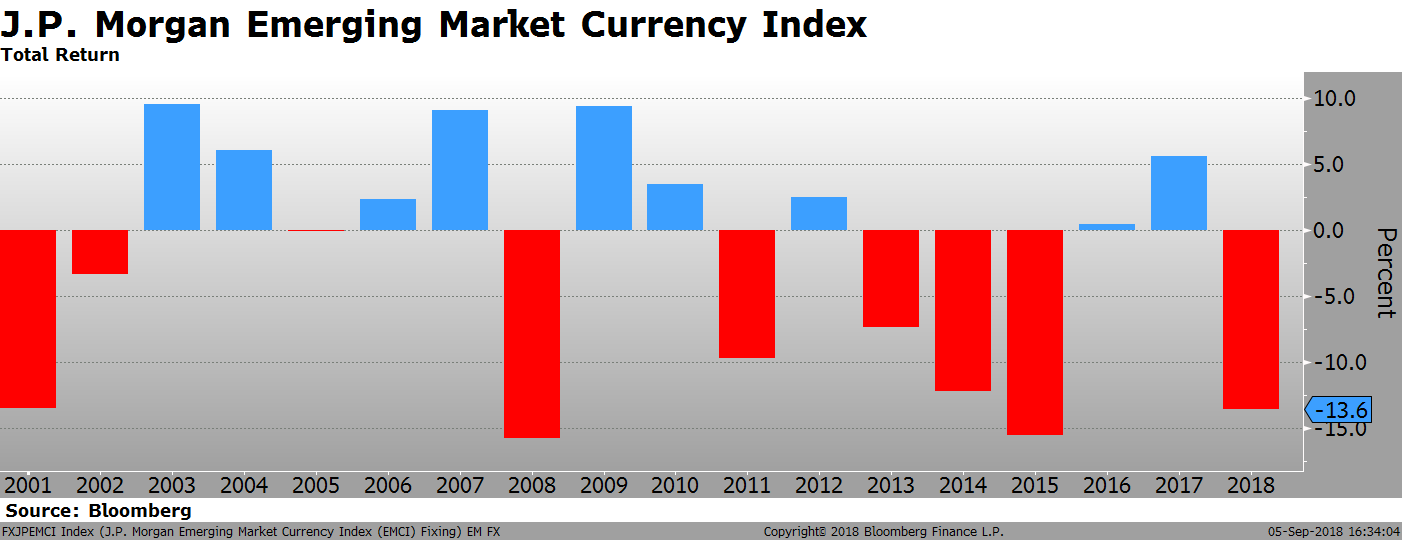

1. EM FX

The weakness in EM seems to be moving from idiosyncratic situations to contagion. The huge currency losses in some EM markets are not without historical precedent. Losses in 2008 and 2015 exceeded 15%. Bottom line: it feels bad, but it could easily get worse.

Why it Matters

Emerging markets had another rough day yesterday. Stocks bonds and currencies of major EM markets fell. Indonesia seems to be the new source of volatility, where 10Y yields spiked 22 bp. The JP Morgan EM currency index is now down close to 14% YTD.

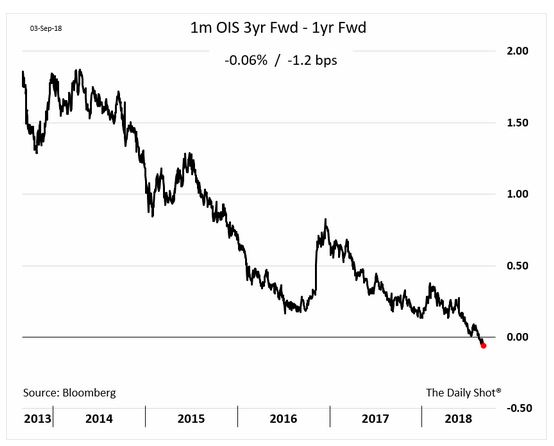

2. Inverted Curve

The yield curve is already inverted…if you look at forward OIS rates. The 1m OIS rate 3 years forward is lower than the 1m OIS rate 1 year forward. The market is pricing a return to rate cuts not long after the tightening cycle is expected to conclude.

Why it Matters

The market is priced for 2-3 more increases in the fed funds rate. That would put real rates in the 50 bp range, assuming a 2.3% median economist forecast for CPI for 2019 and 2020. A 50 bp real rate may not look like tight monetary policy, but if Japan and Europe are still at negative nominal rates, its’ enough to continue to attract capital flows.

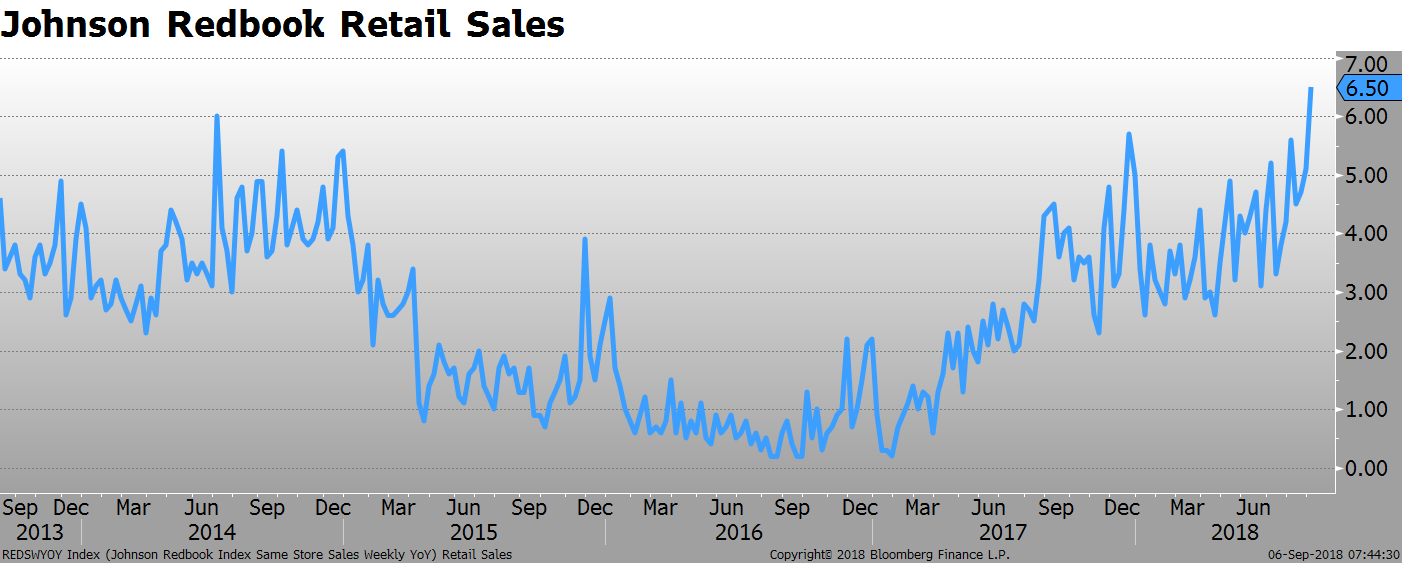

3. Retail Sales

The increase in weekly retail sales, measured via the Johnson Redbook Index, rose to the highest level in the last 5 years. The cutoff period for most retailers was Saturday, Sept 1, so most of the Labor Day shopping activity is not reflected in this number, which makes it even more impressive.

Why it Matters

If you are looking for clues for a slowdown in the US economy, you are not going to find it in retail sales. Consumer spending drives economic activity and for now at least, consumers are still spending.

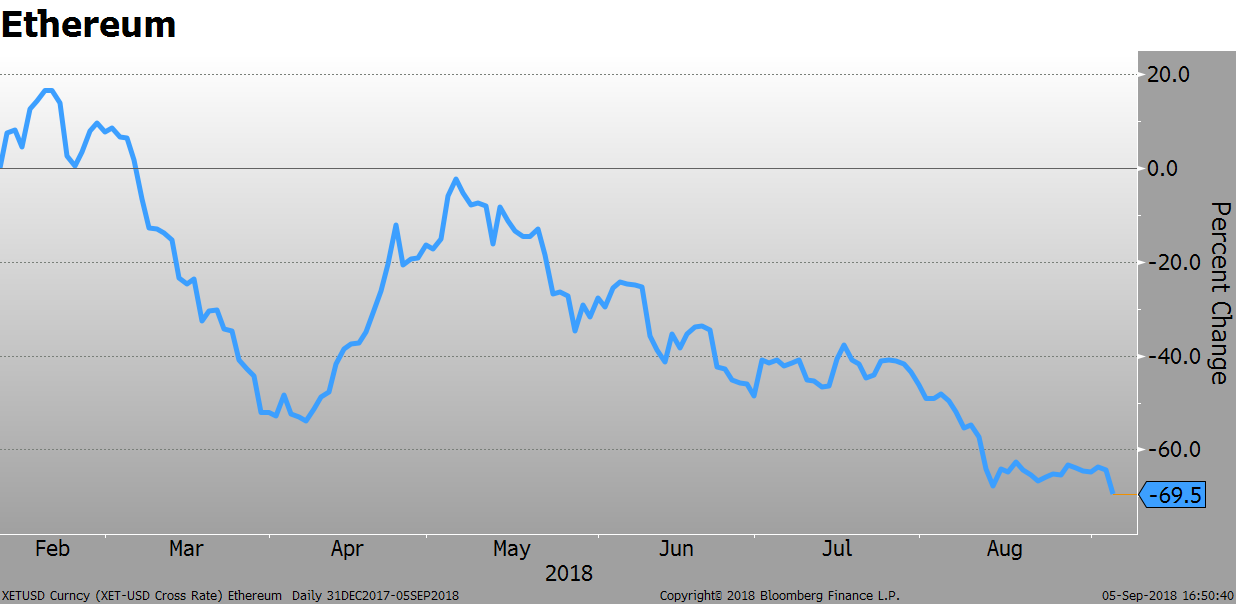

4. Ethereum

The second largest cryptocurrency, Ethereum, hit a new YTD low yesterday of $245 on expectations of further regulations for crypto. Ethereum is down 70% from the high established earlier this year.

Why it Matters

The idea of having anonymous trading of a “currency” is just too much for regulators to handle. The government will not tolerate money laundering, tax evasion, and transactions in illicit goods and services. The appeal of cryptocurrencies is fading.

Important Disclaimer

This material is intended to report solely on the investment strategies and opportunities identified by III Capital Management (“III”). Additional information is available upon request. Information herein is believed to be reliable, but III does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. This material is not an offer or a solicitation for any managed account or fund product of III. Such an offer or solicitation can only be made pursuant to the applicable offering document and otherwise in accordance with applicable futures and securities laws.

III, its employees, its affiliates and/or its affiliates’ advisory clients (including the III funds and other clients of III Capital Management) may hold a position in any of the securities and financial instruments discussed herein, or in other securities or instruments of any issuer discussed herein. Due to III’s fiduciary obligations as a registered investment adviser, in the event of a conflict between the interests of a III client and an AVM client, the interests of the III client will be given priority.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Certain investments, including those involving structured products, futures, options and other derivatives, are complex, may entail substantial risk and are not suitable for all investors. The price and value of, and income produced by, securities and other financial products may fluctuate and may be adversely impacted by exchange rates, interest rates or other factors. Prior to effecting any transaction in options or options-related products, investors should read and understand the current Options Clearing Corporation Disclosure Document, a copy of which may be obtained upon request from III.

All case studies are shown for illustrative purposes only and should not be relied upon as advice or interpreted as a recommendation. Results shown are not meant to be representative of actual investment results. Any securities mentioned throughout the presentation are shown for illustrative purposes only and should not be interpreted as recommendations to buy or sell.

This communication is issued by III, which is regulated in the United States by the Securities and Exchange Commission and the Commodity Futures Trading Commission. Accordingly, this document should not be circulated or presented to persons other than to professional or institutional investors as defined in the relevant local regulations.

III Capital Management

777 Yamato Road | Suite 300 | Boca Raton, FL 33431

© 2018 III Capital Management