The sentiment in risk markets was much stronger this week. The better mood filtered into a variety of indicators and asset classes:

- The AAII investor sentiment survey rebounded, with the Bull-Bear spread shifting from a 2-year low reading of -16% last week (more Bears than Bulls) to +8% this week.

- The VIX, after a manipulated futures settlement on Wednesday, was lower on the week, reflecting the stronger equity market over the last week.

- The 3-month implied correlation on the S&P 500 continued to drop and is now at 34%, down from just under 50% in early April.

- High Yield credit spreads hit a new cycle low, reaching an option-adjusted spread of 323bp on Wednesday.

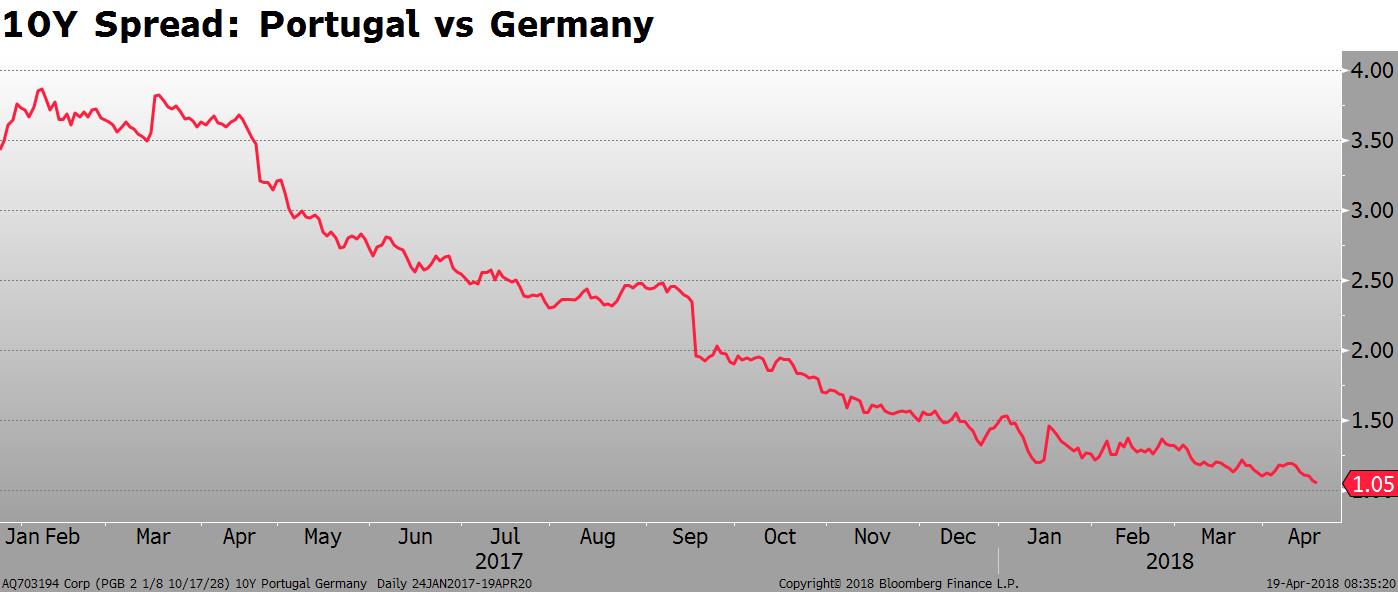

The sentiment in the bond market was different. The 2-year yield rose to 2.43%, the highest level since 2008 and the 10- year yield jumped to within 5 bp of the high reached in February. Both the US and EUR swap curves steepened out to the 10-year point, while 10’s/30’s resumed its flattening trend.

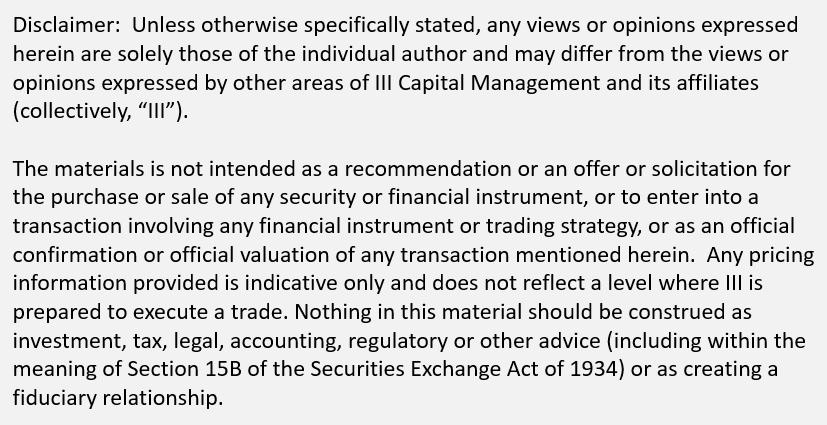

The upward march of short-term rates should be a sign of concern for anybody who holds a position in stocks. The trailing 12-month dividend yield of the S&P 500 is 1.81%, the exact same yield offered by tax-free Municipal Variable Rate Demand notes (VRDN’s). Assuming a tax bracket of 40%, the tax-equivalent yield of the VRDN’s is 3.02%. If you would rather use T-Bills as a truly risk-free comparison. the concept still holds: 3-month T-Bills yield 1.78%. The concern for equity holders should not be rising discount factors to present value future earnings; the real worry is that there is finally a risk-free alternative that provides comparable or better after-tax income.

With average 30-day S&P volatility at 17% in 2018 (compared to just 7% in 2017), the risk-adjusted income from dividends is not nearly as compelling as it was last year. Higher-yielding risk-free income alternatives could pull money out of the equity market that had found its way there when there was no other option to park cash.

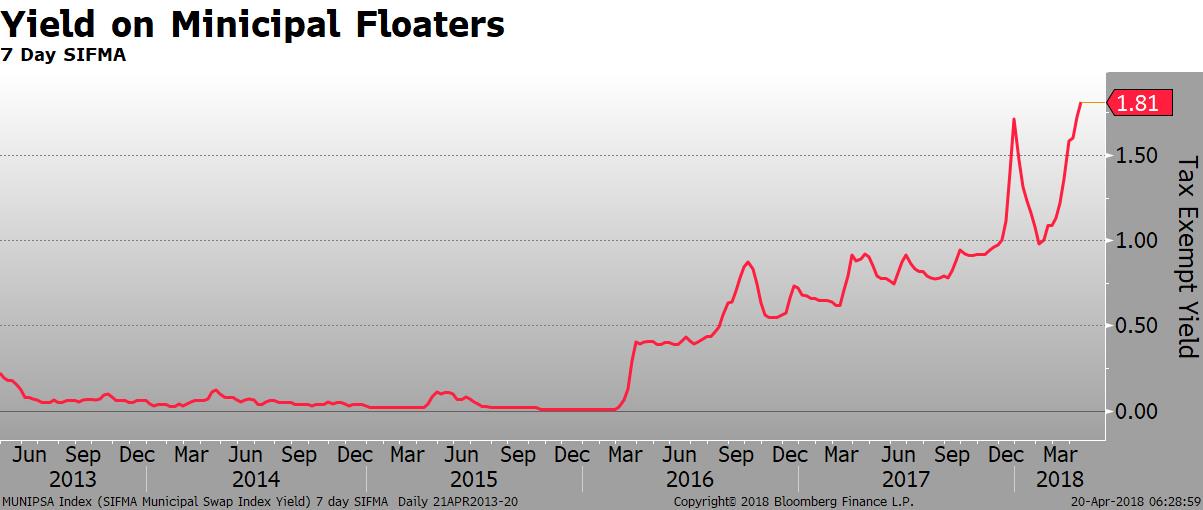

Higher short-term rates do not appear to bother the commodities markets. Both oil and industrial metals are surging. The $5/barrel jump in oil in the last couple of weeks is once again causing inflation concerns. The 10-year breakeven inflation rate rose to 2.18%, the highest level since early 2014 (when crude was over $100/barrel).

Emerging markets yields were also mostly higher. The exceptions were Russia and China. In Russia, both the currency and bonds rallied as geopolitical tensions eased. In China, rates plunged when the central bank unexpectedly reduced the reserve requirement by 1%.

In developed markets, 10-year government bond yields in core Europe were higher, rising even more than in the US.

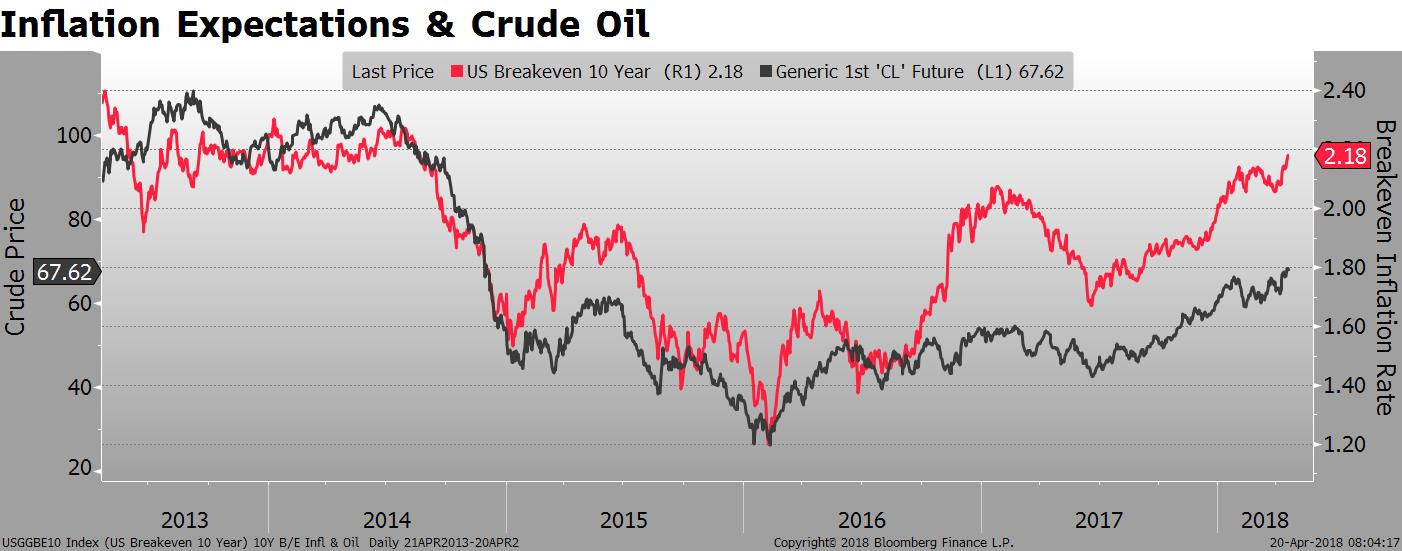

The exception was in the European periphery. The spread to Germany in Portugal, for example, compressed 12 bp to new touch a new low of 105 bp.

The exception was in the European periphery. The spread to Germany in Portugal, for example, compressed 12 bp to new touch a new low of 105 bp.

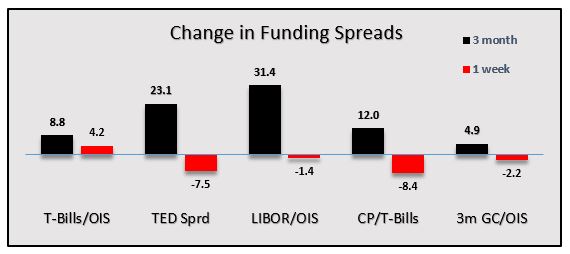

The funding markets showed some signs of stabilization this week. 3-month CP improved 8 bp vs T-Bills and the TED spread narrowed 7.5 bps. Keep in mind, though, that spreads are still much wider over the last three months. The market is expecting (hoping for) further compression now that tax deadline has passed and the US Bill supply picture will take a favorable turn.

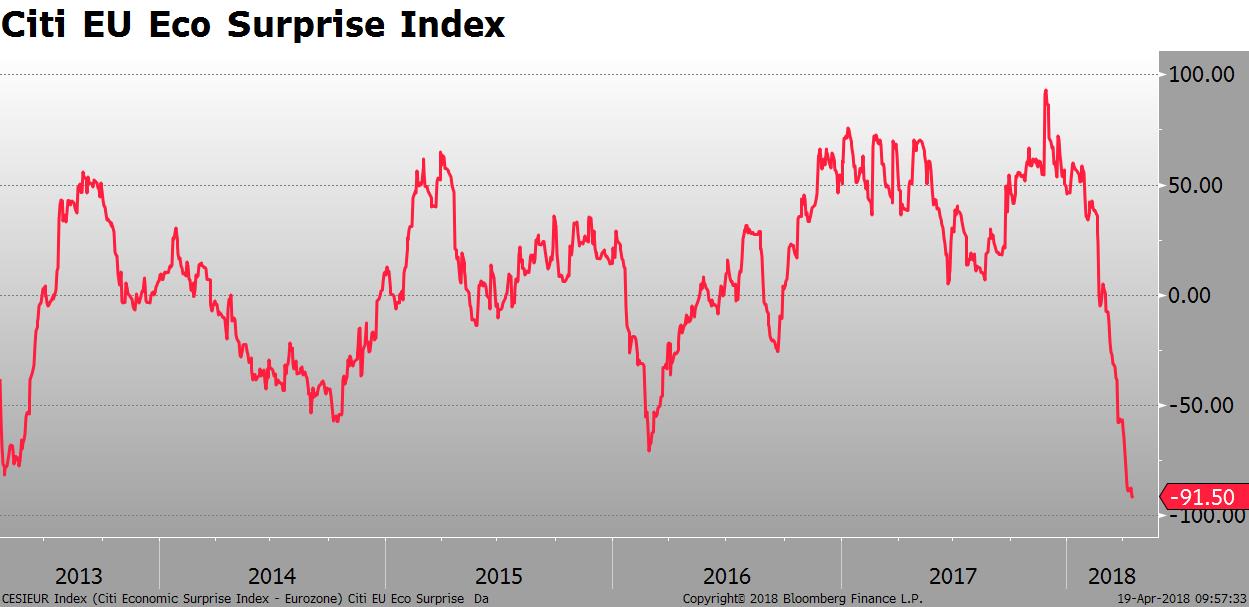

On the economic data front, the big disappointment this week came out of Germany. The ZEW survey is an indicator of economic sentiment for the German economy. The April release showed a drop in the index to the lowest level since 2012. Economic data falling short of expectations has caused the Citi Surprise Index in Europe to fall to extremely low levels.

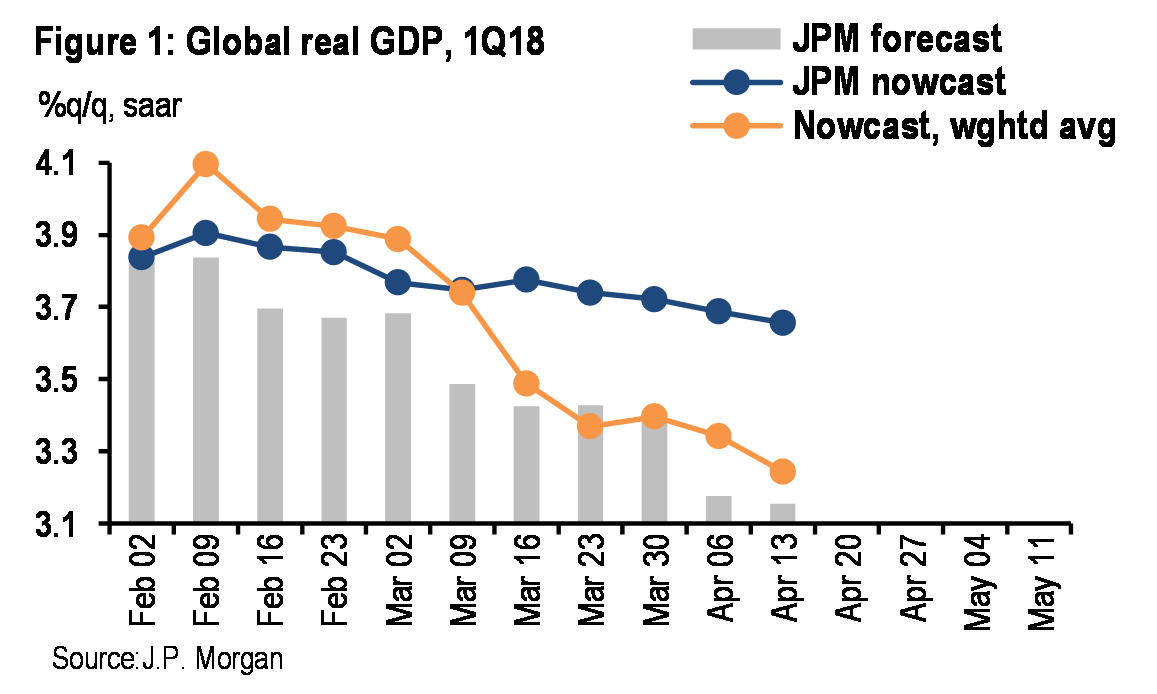

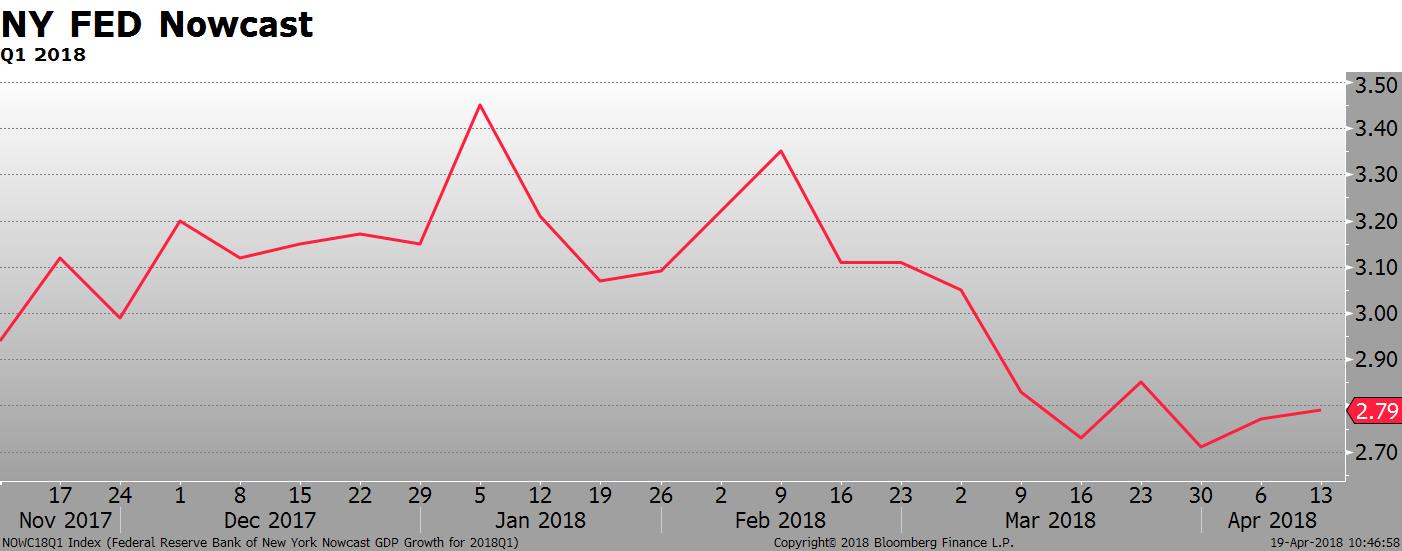

Weaker than expected data is not just a European phenomenon. It is also happening in the US. While not as pronounced, data disappointments in the US have led to a revision of GDP estimates for the first quarter. Both private sector and public growth forecasts are lower than the beginning of the year. JP Morgan has Q1 GDP coming in at 3.3% vs a 3.9% estimate in early February. The New York Fed’s Nowcasting model now predicts growth to be 2.7% compared to 3.4% at the start of the year.

The economic data disappointments in Europe and the US are enough to make one question the whole “synchronized global growth story” that became popular as we entered 2018. I have a post on Forbes coming out on Sunday morning that goes into depth on this issue.

Have a great weekend.

Garth

TOP STORIES OF THE WEEK

[listly id=”25Ph” layout=”full” per_page=”25″ show_list_headline=”false” show_list_badges=”false” show_list_stats=”false” show_list_title=”false” show_author=”false” show_list_description=”false” show_list_tools=”false” show_item_tabs=”false” show_item_filter=”false” show_item_sort=”false” show_item_layout=”false” show_item_search=”false” show_item_timestamp=”false” show_item_voting=”false” show_item_comments=”false” show_item_relist=”false”]