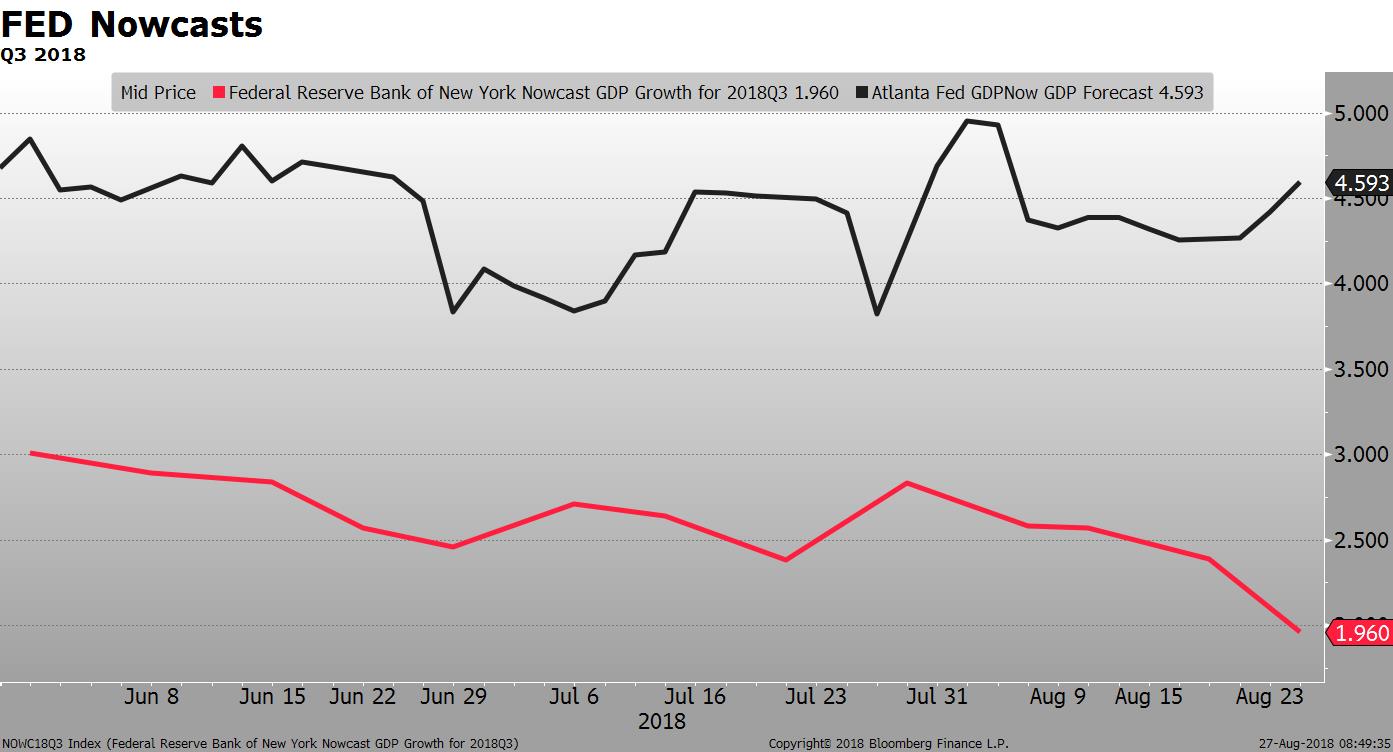

1. GDP Estimates

GDP forecasting is an art, not a science. The differences and divergence between the two indicators highlight the differences in calculation methodology. The NYFRB model uses “dynamic factor modeling” while the Atlanta model is regression-based.

Why it Matters

The Atlanta Fed’s real-time GDP estimate (GDP Now for Q3 growth is coming in at 4.6%. The New York Fed’s estimate (Nowcast) is estimating 2.0%. That is a massive difference between the two, and economic data released last week caused one to increase and the other to decrease. Crazy.

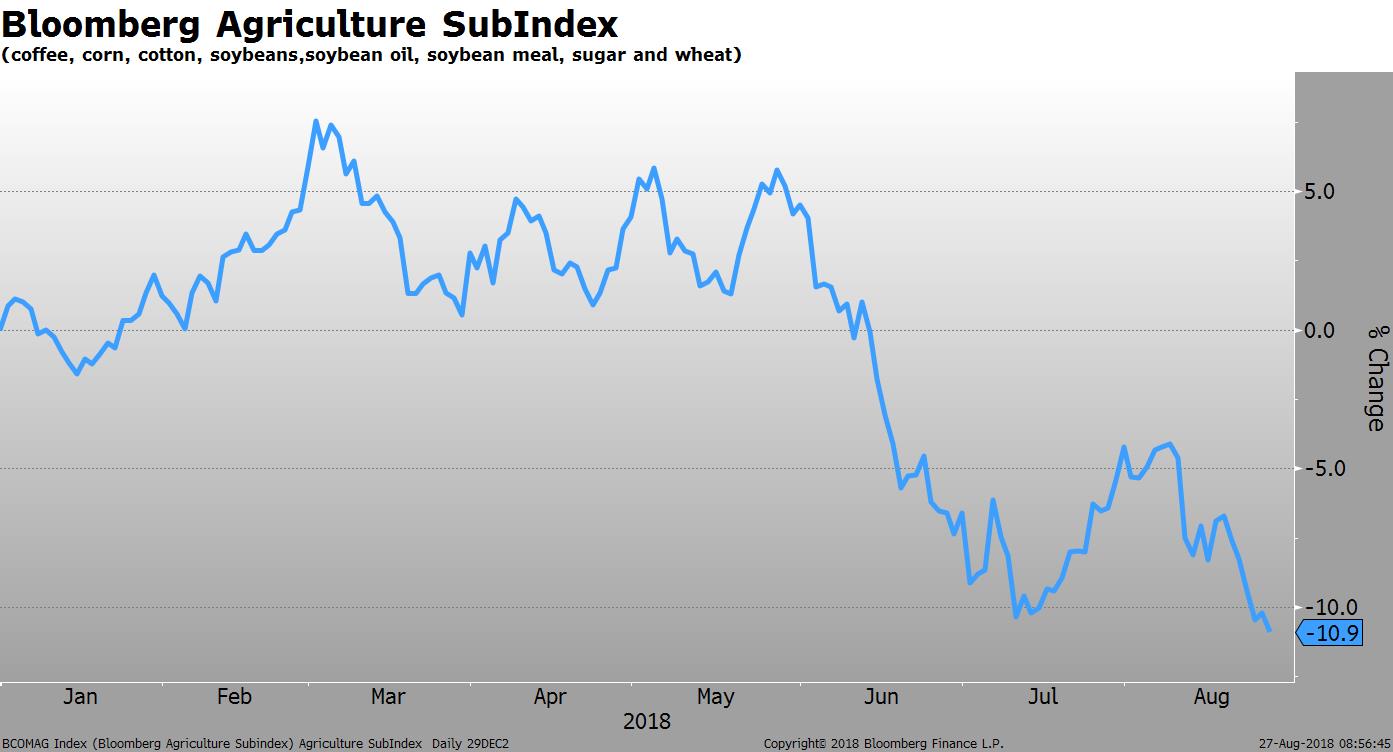

2. Agriculture Slump

The Bloomberg Agriculture Index, which is comprised of commodities such as coffee, soybeans & wheat) is retesting the mid-July lows. The trade war on the eastern front (China-US) is causing most of the damage. The index has lost 10.9% YTD.

Why it Matters

The Trump administration just detailed its plans for the $4.7 billion bailout to help farmers affected by the tariffs. If commodity prices don’t rebound in the next couple of months, it could have an impact on the mid-term elections. Republican support from the farmers will be crucial.

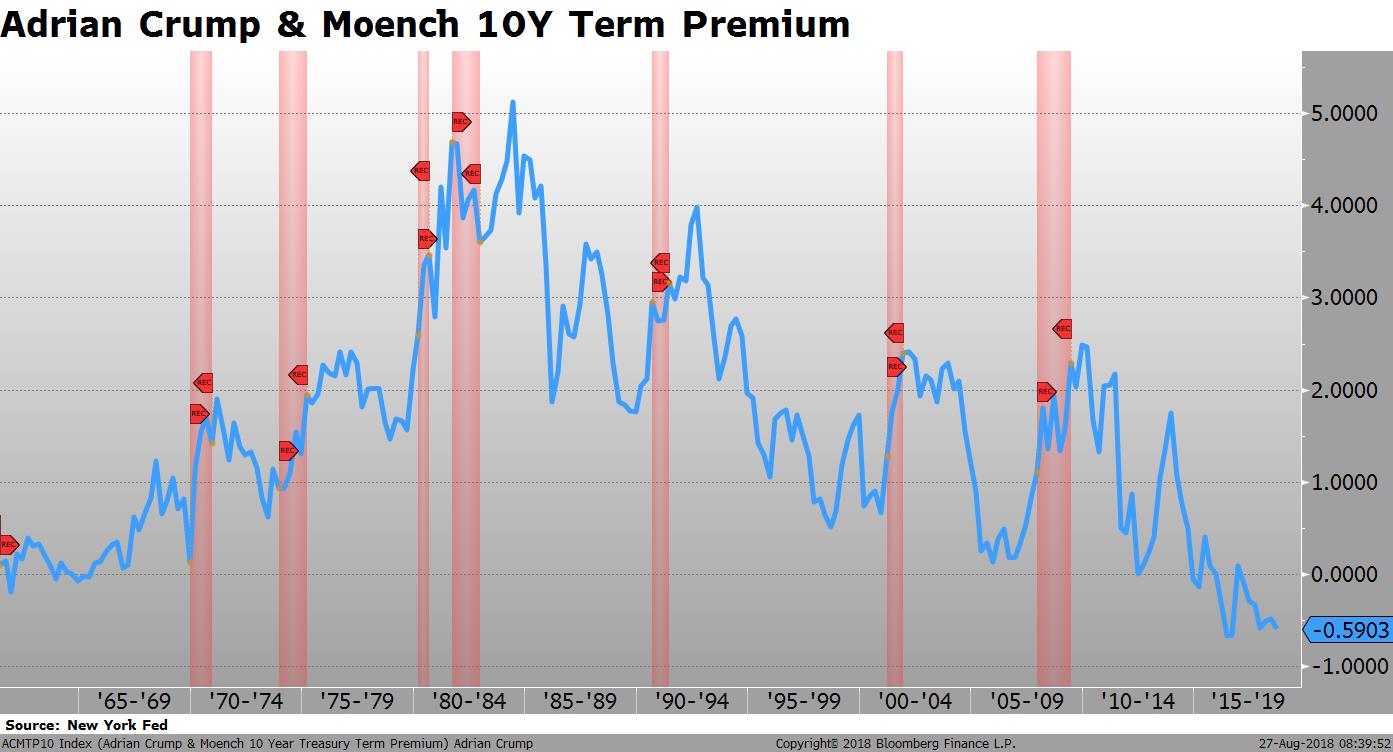

3. US 10Y Term Premium

The yield curve keeps flattening and recession calls are getting louder. Are the differences in term-premium are enough to “Make this time different?” The Fed’s measure of term premium introduced Adrian, Crump & Moench, is -0.60% today– much lower than before prior recessions.

Why it Matters

If the yield curve does have some sort of magical predictive power, the concept of term premium has to play a role. The last 7 recessions may have been preceded by a yield curve inversion, but they were NOT preceded by $4 trillion in QE.

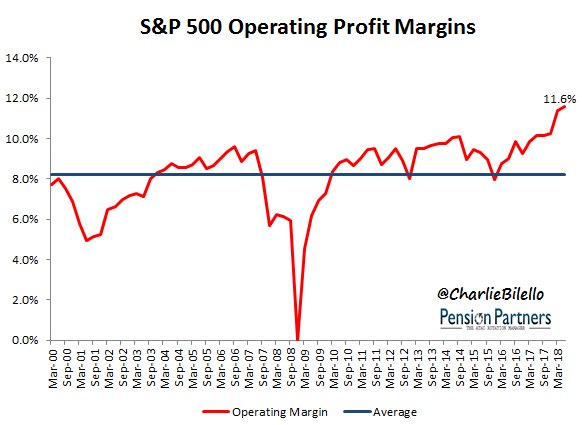

4. S&P Margins

US equity markets set a new high yesterday and appear to have regained positive momentum. Corporate fundamentals keep improving. Operating margins for S&P 500 companies hit a 20-year last quarter, rising to 11.6%.

Why it Matters

Margin expansion is a major factor contributing to profit growth, which is driving the market higher compared to international markets. I’m not sure if we are at peak margins yet, but we have to be getting close.

Important Disclaimer

This material is intended to report solely on the investment strategies and opportunities identified by III Capital Management (“III”). Additional information is available upon request. Information herein is believed to be reliable, but III does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. This material is not an offer or a solicitation for any managed account or fund product of III. Such an offer or solicitation can only be made pursuant to the applicable offering document and otherwise in accordance with applicable futures and securities laws.

III, its employees, its affiliates and/or its affiliates’ advisory clients (including the III funds and other clients of III Capital Management) may hold a position in any of the securities and financial instruments discussed herein, or in other securities or instruments of any issuer discussed herein. Due to III’s fiduciary obligations as a registered investment adviser, in the event of a conflict between the interests of a III client and an AVM client, the interests of the III client will be given priority.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Certain investments, including those involving structured products, futures, options and other derivatives, are complex, may entail substantial risk and are not suitable for all investors. The price and value of, and income produced by, securities and other financial products may fluctuate and may be adversely impacted by exchange rates, interest rates or other factors. Prior to effecting any transaction in options or options-related products, investors should read and understand the current Options Clearing Corporation Disclosure Document, a copy of which may be obtained upon request from III.

All case studies are shown for illustrative purposes only and should not be relied upon as advice or interpreted as a recommendation. Results shown are not meant to be representative of actual investment results. Any securities mentioned throughout the presentation are shown for illustrative purposes only and should not be interpreted as recommendations to buy or sell.

This communication is issued by III, which is regulated in the United States by the Securities and Exchange Commission and the Commodity Futures Trading Commission. Accordingly, this document should not be circulated or presented to persons other than to professional or institutional investors as defined in the relevant local regulations.

III Capital Management

777 Yamato Road | Suite 300 | Boca Raton, FL 33431

© 2018 III Capital Management