Markets got a dose of reality this week. After a prolonged period of falling volatility and positive returns for risk assets, the narrative is changing. Rising tensions in the Middle East and higher-than-expected inflation in the US helped propel commodity prices higher and jolted interest rates and the dollar through significant technical resistance. Among the equity indices, large-cap stocks generally outperformed small-caps, with the S&P 500 dropping 1.55% and the Russell 2000 falling 2.92%. Let’s start with inflation.

Inflation

Let’s face it: Wall Street economists have struggled with getting the right call on the economy over the last few years. First, there was the “near certainty” of a recession due to restrictive monetary policy and the inverted yield curve. Then, there was the “continued disinflation” narrative that included a prediction that the Fed was going to lower rates by up to 1.5% throughout 2024. At the moment, markets appear to be capitulating on such aggressive calls for monetary easing. The data is just not cooperating, making it difficult for Fed officials and Chair Powell to build confidence that inflation won’t reaccelerate.

Market weakness started on Wednesday morning following the release of the US Consumer Price Index (CPI) data, which showed a higher-than-expected increase. Year-over-year, overall inflation rose by 3.5%, marking its largest increase since September. More strikingly, the “supercore” inflation, which excludes energy and housing costs, surged by 4.8% year-over-year — well above forecasts and the highest rise in ten months.

Here are some of the comments from various Fed members after the CPI print:

COLLINS: NOW SEE FED CUTTING LATER THAN PREVIOUSLY THOUGHT

GOOLSBEE: IF PCE REINFLATES, ‘WE WILL STABILIZE THE PRICES’

SCHMID: REASON TO THINK RATES WILL STAY HIGHER FOR LONGER

BOSTIC: `I AM NOT IN A HURRY’ TO CUT INTEREST RATES

DALY: NO URGENCY TO CUT INTEREST RATES

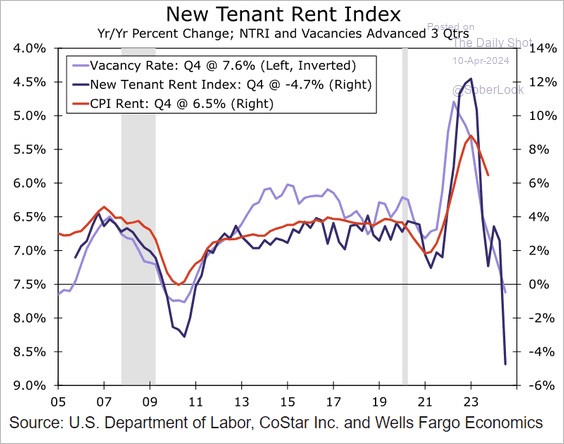

The rise in March’s CPI was primarily boosted by the shelter and energy components, which together drove more than half of the MoM headline gain. Shelter, though, operates with a significant lag and should eventually push lower. Vacancy rates are beginning to rise, and new tenants are benefiting from lower rents. But it will take time for these lower rents to feed into the official CPI numbers.

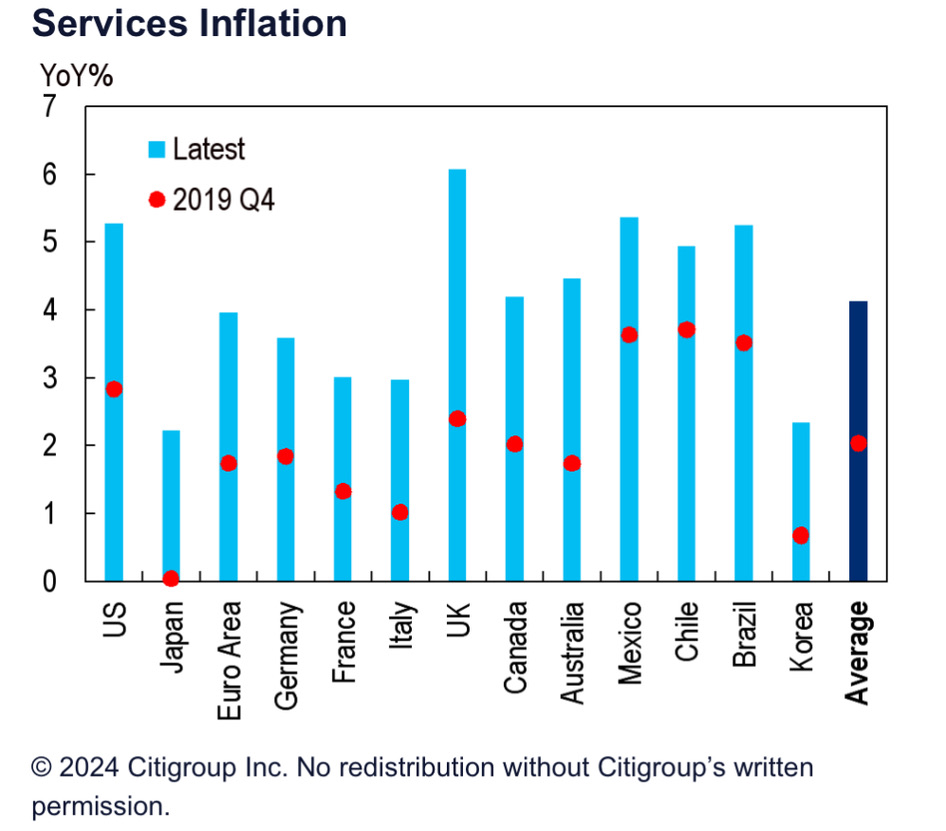

Core services are the main culprits in preventing a further drop in inflation, a problem present in most countries following the pandemic. Services inflation is running at an average of 2x 2019 levels.

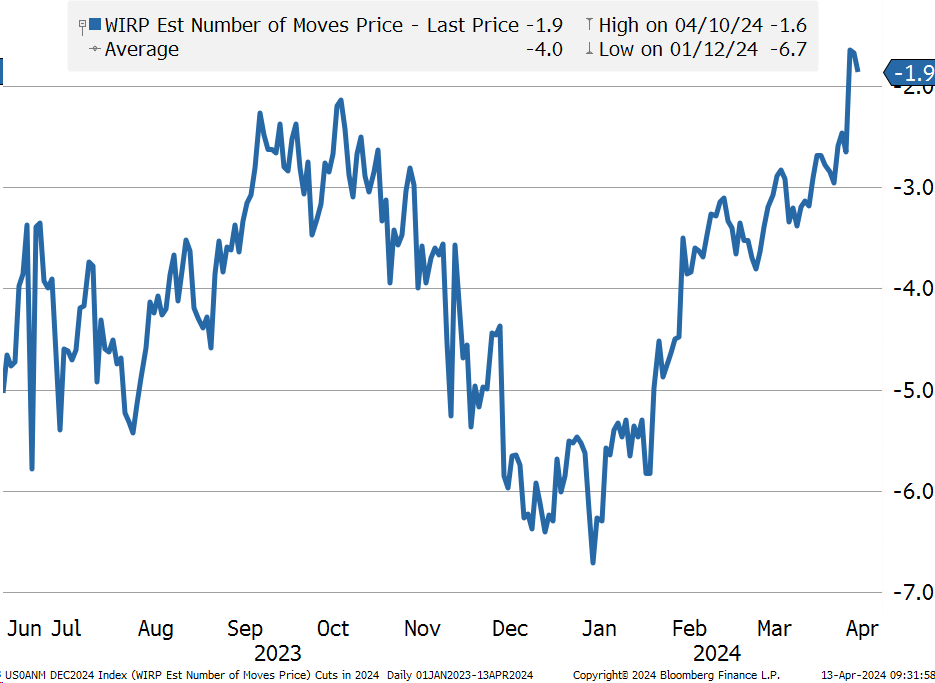

Expectations for a mid-year start to easing were dialed back. The probability of a Fed rate cut in June fell to 21% (down from 72% a month ago), and the probability of a move in July dropped to 47% (down from 90% last month.)

Market pricing for the cumulative amount of cuts in 2024 fell to under 2, down from almost 7 in January.

The entire Treasury curve sold off, particularly at the short end and the middle of the yield curve. The dollar surged. 2-year notes touched 5.00% before rebounding slightly on Friday. It’s worth noting, though, that interest rates in the US were already rising before the CPI number. US rates have been under pressure since the start of the year. Interest rates in the US (and the US economy) show signs of divergence from other developed markets.

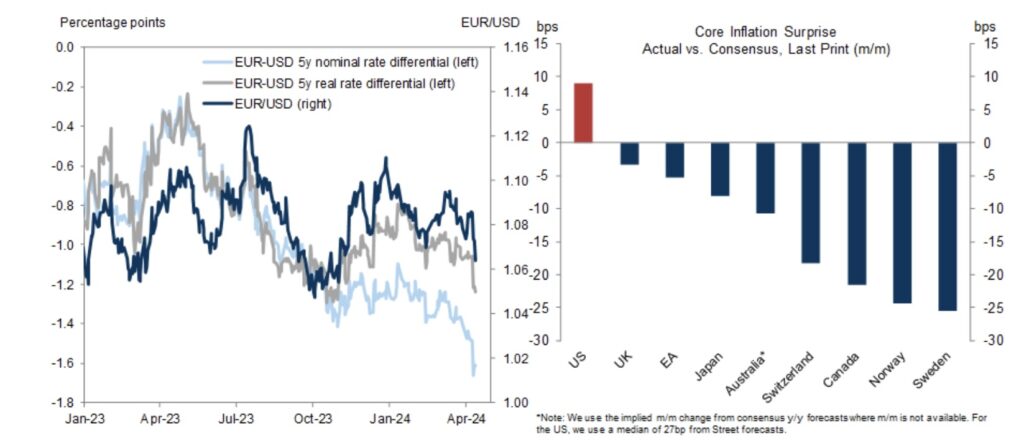

Inflation has come in below consensus in Europe, supporting the notion that the ECB will start lowering rates before the US. This has caused the interest rate differential between the US and Europe to widen. 5-year Treasury rates are 70 bp higher on the year and the nominal rate differential between Euro and US rates has widened by roughly 50 bps. (More on this below).

The ECB kept rates on hold last week at its scheduled meeting but hinted that the first rate cut was imminent. If incoming data and the updated projections presented in June provide the Council with a “further increase in confidence that inflation is converging to the target in a sustained manner,” the “current level of monetary policy restriction” could be reduced.

The upshot of recent economic data trends could have several implications for the market. First, we are due for a pullback in US equity prices. US markets have shown resistance to higher rates but are showing signs of fatigue.

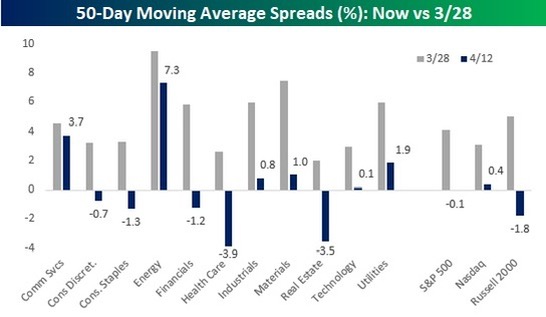

Broader indices either sit right on top of their 50-day moving averages or have dipped below them. At a sector level, Consumer Discretionary, Consumer Staples, Financials, Healthcare and Real Estate broke through technical support last week.

With asset managers running decade-high positions in most major indices (not the case for EM), there is definitely room for profit-taking. Higher volatility and the breach of technical levels and momentum could trigger CTA and vol control funds to reduce positions early next week.

Another significant outcome of the change in consensus for the path of rates is the impact on the US dollar. Many investors, myself included, are waiting for the dollar to peak. It looks like we will have to wait longer. Interest rate differentials and the divergence in the expected path of GDP between the US and the rest of the world have kept the dollar bid.

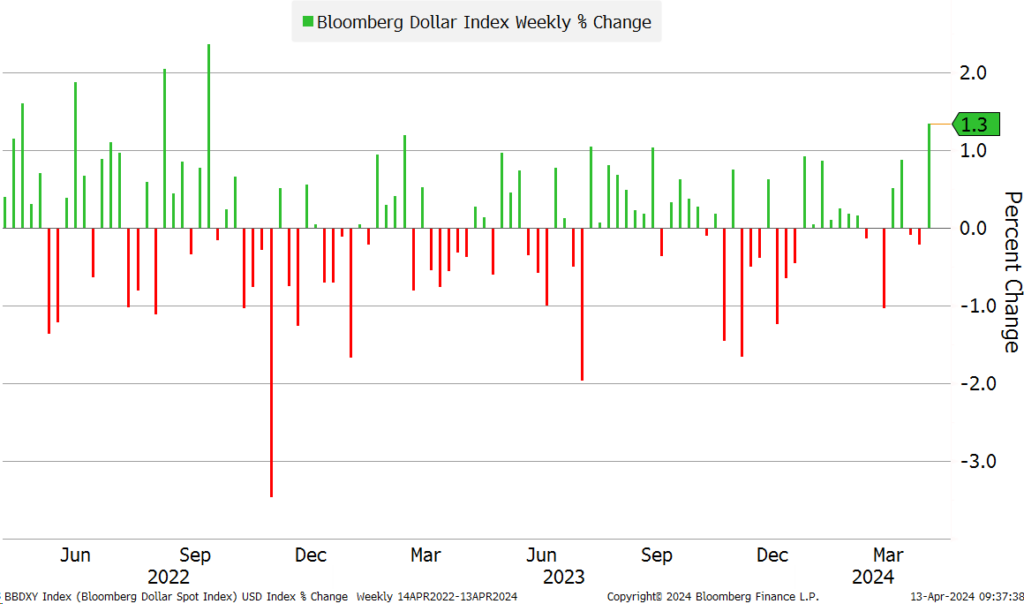

The dollar had its best week since last September. The Bloomberg Dollar Index jumped 1.3%.

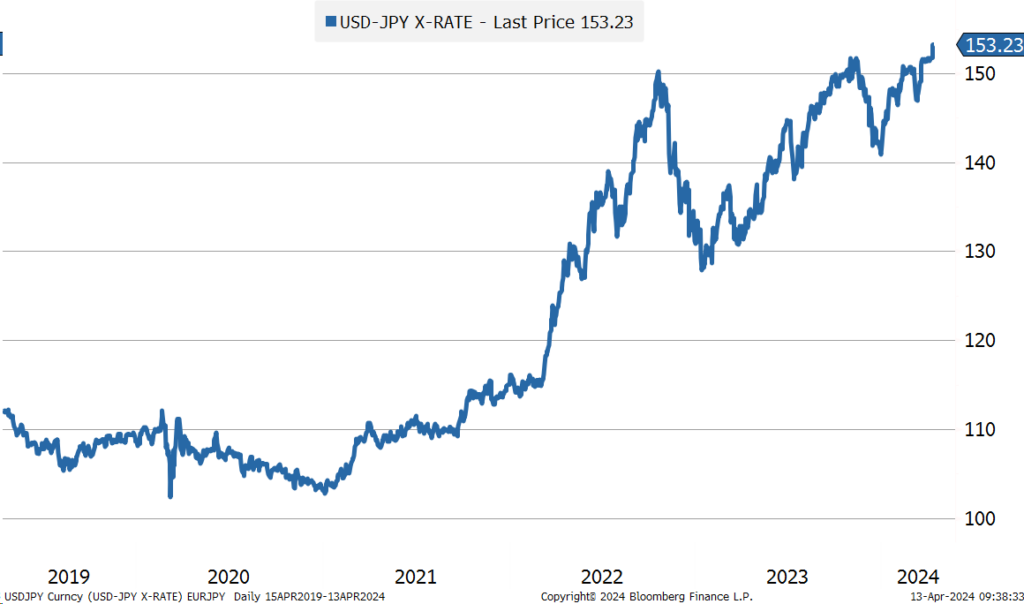

And the Japanese yen hit a new high, rising above 153 late Friday.

A stronger dollar will be a headwind for earnings in the tech sector, where more than 50% of revenue is generated outside of the US. Strong EPS growth in the technology sector, which now accounts for more than 30% of the S&P market cap, is one of the main drivers for the outperformance of the broader markets in recent years. Yes, the dollar has been rising for some time now, and these companies have managed to beat earnings. But if dollar strength accelerates, it could have implications for other sectors as well.

Commodities

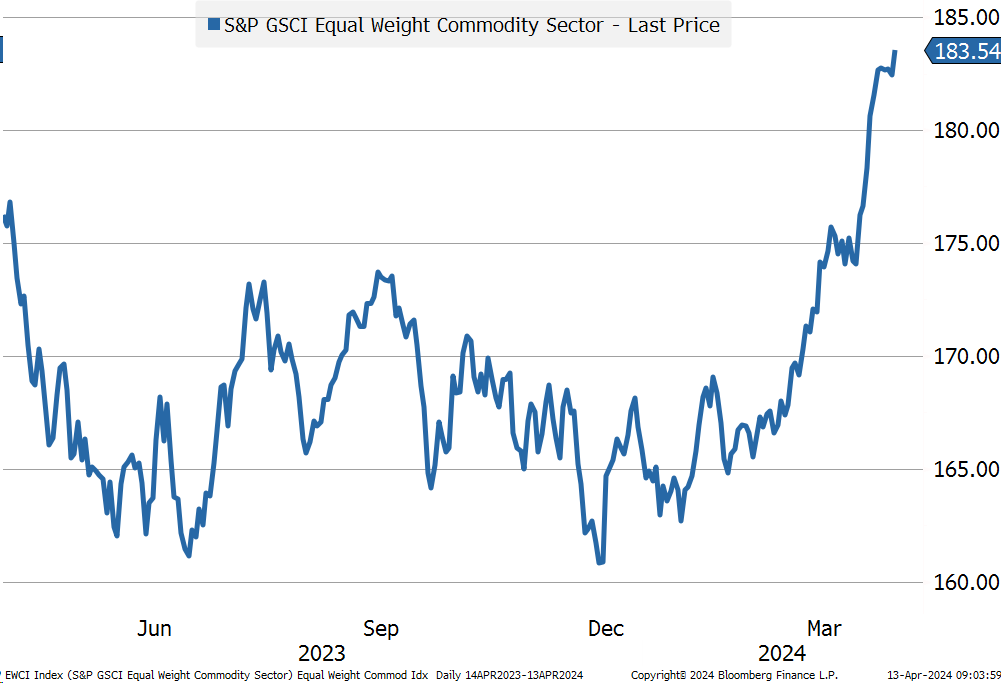

Something is going on in the commodity market. Both supply and demand forces are causing many commodities to reach new highs. It’s not just oil and gas that dominate the popular S&P GSCI indices. Equal-weighted indices are performing just as well. Even gold, which has been kind of a sleepy market for the last few years, hit a new all-time high of $2430 on Friday before retreating slightly in the afternoon.

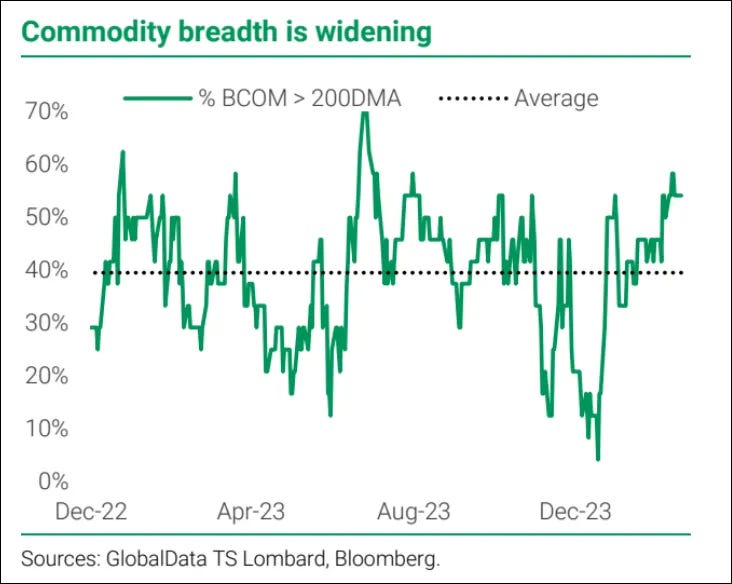

And breadth is increasing. More than half of the commodities in the Bloomberg Commodities Index are trading above their 200-day moving average.

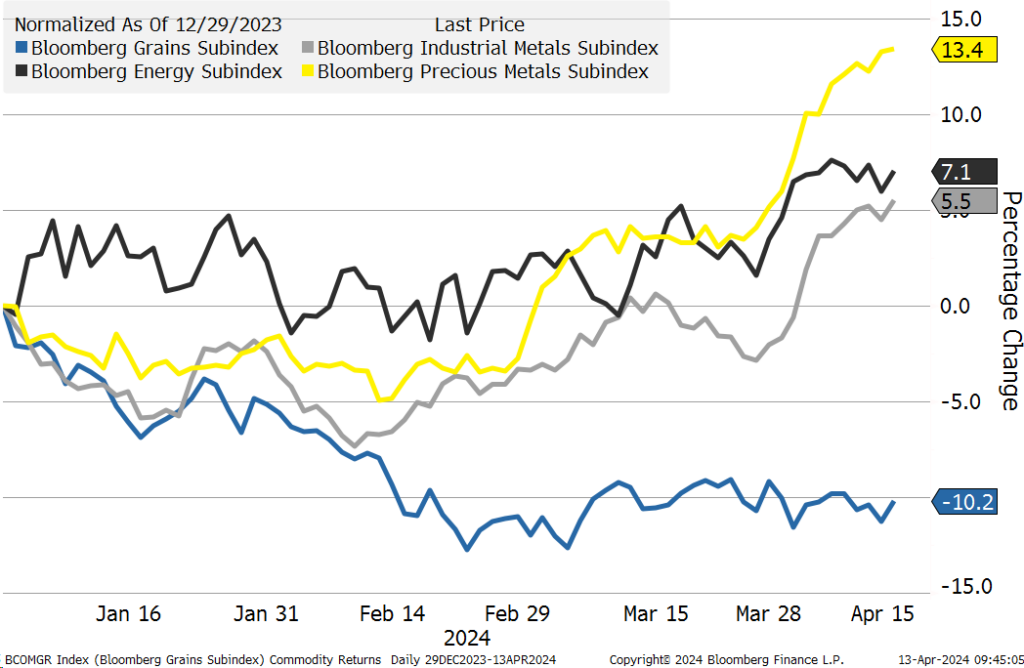

Only grains are lower this year. Precious metals are up 13.4% YTD, energy is 7.1% higher and industrial metals have risen 5.5%.

I’m not a commodity expert, but I understand that the prices of precious and industrial metals, energy, and food have many downstream impacts. One person who IS a commodity expert is Carlyle’s Jeff Currie (Former Head of Commodities at Goldman). In a recent CNBC interview, he suggests that commodities are the best play at this point in the business cycle due to factors such as economic growth, low inventories, supply disruptions, and a broad-based rally across the entire commodity complex.

His main points are:

- Commodities are the best-performing asset, with a 14% year-to-date increase, indicating a classic late-cycle rally.

- Economic growth worldwide and expanding industrial production contribute to a favorable commodity environment.

- Tight markets, low inventories, and supply disruptions in various commodities strengthen the case for a rally.

- The broad-based rally across the entire commodity complex suggests a compelling opportunity for investors.

- Gold indicates that macro tail risks are not currently priced in, and there are concerns about higher oil and food prices influencing the market.

Iran

Things got heated over the weekend. Iran launched a wave of over 300 drones and cruise and ballistic missiles toward Israel, nearly all of which were apparently shot down. The attack was in response to an April 1 airstrike in Damascus on an Iranian embassy building that killed seven high-ranking members of Iran’s Islamic Revolutionary Guard. What is a little surprising to me is not the Iranian response but how well the retaliation was telegraphed. In recent days, social media accounts associated with Iran’s Revolutionary Guard were messaging around a potential attack on Israel. If they really wanted to inflict damage, why would they announce their intentions, along with the timing, of an attack so clearly?

It could be that Iran HAD to do something but did not want to do enough to get dragged directly into the conflict. According to an article published in the FT over the weekend, General Mohammad Bagheri, chief of staff of the Iranian armed forces, said by targeting the Iranian consulate in Damascus in an attack on April 1, Israel had “crossed a red line that was unbearable.” However, after the strike, Bagheri said, “The mission is accomplished and the operation is over and we have no intentions of going further.” Bagheri said, but if Israel opted to “commit any act against us, be it on our territory or our compounds in Syria and elsewhere, the next operation will be larger”.

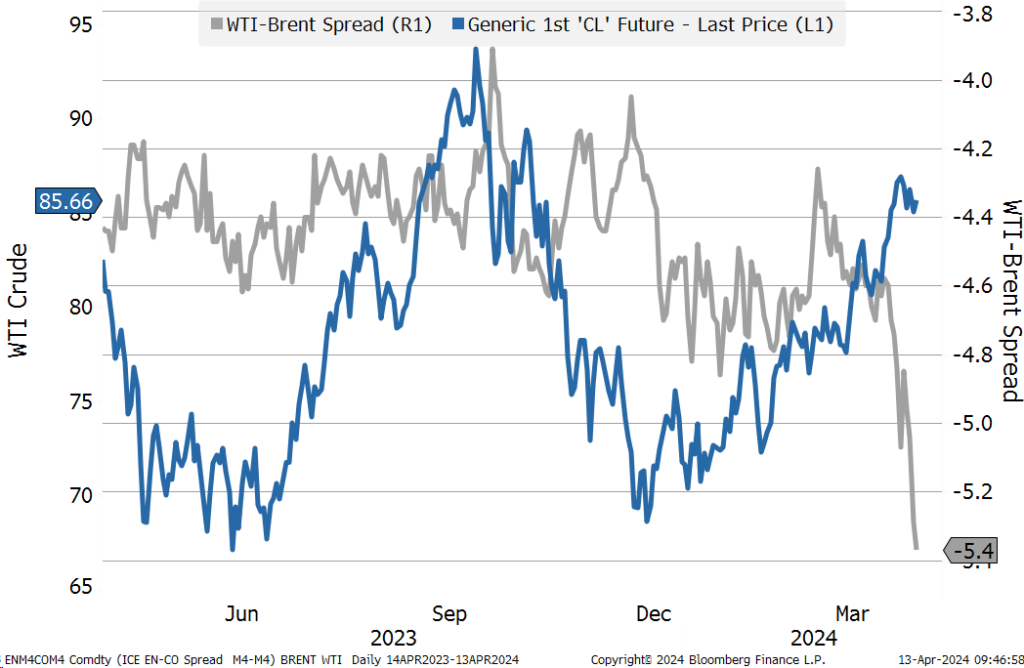

So it sounds like Iran is done for now unless Israel responds. The Biden administration appears to be counseling Israel to let things simmer down. Meanwhile, potential supply concerns are showing up in the crude market, where the spread between Brent crude and WTI has widened to $5.4 per barrel, the widest level in a year.

NHL Playoffs

A little off-topic, I know. But my favorite time of year is rapidly approaching: NHL playoffs. I’m a big hockey fan and the playoffs are starting April 20th. My home Florida Panthers have secured their spot and look to have home ice advantage against the Toronto Maple Leafs. The Leafs have a 2-1 record against the Panthers this year, but as we saw last year, the regular season doesn’t count. Anything can happen. As much as I would like to see a Canadian team bring home the cup, I have to back the Cats who have never won the Stanley Cup.

It’s not the Leafs that concern me. It’s the Rangers. The Panthers play a very physical and aggressive game, putting instant pressure on the other team’s defense in the offensive zone and creating a lot of turnovers. Panther hockey can also be a little chippy. They are the most penalized team in the Eastern Conference and love to get team dust-ups. Nobody is afraid to finish their checks or drop their gloves. “All for one and one for all” is a nice concept, but what happens when Laviolette sends Rempe over the boards to settle a score? The guy scares me to death. Who on the Panthers has a chance against this guy? Yikes.