A study released today by NTT Data on the current state of the global supply chain offers clues into how the logistics industry is managing through the worst crisis in decades. The 2022 26th Annual Third-Party Logistics Study, which included data gathered this spring from surveys and one-on-one interviews with almost 350 companies, illuminates critical issues faced by logistics managers worldwide.

The pandemic placed a spotlight on supply chains, illuminating the downsides of just-in-time inventory management and vulnerabilities in sourcing strategies. The report highlights several ways the industry plans to change to limit future disruptions: advancements in technology, reshoring of production, growth of the supply chain as-a-service business model.

Increased use of technology will make more intelligent, more agile supply chains

Technological advancements have the potential to relieve some of the stress in the industry. Promising technologies such as 5G, real-time data transmission, robotics, Internet of Things and data analytics will help logistics managers with better visibility into the different areas of the supply chain and improve maneuverability when issues occur.

Just over half of third-party logistics managers (56%) said they feel it is moderately or critically important to provide 5G-enabled services to their clients. “5G reduces the amount of latency, so it is much more real-time, which is important because there is a large amount of data that has to travel back and forth”, says Dave Bushee, Senior VP of information technology for Penske Logistics, one of the main sponsors of the study.

Smart factories and warehouses can increase square footage capacity and autonomous processes could address labor shortages — to an extent. “Tech-driven productivity improvements can only help so much,” according to Sylvie Thompson, a supply chain consultant with NTT Data Services. “No amount of technology is going to resolve some of the capacity issues, but it will give us more agility to adjust to maintain production,” says Thompson. Yet, many processes in the chain still require human intervention, and as such, demand for labor will still be an issue.

Logistics managers plan to pivot towards regional/domestic supply chains

For years, supply chains have focused on reducing inventory levels and cutting costs by embracing lean, just-in-time management in their logistics plans. These efforts negatively impacted the resilience and agility of the supply chain.

The pandemic exposed weaknesses in contingency planning and risk mitigation strategies across the world. From the initial scarcity in personal protective equipment to the shortage in microprocessors, challenges emerged in linking suppliers of goods on one side of the planet to sources of demand on the other. As a result, companies are growing more risk-averse with their global manufacturing footprint.

Cracks in the supply chain were growing even before the pandemic took root thanks to increased geopolitical risk between China and the U.S., causing firms to rethink their logistics strategies. “Nearshoring and restoring absolutely is going to happen. It has been happening quietly for last few years,” says Kevin Smith, CEO of Sustainable Supply Chain Consulting.

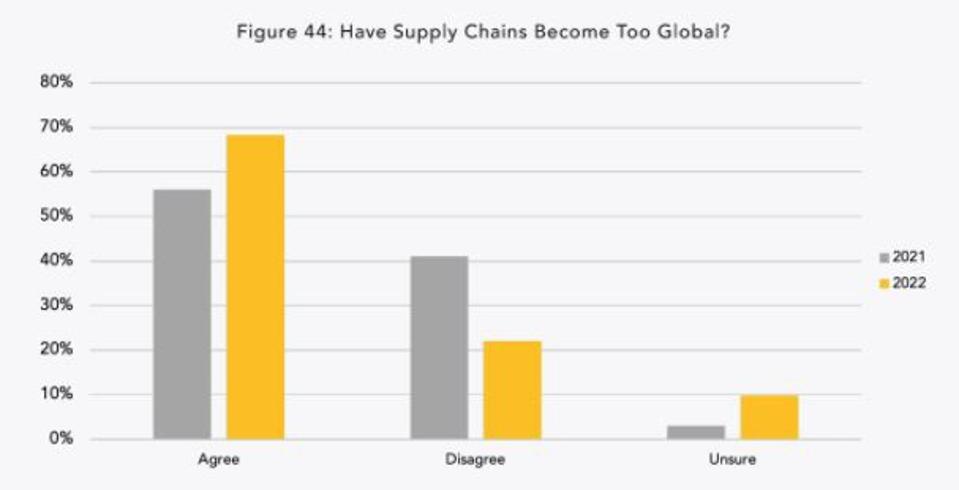

Almost two-thirds of shippers in the survey (68%) believe supply chains have become too global and must be balanced towards more regional and local/domestic ecosystems.

Factors contributing to a global rebalancing include:

- more restrictive trade policies

- changes in tax implications

- changes in government regulations

- increased awareness of supply chain vulnerabilities

- increased need for supply chain resilience

- new sources of raw materials and supplies

Nearly 70% of companies in the survey said supply chains have become too global

ANNUAL THIRD PARTY LOGISTICS STUDY

Risks associated with a single source of supply jumped during the pandemic. A single outbreak of COVID-19 at a manufacturing plant in Thailand, for example, can have reverberations thousands of miles away. A new definition of single source of supply now includes a single country or region, not just exposure to one company. The result is a pivot towards more regional or local networks rather than the traditional global ones.

“When a global link breaks, regional links need to be self-sustainable,” Thompson says when describing the impetus behind the shift. Until these links can be established, risks associated with raw material shortages, rising transportation costs and delays will likely continue. “Whether we like it or not, all supply chains are related. Until the world gets the virus under control, supply chains are going to continue to be disrupted,” Thompson adds.

According to the study, 83% of shippers reported disruption in the supply of key materials this year compared to 49% of respondents in the 2021 survey, and 83% of shippers said they plan to adjust sources of supply as a direct result of efforts to rebalance towards regional and local/domestic sources. Furthermore, 68% said supply chains have become too global and 45% of the companies surveyed anticipate adjusting production locations over the next three years. Such adjustments will hopefully minimize the ripple effects of a single breakdown in the global supply chain.

More companies will move to monetize excess capacity in their own supply chain

As it currently stands, the logistics industry is not blessed with lots of spare capacity. Cargo ships, containers, truck drivers, and warehouse space are all in short supply. Individual companies, though, often do have spare capacity at various points along their supply chains.

Logistics giants like AmazonAMZN and WalmartWMT, who have invested heavily over the last decade in developing their networks, are beginning to let other companies piggyback on their investments. These integrated conglomerates are starting to change the way they view their supply chain.

The new business model is called Supply Chain as-a-Service, or “SCaaS.” For example, having a proprietary truck fleet, once seen as a competitive advantage, is now seen as a way to generate additional revenue. Companies are looking at spare capacity as an alternative source of profit rather than cost centers, the way they have traditionally been viewed. SCaaS services can include inventory management, reverse logistics, logistics consulting, sourcing and customer service.

In August, Walmart announced a new line of business, Walmart GoLocal, which will provide last-mile deliveries to other merchants. “Walmart has spent years building and scaling commerce capabilities that support our network of more than 4,700 stores, and we look forward to helping other businesses have access to the same reliable, quality and low-cost services,” says John Furner, President and CEO of Walmart U.S.

Amazon has invested billions of dollars in building out its massive network of trucks, warehouses and planes. As a leader in technology, we should expect Amazon to be keen to find ways to use its advanced data analytics and end-to-end visibility of the supply chain to monetize any spare capacity in its system.

It’s not just the giants that are considering adapting to a new business model. The study released today shows that 35% of companies involved in logistics either currently offer SCaaS or plan to explore it over the next year. These efforts should help alleviate some of the capacity constraints and help prevent the creation of future bottlenecks.

Roughly 30% of logistics companies are investigating a supply chain as-a-service business model

ANNUAL THIRD PARTY LOGISTICS STUDY

When will things get back to normal?

Nobody knows for sure. When asked this question, before the recent surge of the delta variant, 37% of companies in the study believed it would take more than six months for the global supply chain to return to normal. Some felt it would take much longer.

The good news is that the industry appears to recognize its shortfalls and is embracing a variety of tactics to correct them. Unfortunately, some of these changes will take time. As long as demand remains unpredictable and the multi-legged supply chain is vulnerable to COVID outbreaks on the other side of the world, no magic bullet is available.