1. Iranian Inflation

A 60% depreciation of the Iranian Rial vs the USD in the last year is filtering into higher inflation. The official rate is running at an annual rate of 18%, up from 10% at the start of the year. Food prices are climbing even faster. Food prices have risen over 8% in the last two months alone.

The people in Iran are protesting in the street over mismanagement of the economy and corruption in the government. When food prices soar, the protests get larger and louder. The black market value for the Rial is 109,000 Rial/USD vs the official rate of 42,000. Actual inflation is probably worse than what is reported.

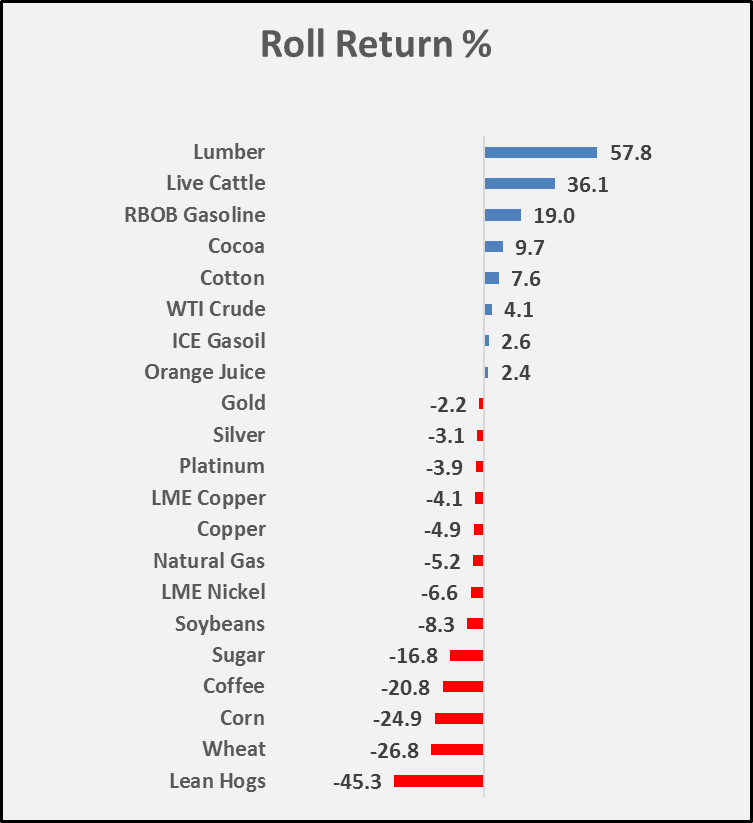

2. Commodity Roll Yields

The “roll return” for certain commodities has been huge in the last year. The roll return is the profit or loss realized by rolling futures contracts and is independent of underlying movements in the commodity itself. The slope of the futures curve drives returns.

The total return from directly investing in commodities via the futures market can vary enormously. What contract you buy and when you roll can have a massive impact on your return. The roll added almost 58% to the total return for a long futures position in Lumber.

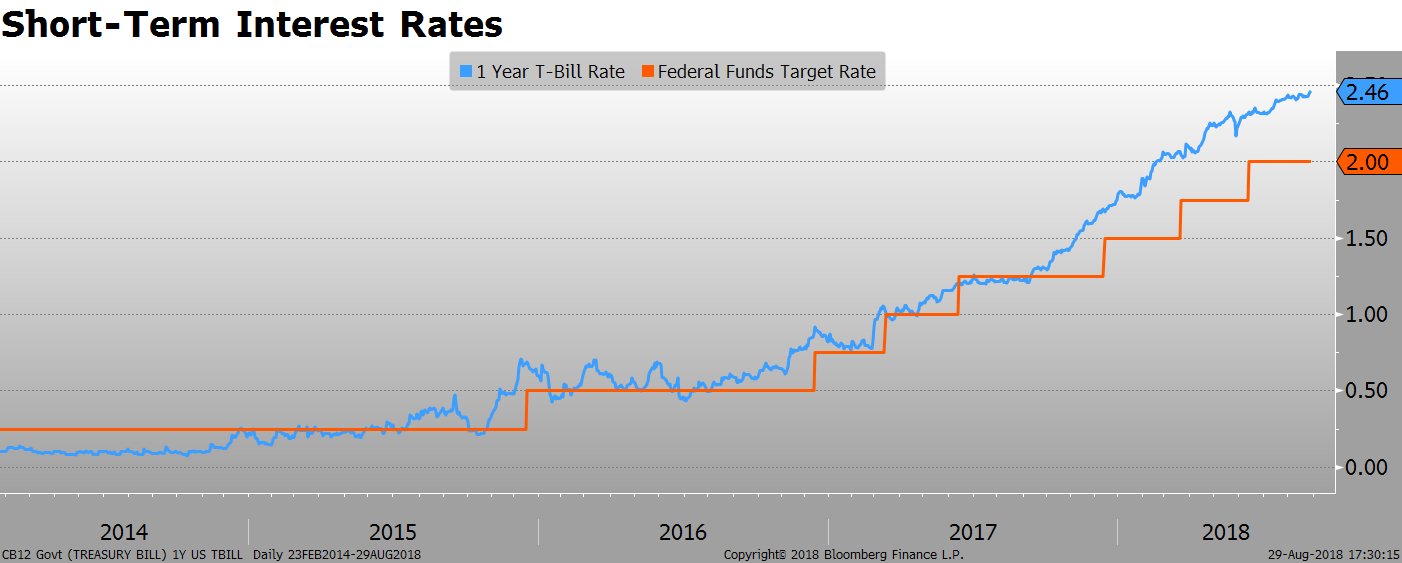

3. Short-Term Rates

The 1-year T-Bill rate hit 2.46% yesterday. The expectation for today’s release of the PCE Core rate is 2%. With real short-term rates approaching 50bp, it is hard to claim monetary policy is still “accommodative”.

After almost a decade of suffering inflation-adjusted losses on cash, a real short-term yield of 50 bp gives investors an attractive alternative to riskier markets. Interestingly, the tighter policy is having a larger impact on international markets than domestic markets.

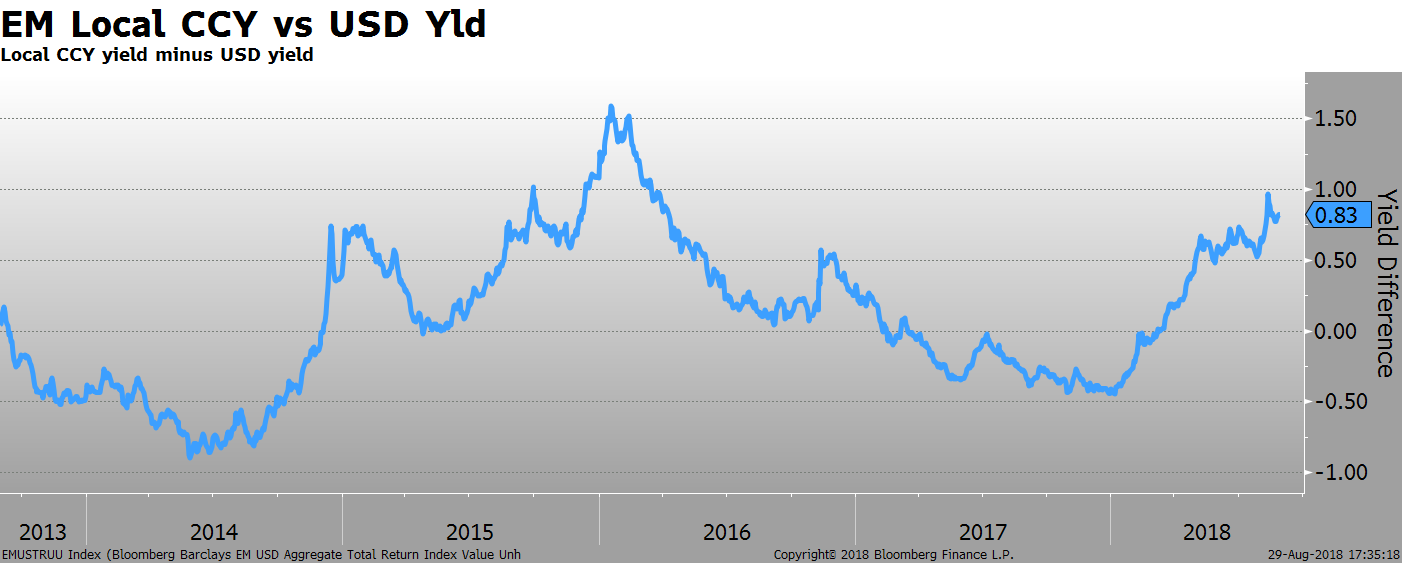

4. EM USD vs Local CCY

The yield on local currency emerging market sovereign bonds, measured using the Bloomberg Barclays Index, is now 83 bp higher than the similar index that tracks USD bonds of the same issuers. The local currency bonds traded almost 50 bp tighter than the USD denominated issues as recently as the start of the year.

USD investors need to remember the total return in local currency bonds is determined by both changes in interest rates and fluctuations in the currency. With such large movements in EM currencies this year, investors have repriced the risk premium for non-USD EM bonds.

Important Disclaimer

This material is intended to report solely on the investment strategies and opportunities identified by III Capital Management (“III”). Additional information is available upon request. Information herein is believed to be reliable, but III does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. This material is not an offer or a solicitation for any managed account or fund product of III. Such an offer or solicitation can only be made pursuant to the applicable offering document and otherwise in accordance with applicable futures and securities laws.

III, its employees, its affiliates and/or its affiliates’ advisory clients (including the III funds and other clients of III Capital Management) may hold a position in any of the securities and financial instruments discussed herein, or in other securities or instruments of any issuer discussed herein. Due to III’s fiduciary obligations as a registered investment adviser, in the event of a conflict between the interests of a III client and an AVM client, the interests of the III client will be given priority.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Certain investments, including those involving structured products, futures, options and other derivatives, are complex, may entail substantial risk and are not suitable for all investors. The price and value of, and income produced by, securities and other financial products may fluctuate and may be adversely impacted by exchange rates, interest rates or other factors. Prior to effecting any transaction in options or options-related products, investors should read and understand the current Options Clearing Corporation Disclosure Document, a copy of which may be obtained upon request from III.

All case studies are shown for illustrative purposes only and should not be relied upon as advice or interpreted as a recommendation. Results shown are not meant to be representative of actual investment results. Any securities mentioned throughout the presentation are shown for illustrative purposes only and should not be interpreted as recommendations to buy or sell.

This communication is issued by III, which is regulated in the United States by the Securities and Exchange Commission and the Commodity Futures Trading Commission. Accordingly, this document should not be circulated or presented to persons other than to professional or institutional investors as defined in the relevant local regulations.

III Capital Management

777 Yamato Road | Suite 300 | Boca Raton, FL 33431

© 2018 III Capital Management