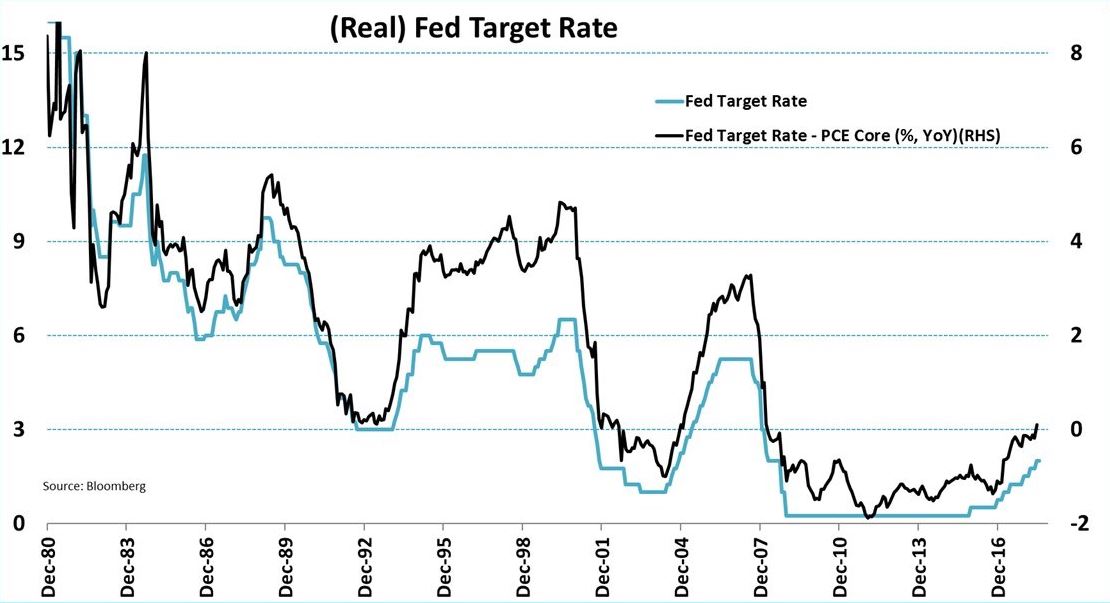

1. Real Fed Fund Rate

For the first time in more than a decade, the overnight real rate (Fed target rate minus PCE core rate) in the US is positive. The real rate should rise as the Fed continues to raise interest rates.

Why it Matters

A positive real rate on cash alleviates the need for investors to chase yield in riskier asset classes. A growing positive real return for cash makes it a viable asset class again. This could be one factor behind the recent cheapening of gold as a store of value.

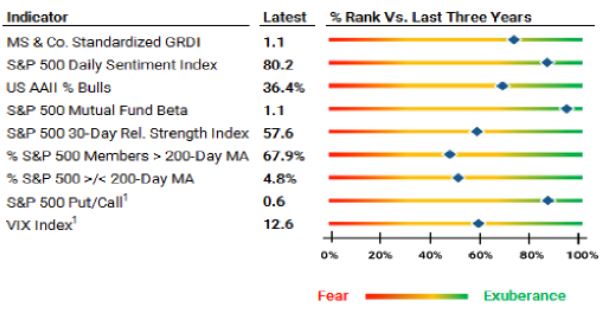

2. Investor Sentiment

Despite the turmoil in emerging market debt and equities, investor sentiment remains strong. According to Morgan Stanley data, most indicators point a little more toward “exuberance” than “fear”.

Why it Matters

Everybody is looking for the catalyst to signal the top in US equities; whether it is from peak earnings, tight monetary policy, or a slowdown in global growth. Regardless of the source, most tops are also associated with excessive levels of euphoria. We are not there yet.

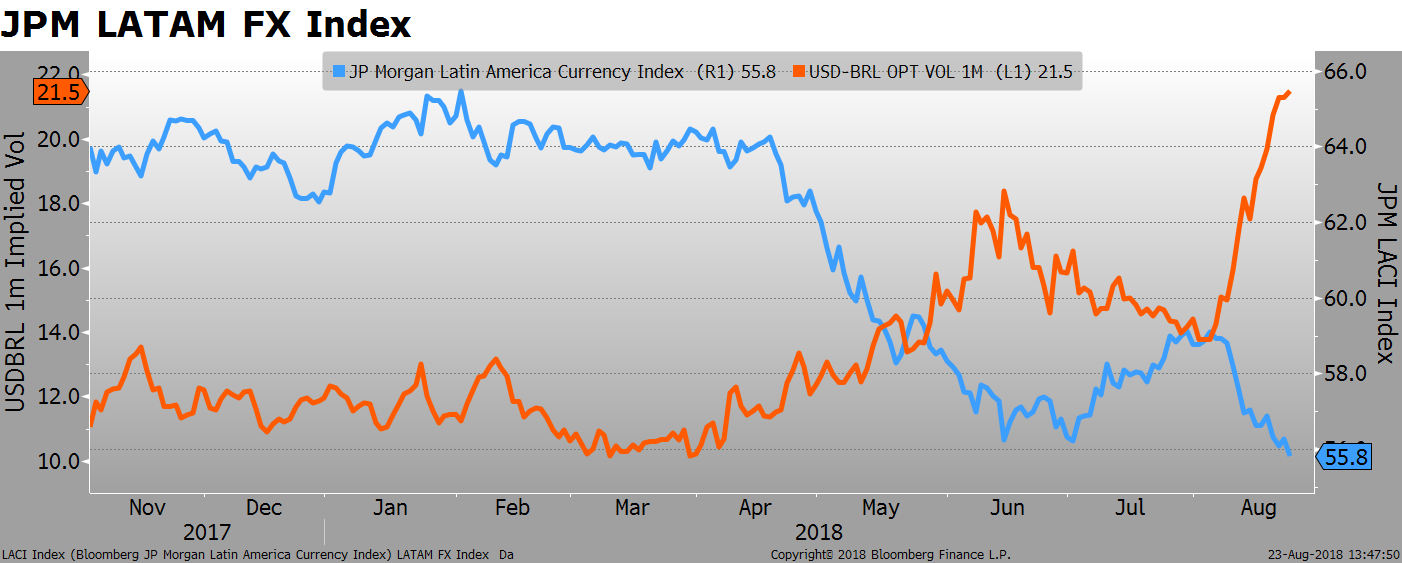

3. LATAM FX

The JP Morgan LACI Index of LATAM currencies hit a new low yesterday. Once again, Brazil led the way down. Brazil has the largest weight in the index (ARS 10%, BRL 33%, CLP 12%, COP 7%, MXN 33% PEN 5%).

Why it Matters

Investor focus on EM currencies has moved from Turkey to Brazil. 1-month volatility on USDBRL has spiked. We have to watch for spillover effects into developed market risk assets.

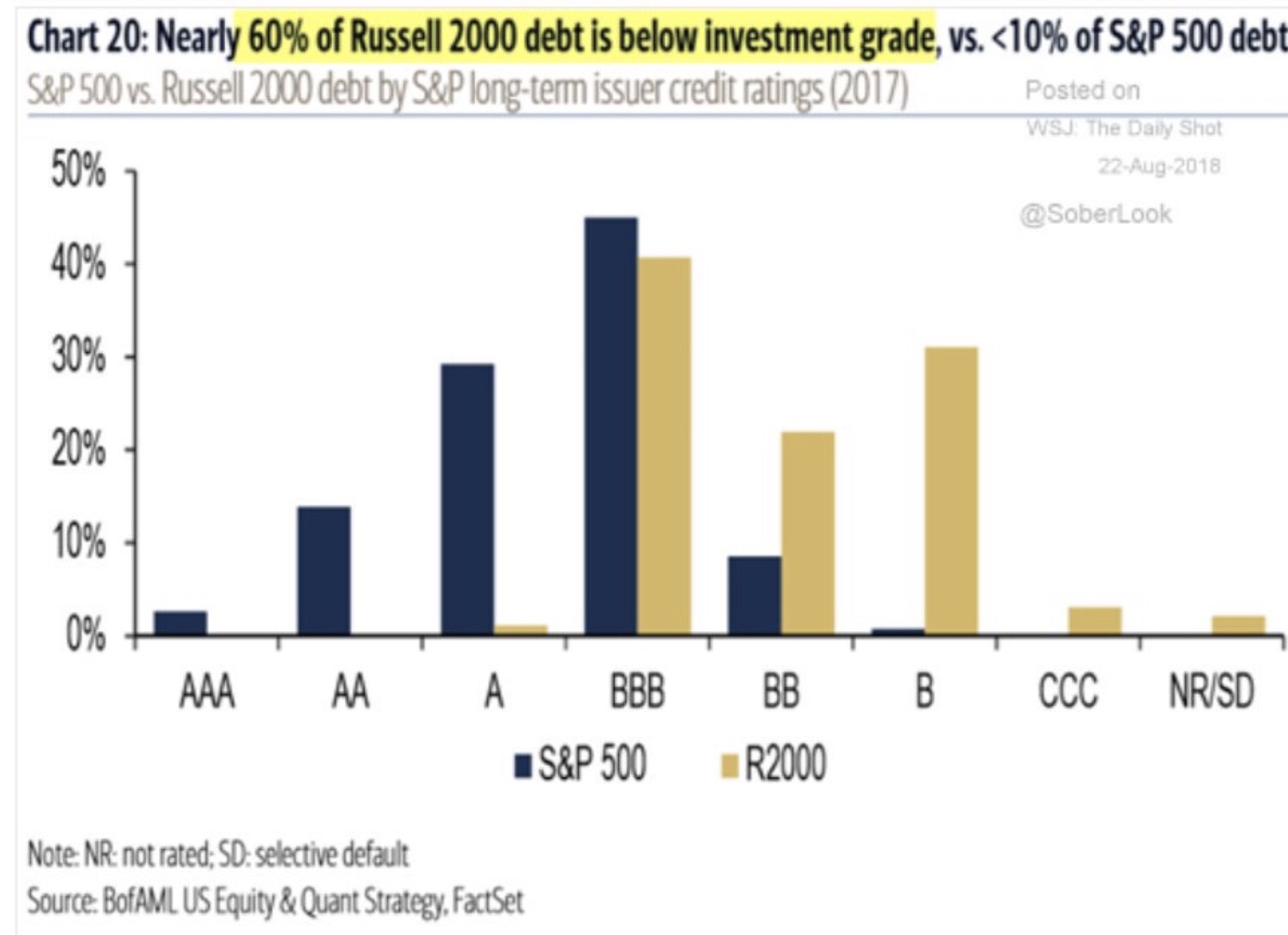

4. Small Caps

The small-cap outperformance is largely attributed to the strength in the USD and exposure to a potential trade disruption. There may be additional return sensitivity to the eventual turn of the credit cycle when investors shun weaker balance sheets.

Why it Matters

Small cap equities (Russell 2000) made a new all-time high yesterday, with the index up almost 12% YTD. The index composition from a credit quality perspective, however, is much worse than the S&P: 60% of the Russell 2000 is below IG vs 10% for the S&P 500.

Important Disclaimer

This material is intended to report solely on the investment strategies and opportunities identified by III Capital Management (“III”). Additional information is available upon request. Information herein is believed to be reliable, but III does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. This material is not an offer or a solicitation for any managed account or fund product of III. Such an offer or solicitation can only be made pursuant to the applicable offering document and otherwise in accordance with applicable futures and securities laws.

III, its employees, its affiliates and/or its affiliates’ advisory clients (including the III funds and other clients of III Capital Management) may hold a position in any of the securities and financial instruments discussed herein, or in other securities or instruments of any issuer discussed herein. Due to III’s fiduciary obligations as a registered investment adviser, in the event of a conflict between the interests of a III client and an AVM client, the interests of the III client will be given priority.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Certain investments, including those involving structured products, futures, options and other derivatives, are complex, may entail substantial risk and are not suitable for all investors. The price and value of, and income produced by, securities and other financial products may fluctuate and may be adversely impacted by exchange rates, interest rates or other factors. Prior to effecting any transaction in options or options-related products, investors should read and understand the current Options Clearing Corporation Disclosure Document, a copy of which may be obtained upon request from III.

All case studies are shown for illustrative purposes only and should not be relied upon as advice or interpreted as a recommendation. Results shown are not meant to be representative of actual investment results. Any securities mentioned throughout the presentation are shown for illustrative purposes only and should not be interpreted as recommendations to buy or sell.

This communication is issued by III, which is regulated in the United States by the Securities and Exchange Commission and the Commodity Futures Trading Commission. Accordingly, this document should not be circulated or presented to persons other than to professional or institutional investors as defined in the relevant local regulations.

III Capital Management

777 Yamato Road | Suite 300 | Boca Raton, FL 33431

© 2018 III Capital Management