outright options, it is not expensive to hold.

Important Disclaimer

This material is intended to report solely on the investment strategies and opportunities identified by III Capital Management (“III”). Additional information is available upon request. Information herein is believed to be reliable, but III does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. This material is not an offer or a solicitation for any managed account or fund product of III. Such an offer or solicitation can only be made pursuant to the applicable offering document and otherwise in accordance with applicable futures and securities laws.

III, its employees, its affiliates and/or its affiliates’ advisory clients (including the III funds and other clients of III Capital Management) may hold a position in any of the securities and financial instruments discussed herein, or in other securities or instruments of any issuer discussed herein. Due to III’s fiduciary obligations as a registered investment adviser, in the event of a conflict between the interests of a III client and an AVM client, the interests of the III client will be given priority.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Certain investments, including those involving structured products, futures, options and other derivatives, are complex, may entail substantial risk and are not suitable for all investors. The price and value of, and income produced by, securities and other financial products may fluctuate and may be adversely impacted by exchange rates, interest rates or other factors. Prior to effecting any transaction in options or options-related products, investors should read and understand the current Options Clearing Corporation Disclosure Document, a copy of which may be obtained upon request from III.

All case studies are shown for illustrative purposes only and should not be relied upon as advice or interpreted as a recommendation. Results shown are not meant to be representative of actual investment results. Any securities mentioned throughout the presentation are shown for illustrative purposes only and should not be interpreted as recommendations to buy or sell.

This communication is issued by III, which is regulated in the United States by the Securities and Exchange Commission and the Commodity Futures Trading Commission. Accordingly, this document should not be circulated or presented to persons other than to professional or institutional investors as defined in the relevant local regulations.

III Capital Management

777 Yamato Road | Suite 300 | Boca Raton, FL 33431

© 2018 III Capital Management