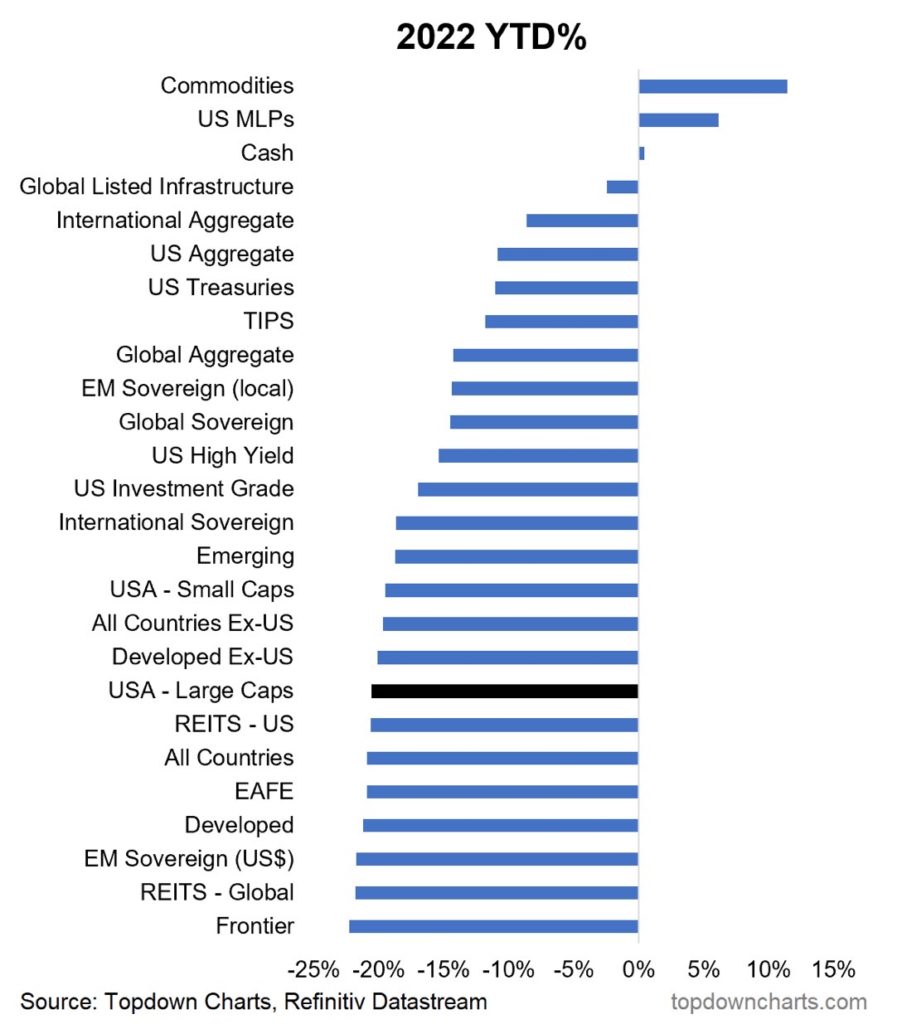

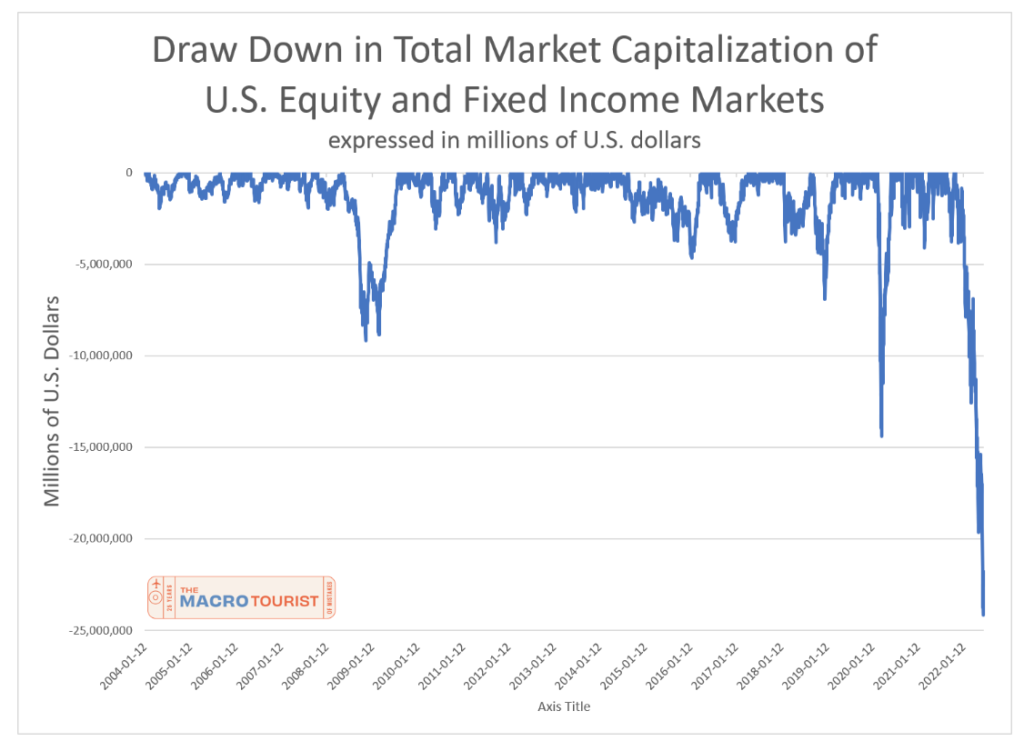

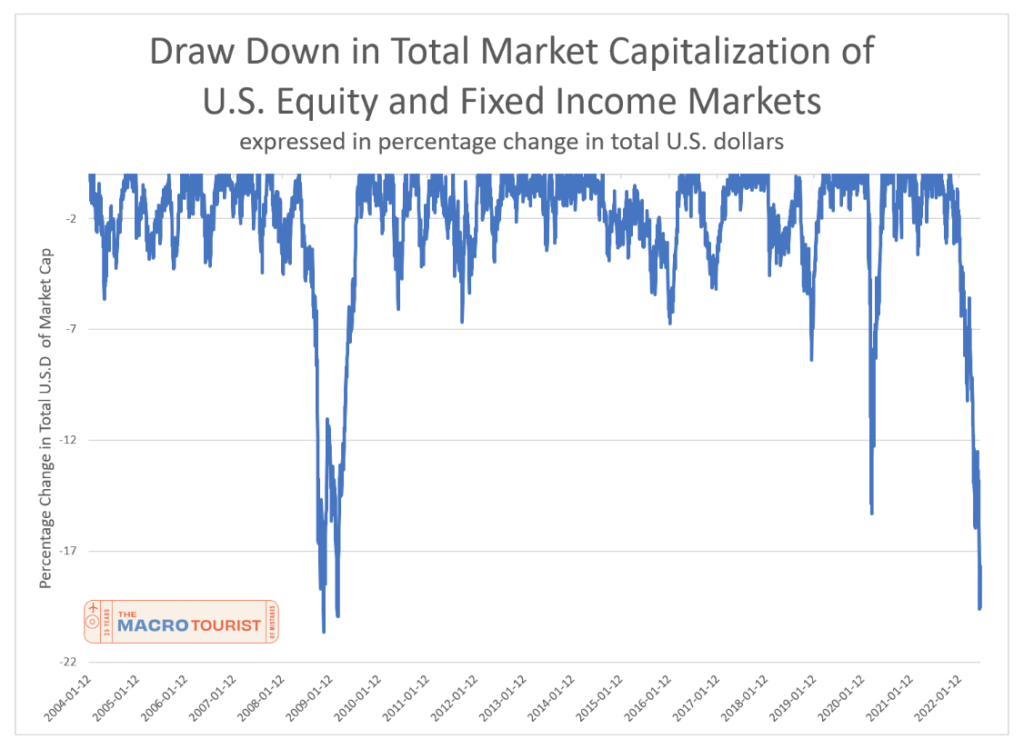

There is no question that the first half of 2022 has been terrible for investors. Virtually every major asset class has experienced a significant price correction, and traditional “safe-haven” markets have lost their negative correlation with risk assets. For anyone running a diversified investment strategy, there truly was no place to hide. The widely-followed “60/40” portfolio posted its worst first-half return since 1932, falling -17%.

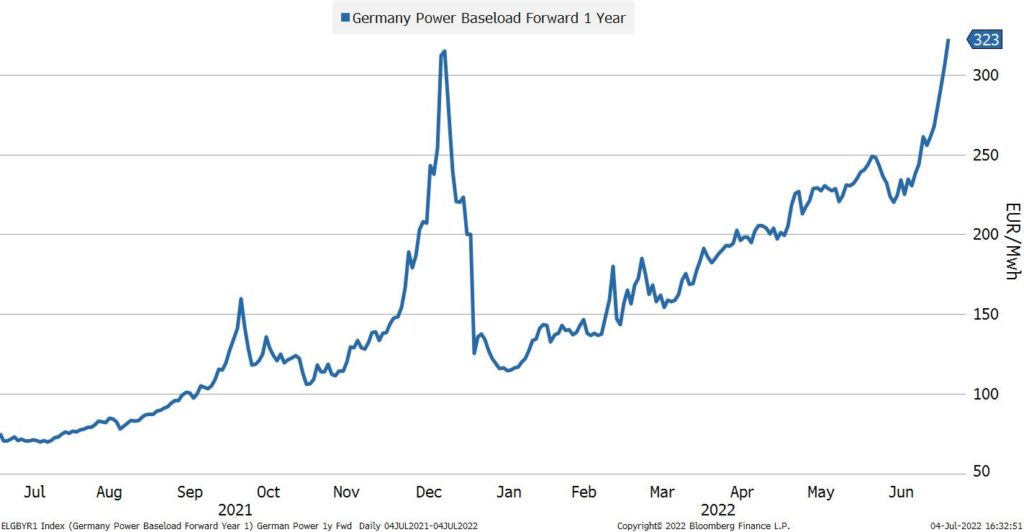

By now, most people are familiar with what happened over the last six months. Continued supply chain snarls, mainly due to China’s “covid-zero” policy, combined with shortages in a variety of commodities stemming from Russia’s invasion of Ukraine, have caused inflation and inflation expectations to hit uncomfortable levels. In response, the Fed has talked tough and acted tougher, raising short-term rates at the fastest pace since 1994.

Equity, fixed-income and credit markets are now in process of bracing for an economic slowdown sufficient to dent demand enough to curb inflation:

- 10-year UST rates have dropped more than 60 bps from their recent highs and breakeven inflation has plummeted back to levels deemed acceptable by the Fed.

- Cyclical stocks have underperformed defensives.

- Credit spreads have widened in anticipation of a pick-up in the default rate.

- The yield curve has flattened and is now predicting the Fed will have to reverse course and switch back to an easing path in early 2023

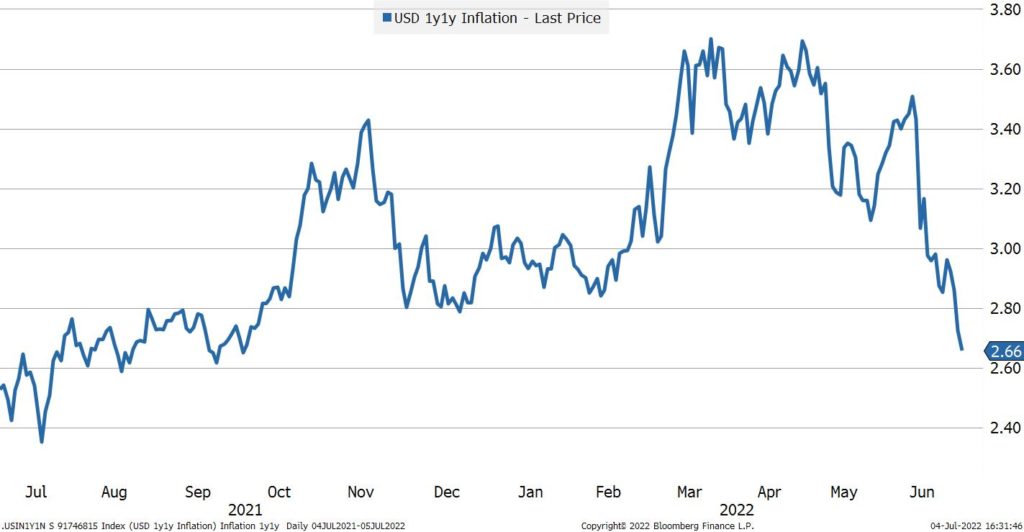

The inflation situation is the largest macro headwind to markets at the moment. And it’s hard to see how the Fed can arrest control of prices absent some serious demand destruction. Higher rates are not going to impact the flow of gas to Europe or increase the flow of grains around the world. But if the economic slowdown is severe enough, slower demand for discretionary goods and confidence-based sectors of the economy such as housing could take the wind out of inflation.

The one-year breakeven yield fell to 4.29%, down 207 bps from its high of 6.36% in March, and the 1Y1Y forward inflation swap rate fell to 2.66%, more than 100 bps lower than just two months ago.

If demand can move back down, then inflation could move to back along that path just as quickly as it went up

– Fed Chair Powell in an address to the Senate Banking Committee

That scenario is possible, maybe even probable with the information we know now.

- Consumer and business confidence are at a multi-decade low, which will translate to reduced spending on goods and services

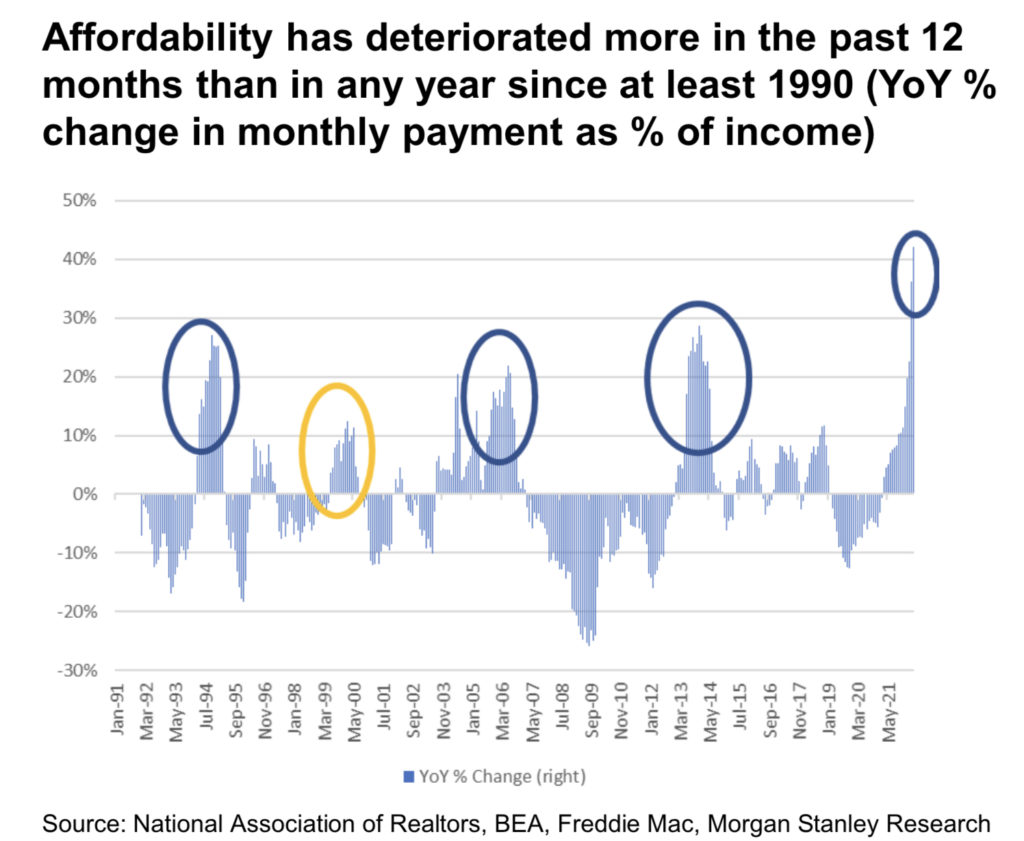

- Higher mortgage rates and reduced affordability have caused a deceleration in the housing market

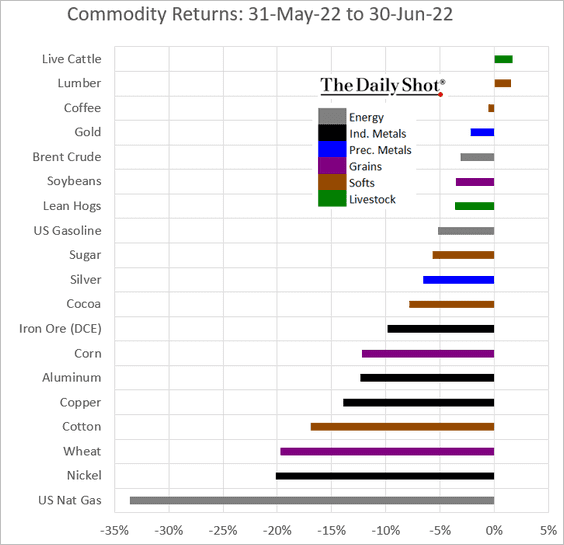

- Commodity prices have rolled over which will lead to lower input costs in aggregate

- While the employment picture is still strong, there are indications that hiring is beginning to slow

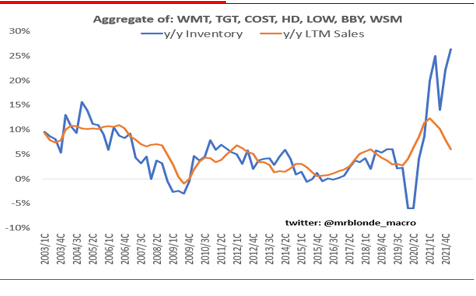

- Inventory levels at major retailers have spiked, suggesting some price cuts are forthcoming

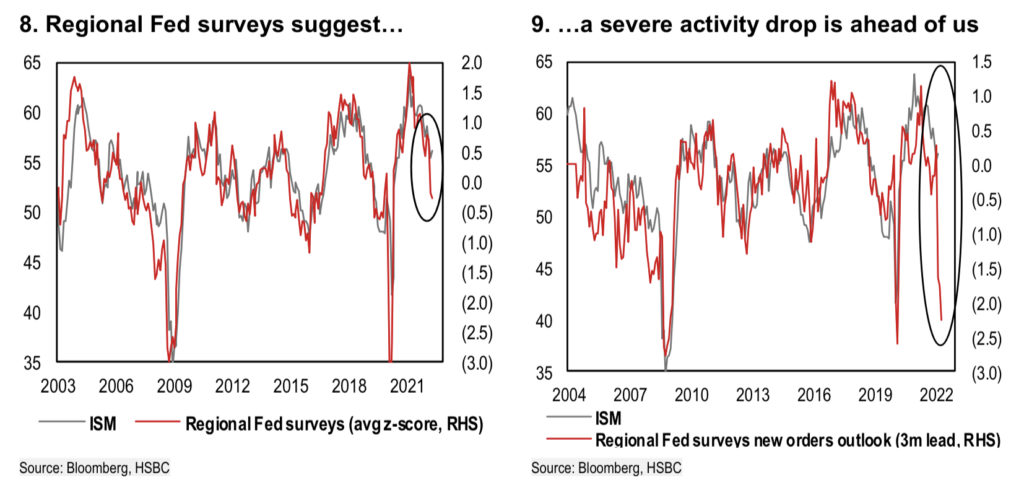

- New manufacturing orders have plunged

Of course, the hard part of the analysis is not observing the economic data; it is determining whether current trends will change or accelerate. It is even harder to predict the impact on financial markets. Much of the uncertainty comes down to predicting earnings.

Morgan Stanley summarized the earnings outlook in a recent note to clients:

There’s a notable disconnect between earnings estimates and the Federal Reserve’s efforts to slow the economy—and inflation. Since March, the Fed has raised the fed funds rate 150 basis points, yet 12-month forward earnings estimates still show double-digit growth. These expectations are completely out of line with economic forecasts that point toward a recession and a fed funds rate that may double before the end of the year. The implication of the sticky earnings forecasts is that the market decline has happened by lowering the valuation multiple on earnings, not cutting the earnings themselves. We don’t think the cyclical bear market can end until earnings are marked down, which makes profit reports for the second and third quarters critical.

– Morgan Stanley

In other words, the valuation correction we have experienced for the last six months has happened from a fall in stock prices. The “P” in the “P/E” ratio has done all the work in bringing multiples back to average levels. But what happens if earnings do not materialize? P/E ratios will start to rise again, removing valuation as a potential upside catalyst.

Past recessions have coincided with a decline in margins and a fall in corporate profitability. S&P 500 profits fell 57% in 2007-2008 and 32% in 2000-2001. Many analysts still project EPS growth for 2022. As MS points out, that is hard to reconcile with the current economic outlook.

The popping of the crypto bubble is looking more and more like the collapse of internet stocks in 2000. Bitcoin collapsed, plunging 58% from $48K at the start of the year to $20K at the end of June. The industry is going through rapid consolidation, either by merger, acquisition or bankruptcy. BlockFi is one of the latest victims. CNBC reported that FTX may buy BlockFi for as little as $25 million – a 99% discount from the $4.8BN Series E valuation in July 2021.

Ouch. As these massive markdowns take place, expect to see some pretty scary performance numbers from some venture and private equity funds over the next couple of quarters. Many allocators in the VC world targeted infrastructure investments in the crypto space such as exchanges and DeFi lenders, wanting to bet on blockchain technologies rather than speculate on individual coins or tokens. Put simply, there is no economic need for dozens of exchanges and hundreds of different DeFi protocols. The industry is consolidating and will face additional regulation in the coming months. The gold rush is over.

Thoughts on different asset classes

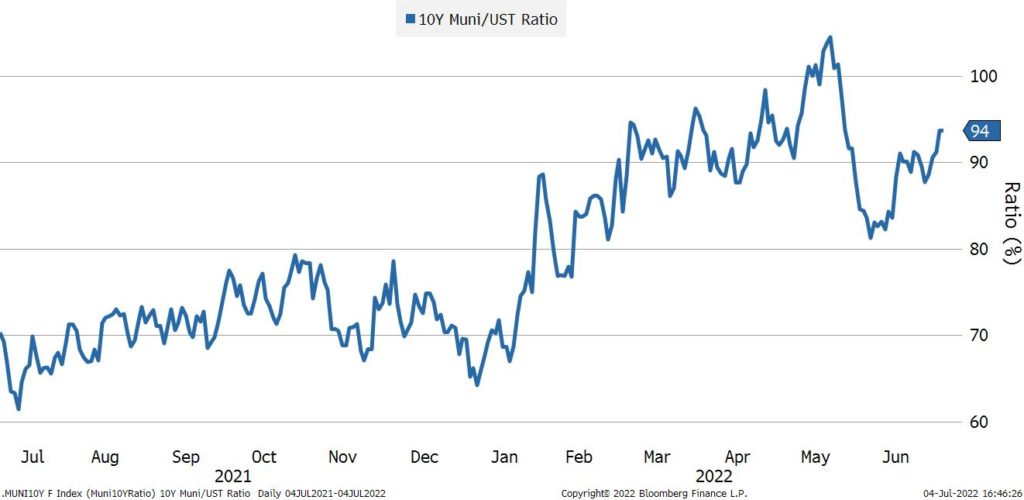

Munis: Municipal bonds are cheap. They are trading at attractive levels relative to UST. I like using PZA for broad market exposure and the unleveraged closed-end fund, NUV, for a tactical allocation until the current 7.4% discount to NAV disappears, at which time I plan to swap into more PZA.

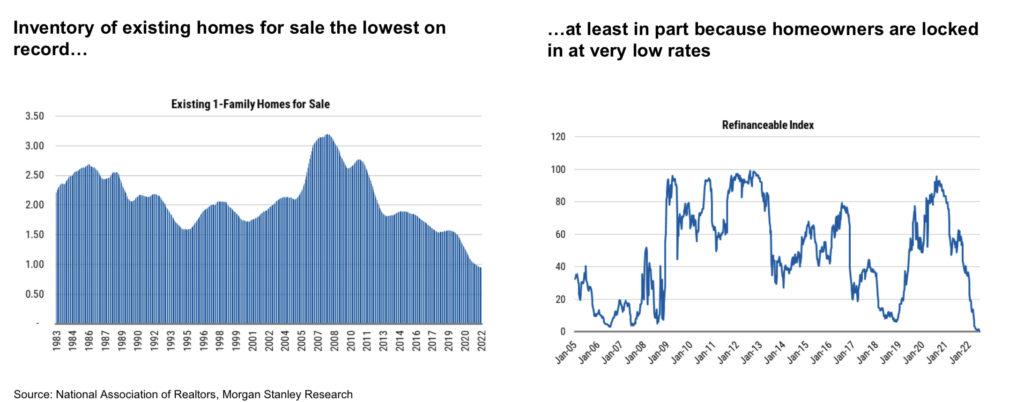

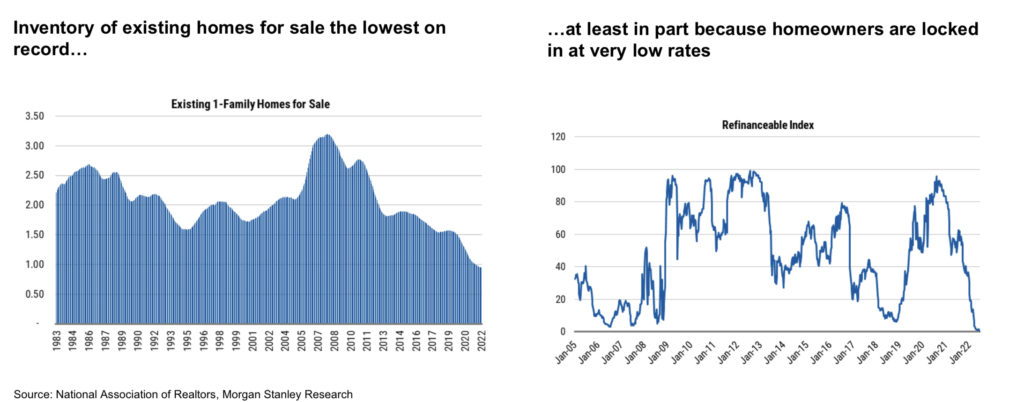

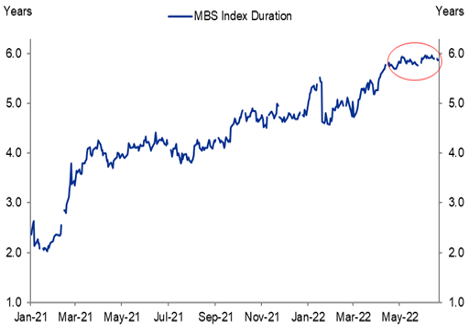

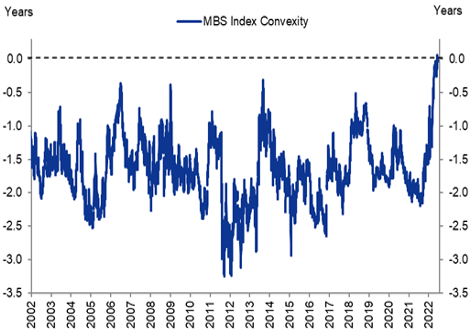

MBS: Fixed-rate Agency mortgages currently look like a good alternative to US Treasuries. Holders of fixed-rate MBS are short a prepayment option: homeowners can repay their mortgage at any time, whether it is through refinancing to take advantage of a lower coupon or through repayment when a house is sold. The duration of a mortgage is dependent on how many homeowners decide to prepay for whatever reason: the duration shrinks when rates are lower and lengthens when interest rates are high. Because owners of mortgage securities are short of this negative convexity, MBS yields should be high than US Treasury yields.

Given most of the mortgage universe consists of lower coupons, the prepayment option for most of the outstanding mortgages is worth very little. In fact, the duration of the mortgage universe has stopped lengthening as yields move higher. There is not much convexity left even if rates continue to climb. Yet extremely high levels of implied volatility in the interest rate market open up the possibility that rates could FALL.

The additional yield in MBS is to compensate for their uncertain duration. Going long MBS is a way to go short interest rate volatility. If you think rates may have peaked and will stabilize around these levels, MBS yields will likely contract relative to Treasuries. MBB or VMBS are two ETFs that provide exposure to fixed-rate MBS.

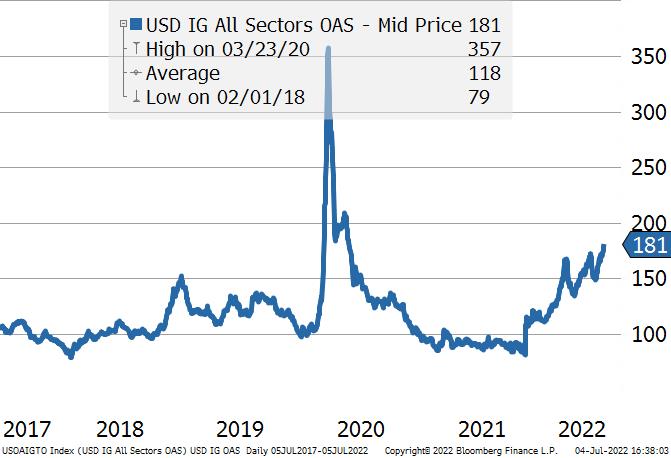

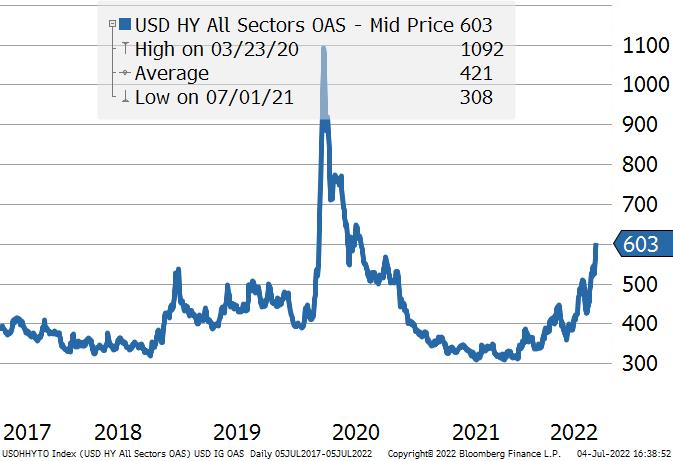

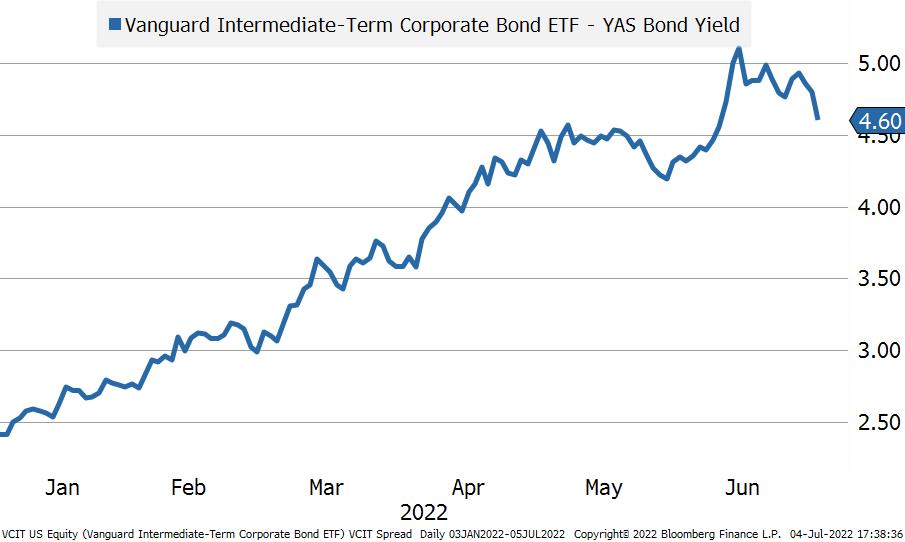

IG & HY Credit: It is not a bad time to overweight credit. Spreads in both investment grade and high yield have widened to reflect the risk of recession. Unlike some other transitions from boom to bust, the current cyclical downturn was not preceded by excessive corporate or consumer leverage. Balance sheets are strong in most industries and debt service costs are low in relation to cash flow.

Wider credit spreads are warranted to reflect the higher volatility and lower liquidity in the market, but default risk, especially in IG, is still quite remote. Given the flatness of the yield curve, I prefer intermediate-term corporates over long-dated bonds.

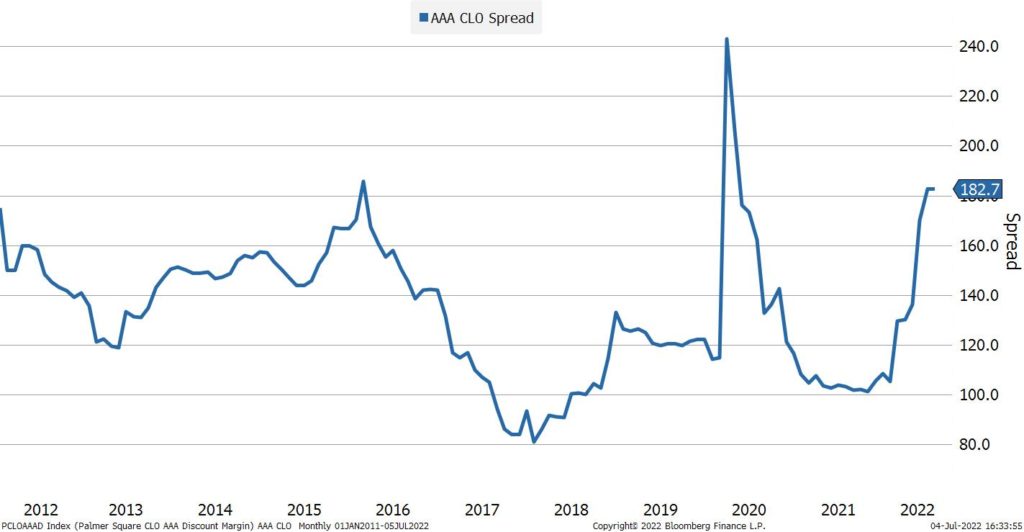

For those with a 2-3 year investment horizon who are looking to capture illiquidity premium, AAA CLO’s are a good option. The current discount margin of 183 bps is at the high end of the range. There is virtually no default risk in a AAA CLO and there is no interest rate risk. The easiest way to access this market is through an ETF like JAAA.

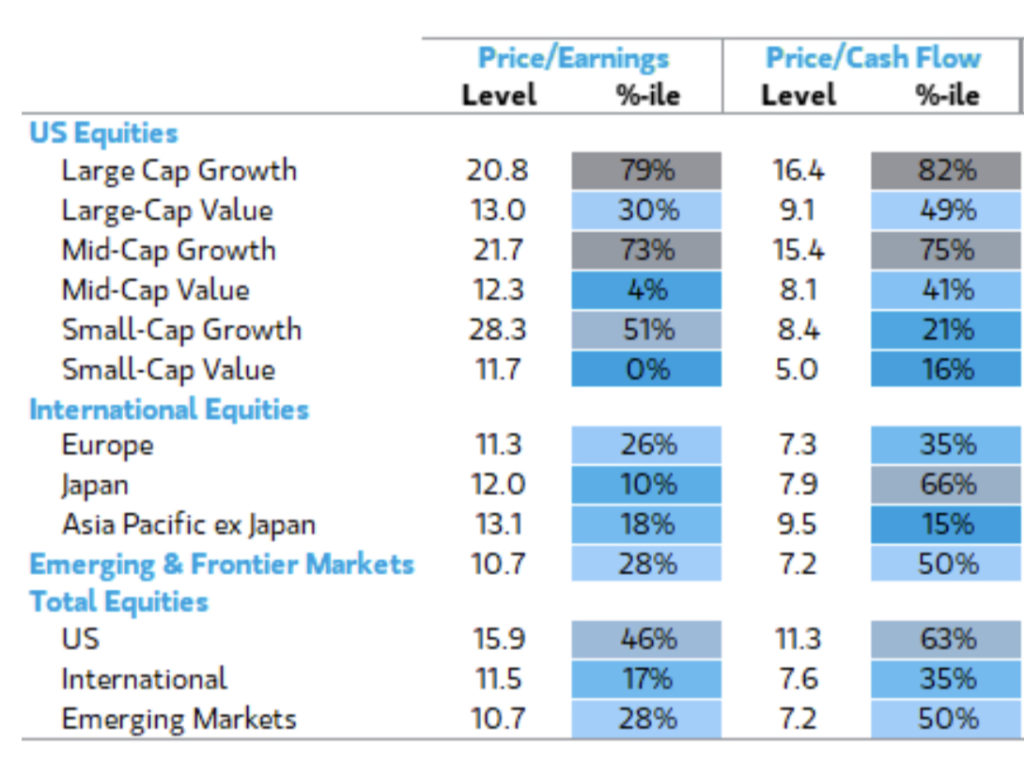

Equities: As mentioned above, equities around the world are clearly lower in price, and if you believe earnings will hold, they are approaching historical averages in terms of valuation. International equities, in particular, look cheap: dividends are higher, earnings multiples are lower, and if the dollar is close to peaking, additional returns can be garnered from currency appreciation. The problem with international exposure, whether it is in Europe or Asia, is that there are additional macro risks.

Europe is more exposed to the global shortage in energy and Asia is vulnerable to policy changes in China. A global slowdown will impact earnings in all regions, but it feels like the tail risk is greater in Europe and Asia. Maybe that is why these markets traded at such a large valuation discount to the U.S. I would be much more comfortable going overweight equities at a 16x forward earnings multiple if profit forecasts were more bearish. Until then, with current prices and valuations, a neutral weight is probably more justified.

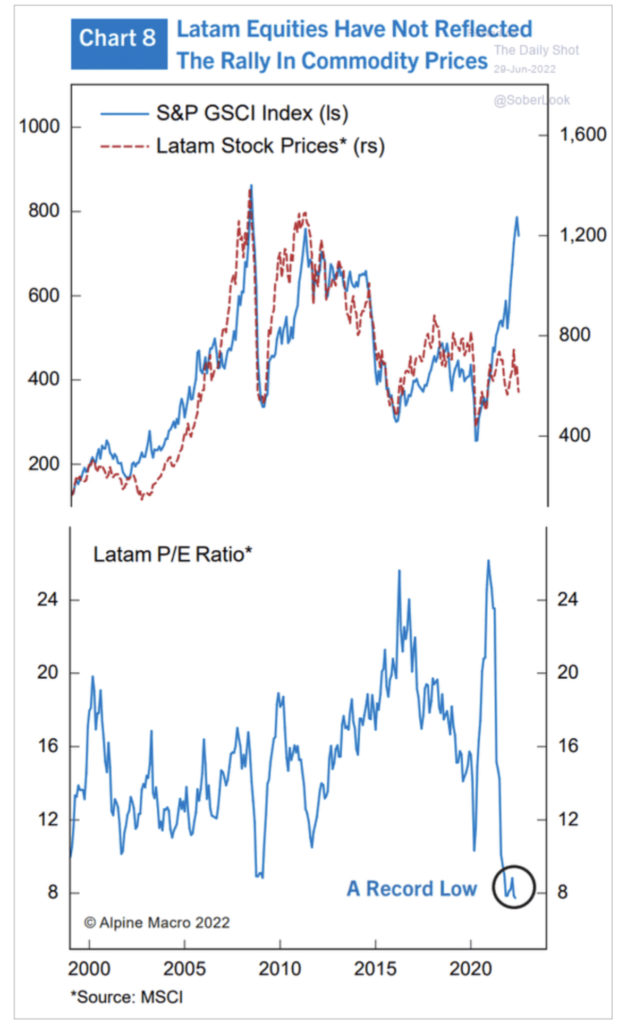

With respect to LATAM, the greater exposure to commodity markets at this stage of the cycle along with a shift to the far-left in many countries make investments in the region more difficult to evaluate, despite record low valuations. Colombia, Peru and Chile elected socialist presidents this year, and Brazil will likely join them soon. In Mexico, a country that should be benefiting from deglobalization and “near shoring” of manufacturing, the push to promote state-owned and domestic Mexican companies is limiting foreign investment. That said, if you are a commodities bull, LATAM equities may still be a good bet. See the chart below:

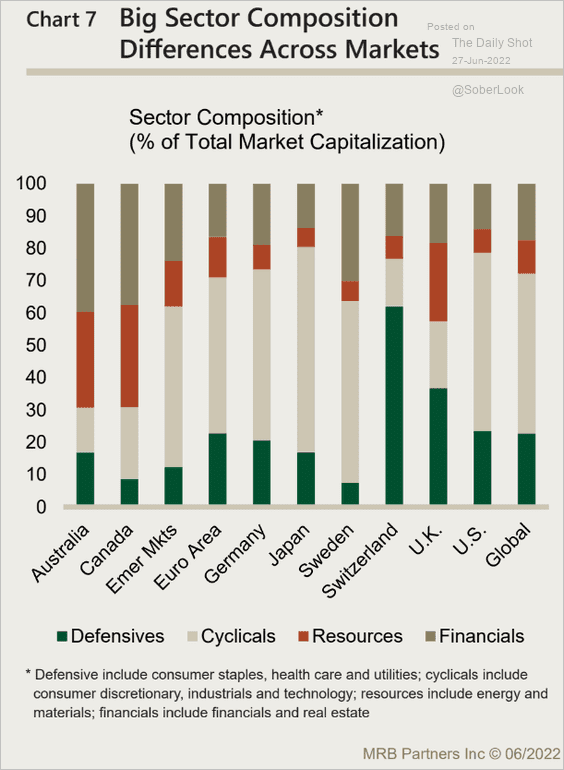

It’s important to remember that looking at international markets using valuation metrics alone is incomplete. There are different political systems, different macro headwinds/tailwinds, and different compositions in the tradeable indices.

The Swiss and UK markets are heavily weighted toward defensive stocks. Australia and Canada have large exposure to resources. Japan and Sweden tilt toward cyclicals. Depending on the stage of the economic cycle, these investment factors can carry very different earnings multiples.

For example, cyclical stocks currently have very low P/E ratios because investors believe the global economy is slowing and earnings have peaked for these stocks. Comparing a P/E ratio in a cyclical-heavy index with a defensive-heavy index is like comparing apples and oranges. Without knowing index factor exposures, investors can be fooled into a “safer” allocation to a region or country with a lower valuation, when in fact they may be loading up on cyclicals that are riskier in a downturn.

Putting it all together

- Maintain a neutral weighting to equities overall, with a small overweight to international markets vs. the U.S.

- If you are looking to add yield to a portfolio, munis and MBS are better options right now than U.S. Treasuries

- Overweight IG and HY credit in fixed income portfolios