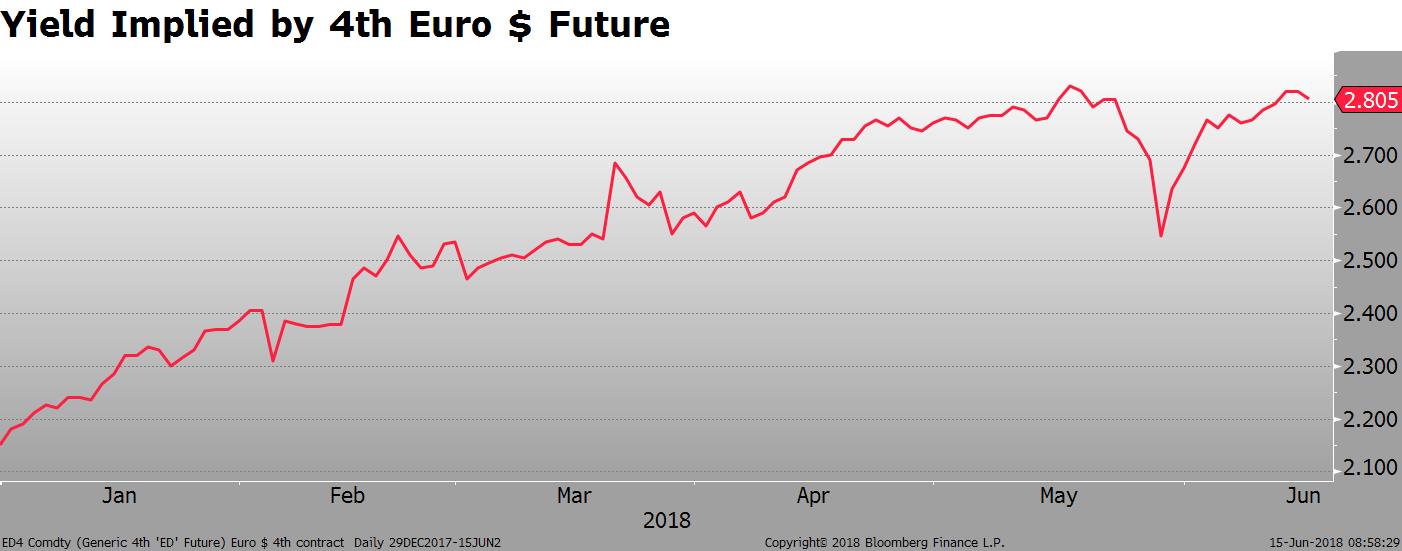

Let’s start with the US economy. The data continues to be strong (jobs, retail sales) while inflation has yet to accelerate. The Fed raised short-term rates again this week and its statement was a slightly more hawkish than expected. The market reacted by pricing in more hikes for the next year.

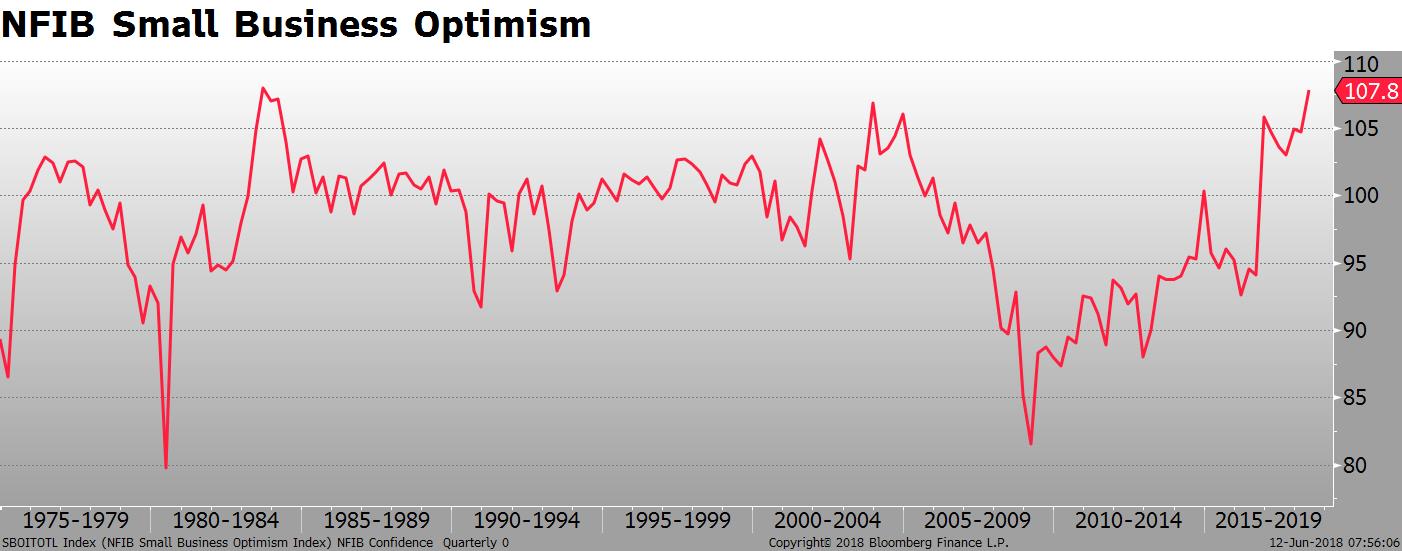

The NFIB Small Business Confidence Index released this week shows the second highest level of optimism since the series began 45 years ago. The May survey of 800 companies also showed that 19% of small businesses were planning on raising prices, the highest since 2008. Also, compensation increases hit a 45 year high.

One reflection of the positive tone is the turnaround in the AAII Investor Sentiment Index. The ratio of “bulls” to “bears” has rebounded from the early April lows. The most recent poll released this Thursday now shows the bulls outnumber the bears by 23%.

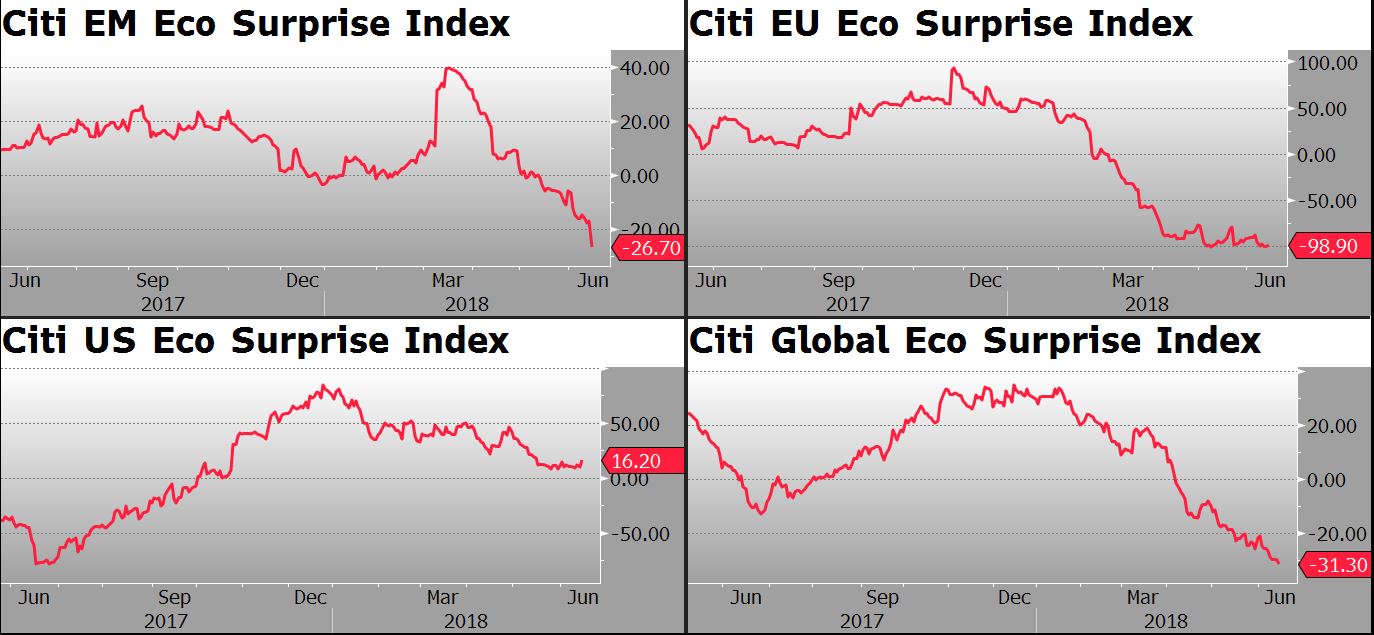

The US, though, is one of the few countries where economic momentum is sustained. The synchronized global growth theme popularized late last year is already showing cracks. European economies are slowing and emerging market assets (currency, bonds an stocks) are underperforming.

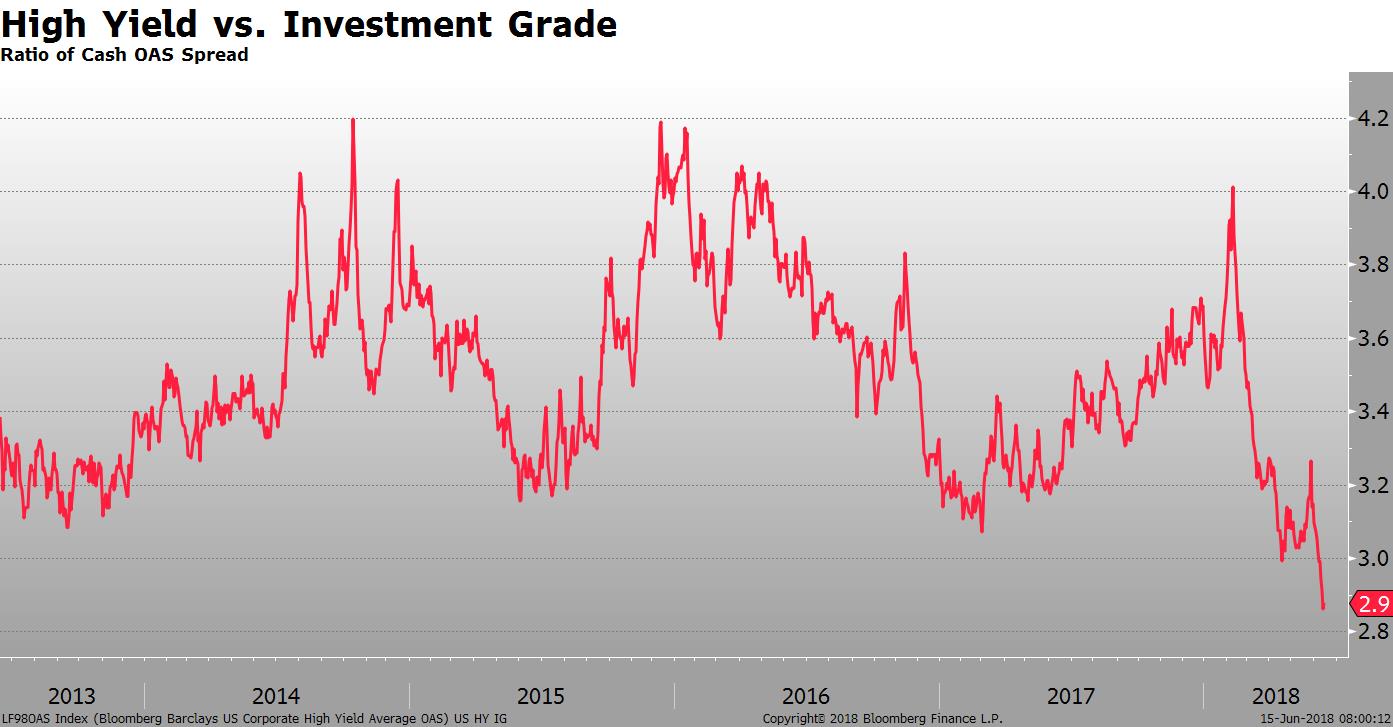

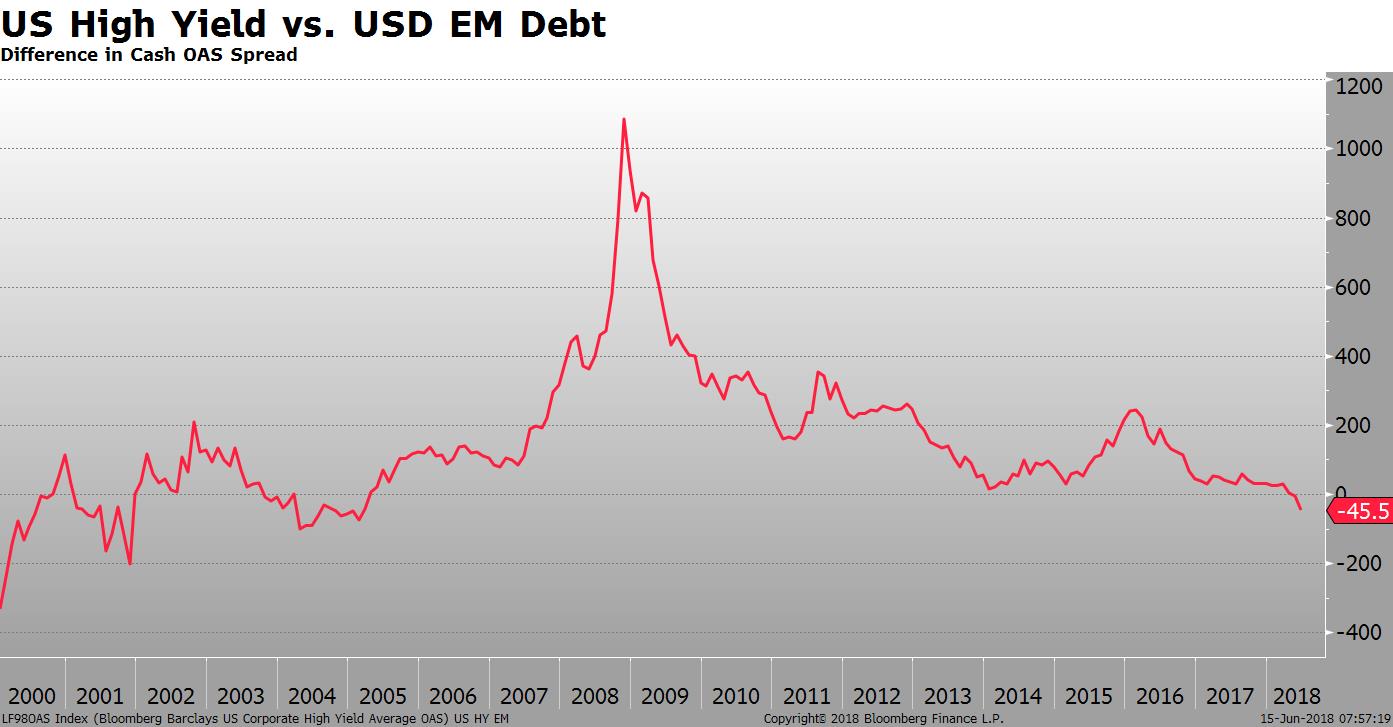

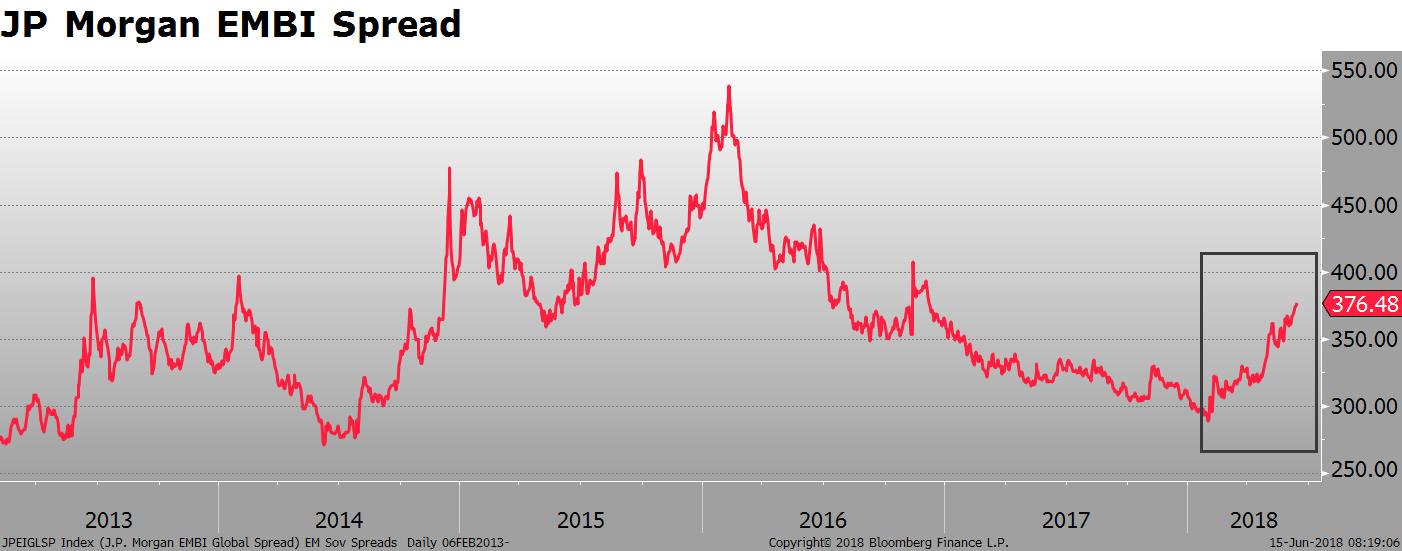

One market that is not showing any sign of stress is the US high yield market. I wrote a post for Forbes this week on the topic. The main point of the article was to highlight that risk seems underpriced in relation to what is happening to credit markets globally. No matter how you look at it, the US junk bond market just looks rich. Rich versus European high yield, rich versus emerging market sovereigns, and expensive relative to US investment grade credit.

The million dollar question is whether the slowdown and stress in the ex-US world will abate and eventually rebound or whether the US can continue to diverge in terms of asset prices and economic performance. Another outcome is for US markets to start to crack.

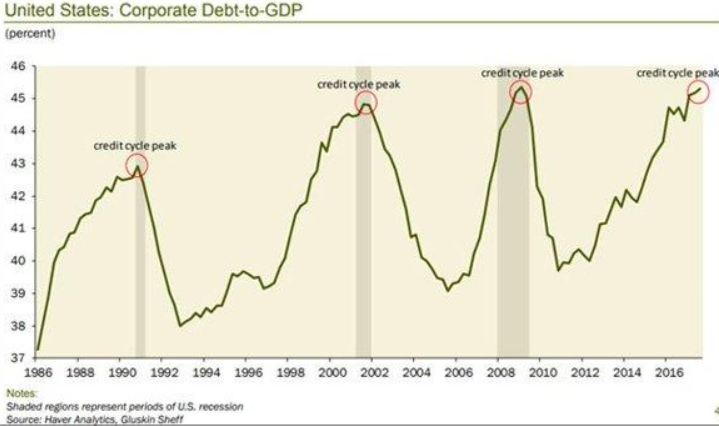

Most economist would agree that we are witnessing typical “late-cycle” behavior. A rally in commodities, central bank tightening, a flattening yield curve, and an outperformance of cyclicals vs defensives in the equity market are all consistent with an economy approaching the peak of the business cycle.

As the 2/10s spread approaching zero, more and more people will sound the alarm signal. Historically, a flat/inverted yield curve has preceded a recession, albeit with a 12-month lag.

One of the biggest risks to the global economy is a slowdown related to the uncertainty surrounding trade. A tit-for-tat tariff escalation will be unquestionably bad for all involved, including the US. There will be winners and losers at the industry level, but more importantly, a trade war would have macro consequences for global growth and inflation. A recent Foreign Policy publication highlights some of these issues.

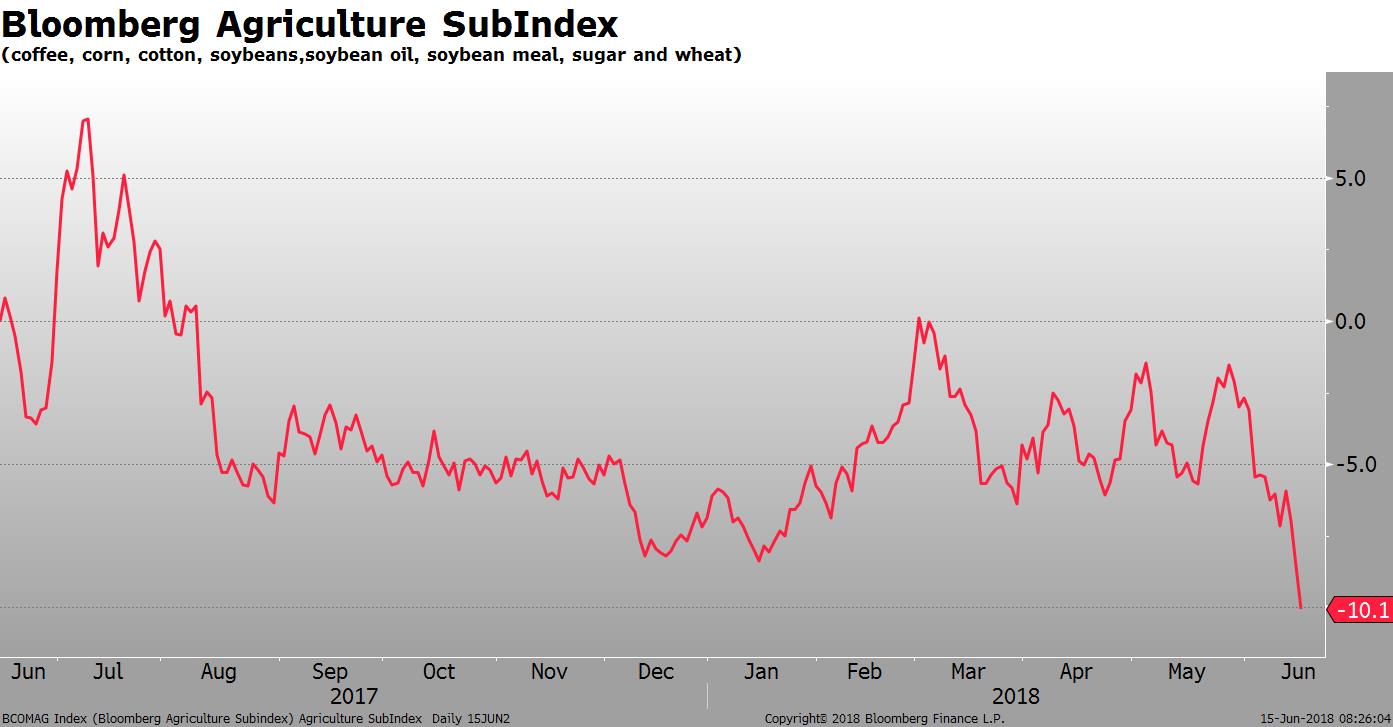

Risks aside, President Trump just approved $50 billion in tariffs on Chinese imports. The list of the items subject to the new 25% tariff will be released next week. Beijing says it has its own list to tax in retaliation (primarily aircraft and soybeans). Soybean futures are tumbling. If NAFTA talks break down, Mexico is also reportedly studying tariffs on soybeans. It appears the US agricultural industry is going to be a net loser if a trade war ensues. The US runs a trade surplus in agricultural products.

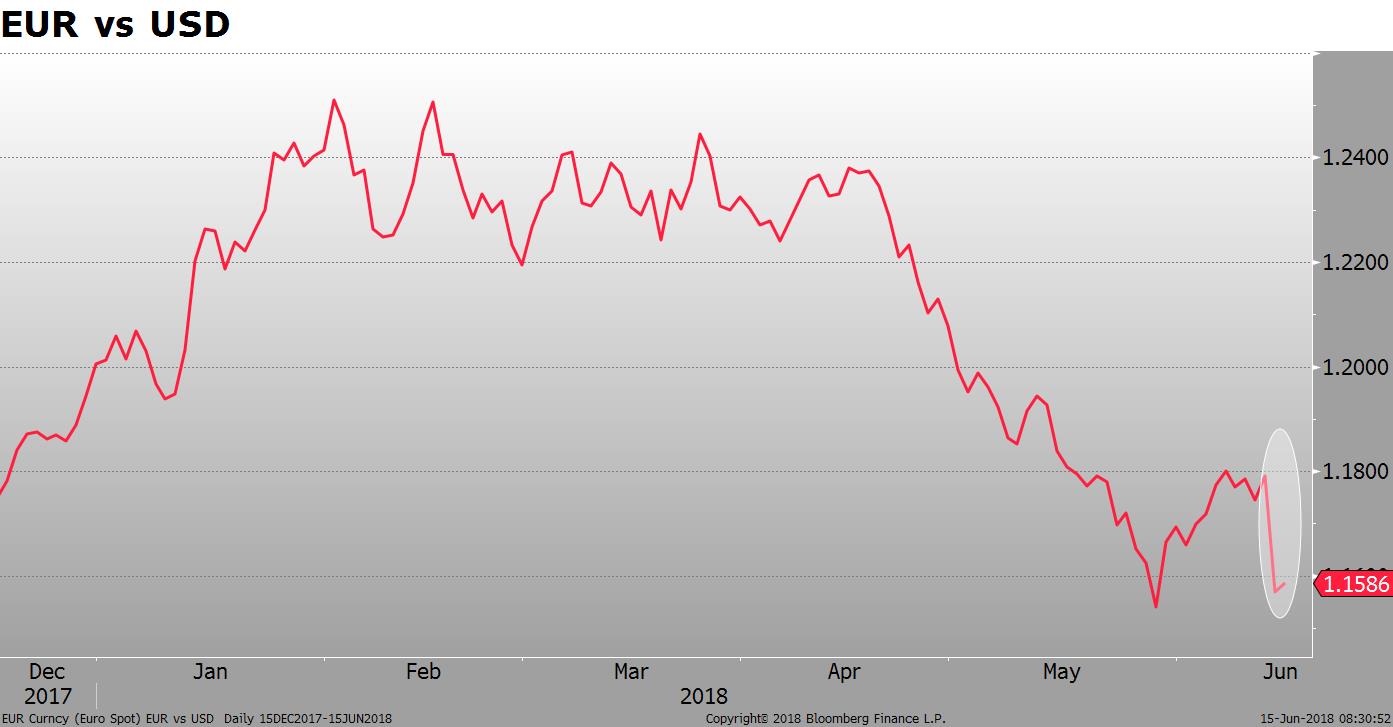

The big news yesterday was the dovish tone set by the ECB with the announcement of the end to QE. QE will end in December 2018, but the first rate hike will not take place until at least the summer of 2019. The market was not expecting such guidance. With the Fed anticipated to move an additional 1% next year, the interest rate differential will continue to widen. The Euro had its largest rally vs the USD in more than two years.

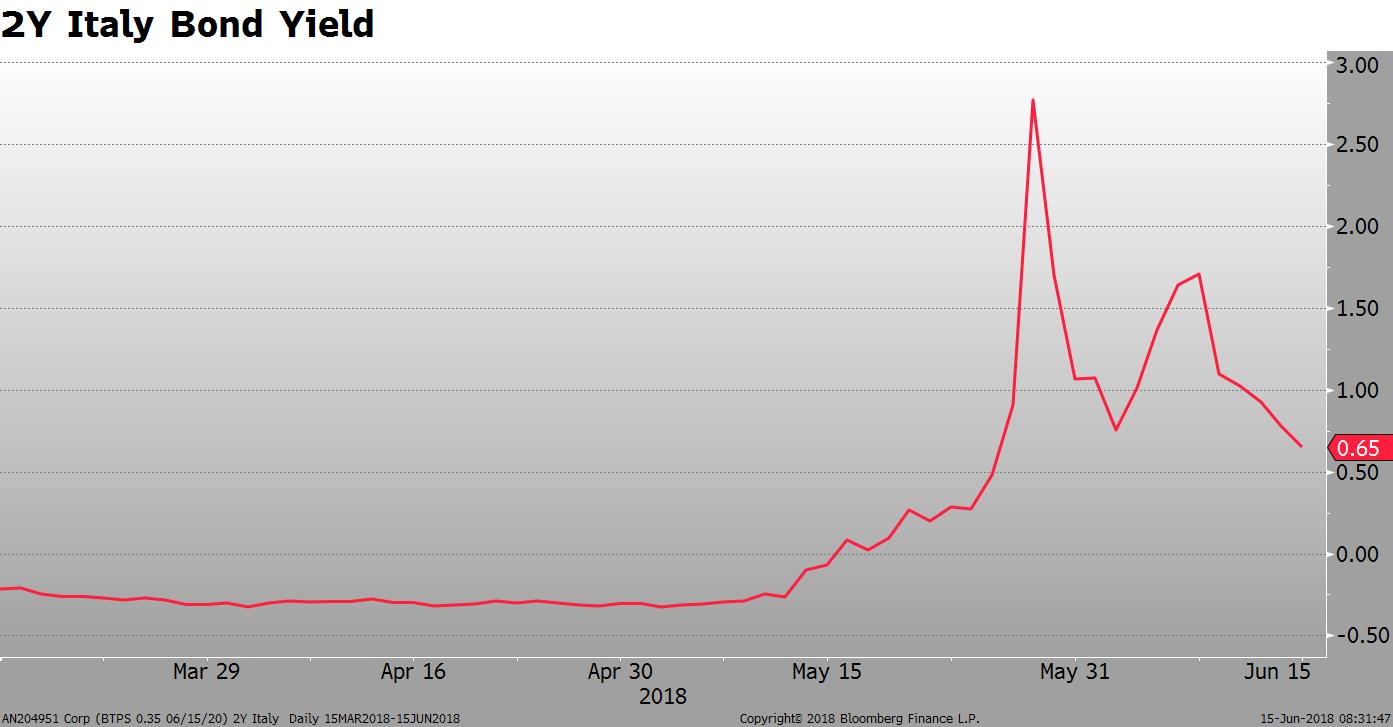

The dovish stance helped the recover the Italian bonds. 2-year Italian yields fell to 0.63%, well below the 2.75% level touched last month.

The weakness in EM currencies goes unabated. The J.P. Morgan Emerging Market Currency Index (EMCI) is down close to 10% from the high set in February.

Local currency bonds are also getting pummeled. The VanEck ETF (EMLC) which tracks the JP Morgan EMBI Index of local currency EM bonds is down 13.2% from mid-February. The combination of rising rates and falling currencies has provided significant negative total returns so far in 2018.

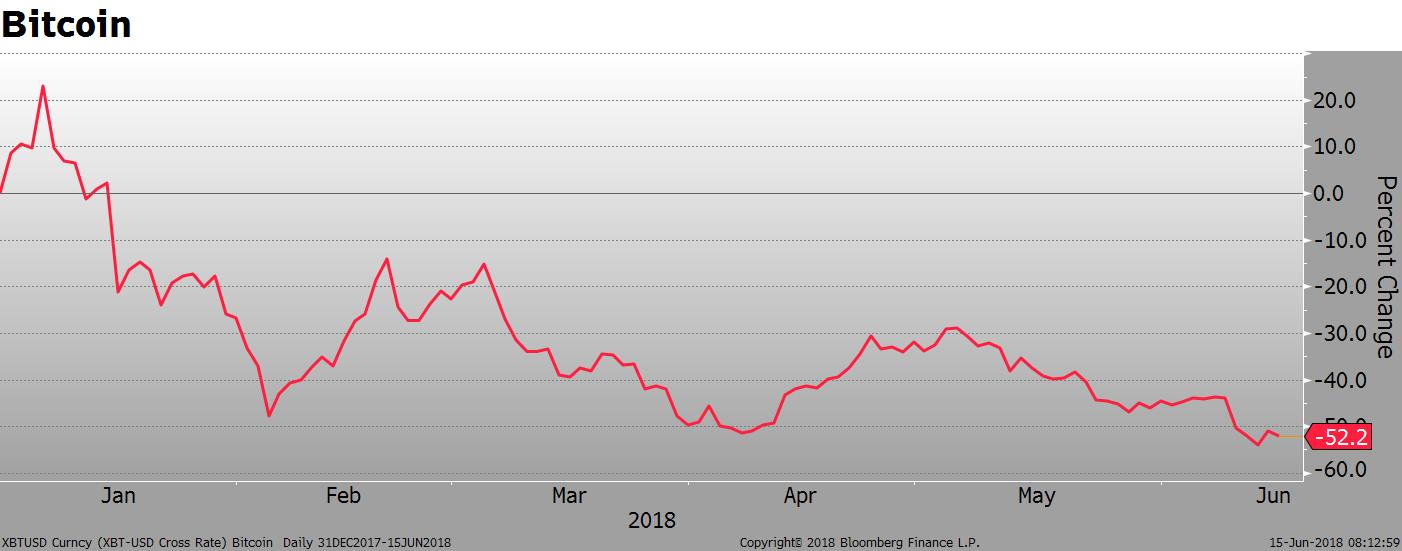

In case you have not been watching, the bubble in crypto seems to have burst. Bitcoin is down 54% YTD and recently fell below the lows set in early April. What has fallen even further is the hype around cryptocurrencies. Google search interest has dropped 90%.

There are many events going on outside of markets, too. This weekend we have the start to the World Cup (no horse in that race), the US Open (my horse, Tiger, is not off to a good start) and of, course, Fathers Day. Enjoy your weekend.